Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

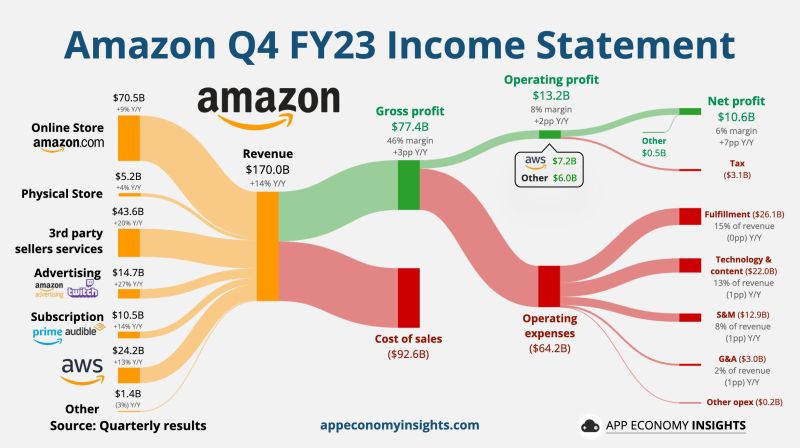

Amazon on Thursday reported fourth-quarter results that sailed past analysts’ estimates, and gave strong guidance for the current quarter.

The stock climbed more than 8% in extended trading. $AMZN Amazon Q4 FY23: • Revenue +14% Y/Y to $170B ($3.7B beat). • Operating margin 8% (+2pp Y/Y). • FCF $37B TTM. AWS: • Revenue +13% Y/Y to $24.2B. • Operating margin 30% (+5pp Y/Y). Q1 FY24 Guidance: • Revenue ~$138-$143B ($142B expected).

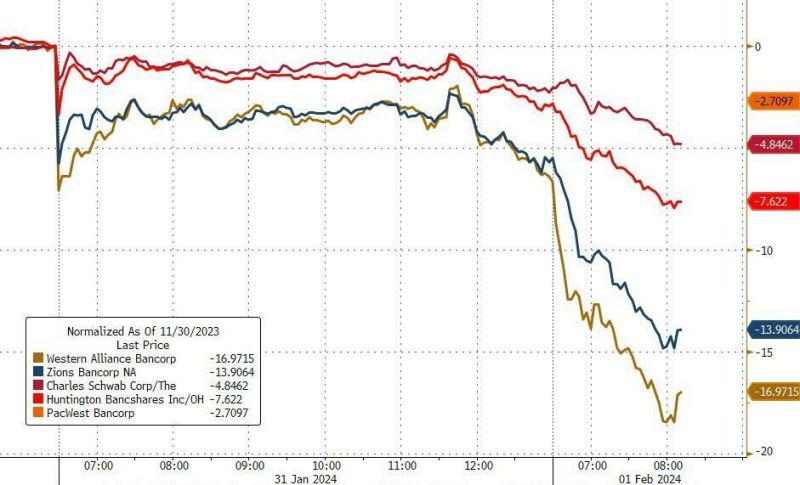

Multiple small us banks tumbled high-single and double digits.

There is a silver lining though -> the market quickly remembered that it was precisely the bank crisis last March that sparked a powerful Fed response (BTFP), and a violent rally, and we got the same thing today as stocks slingshot sharply higher closing 1.1% higher... Source: www.zerohedge.com

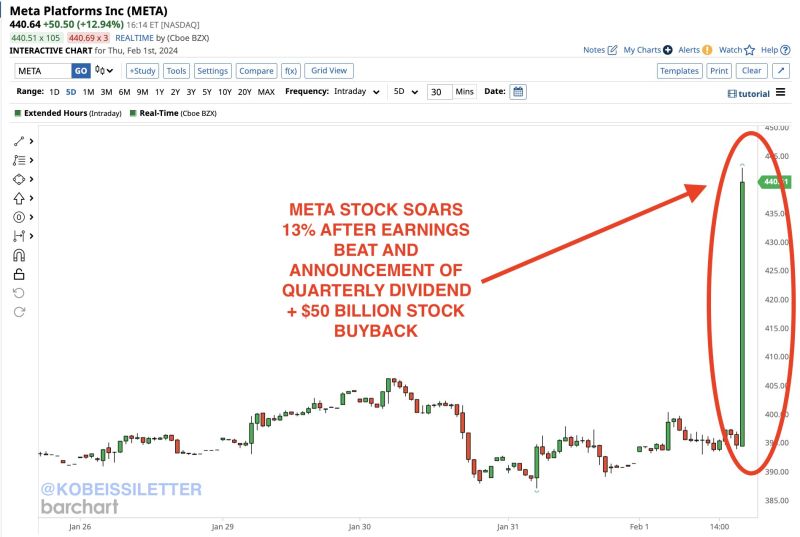

BREAKING: Meta stock, $META, soars 13% after beating earnings expectations and announcing a quarterly dividend with a $50 billion stock buyback.

The stock has added $130 billion in market cap in just 15 minutes. For the first time in history, $META now has a market cap of $1.1 trillion. It is officially the 7th largest public company in the world. Source: Barchart, The Kobeissi Letter

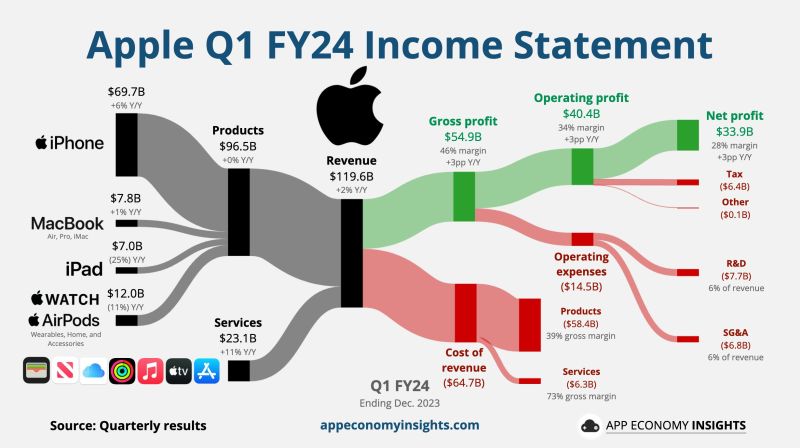

Apple reported fiscal first-quarter earnings on Thursday that beat estimates for revenue and earnings, but Apple showed a 13% decline in sales in China, one of its most important markets.

Apple shares fell over 1% in extended trading. Here’s how Apple did $AAPL Apple Q1 FY24 in a nutshell: • Revenue +2% Y/Y to $119.6B ($1.3B beat). Services +11% Y/Y to $23.1B. Products +0% Y/Y to $96.5B. • Operating margin 34% (+3pp Y/Y). • EPS $2.18 ($0.07 beat). • $20.1B in buybacks and $3.8B in dividends. Source: App Economic Insights

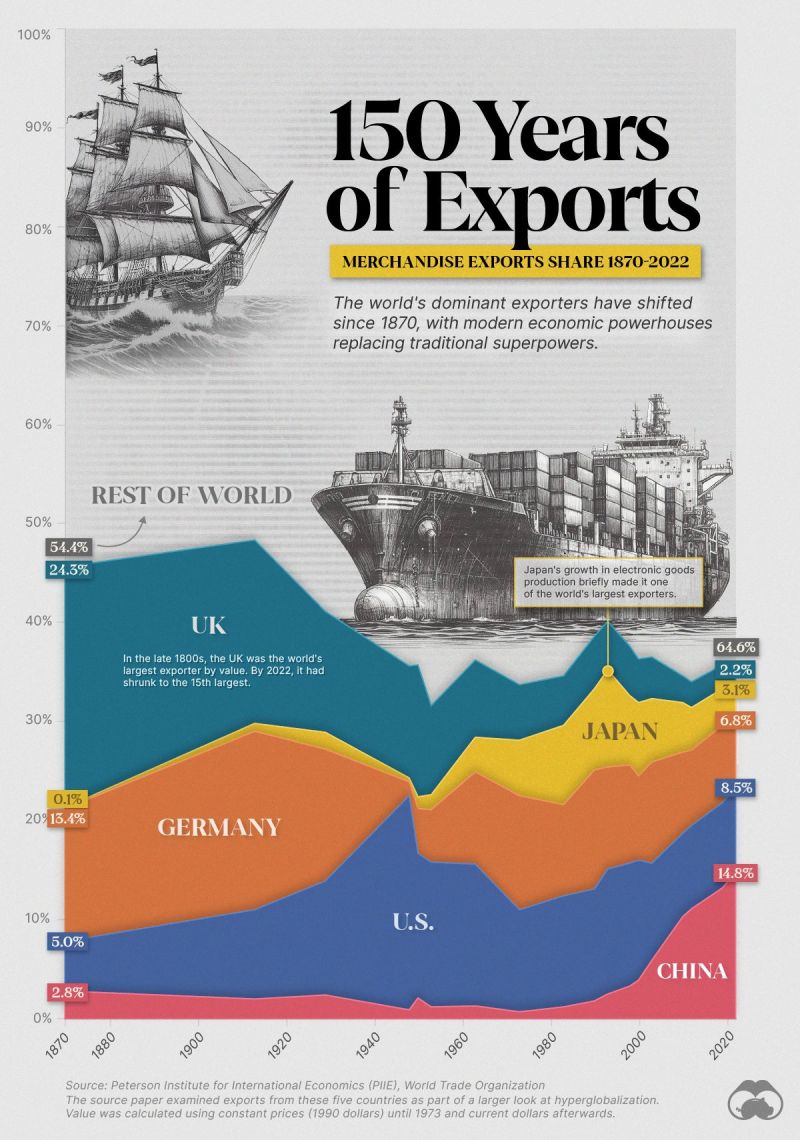

Visualizing 150 Years of Exports for Top Economic Superpowers

Source: Visual Capitalist

Steve Jobs said that the most powerful person in the world, is the storyteller.

Here are the 5 principles for telling an amazing story Source: Sachin Ramje

Investing with intelligence

Our latest research, commentary and market outlooks