Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

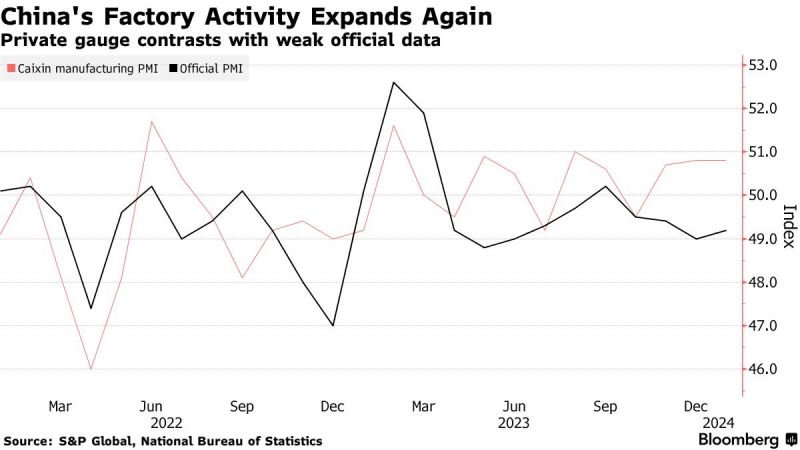

China Factory Activity Expands Again, Private Survey Shows

Source: Bloomberg, C.Barraud

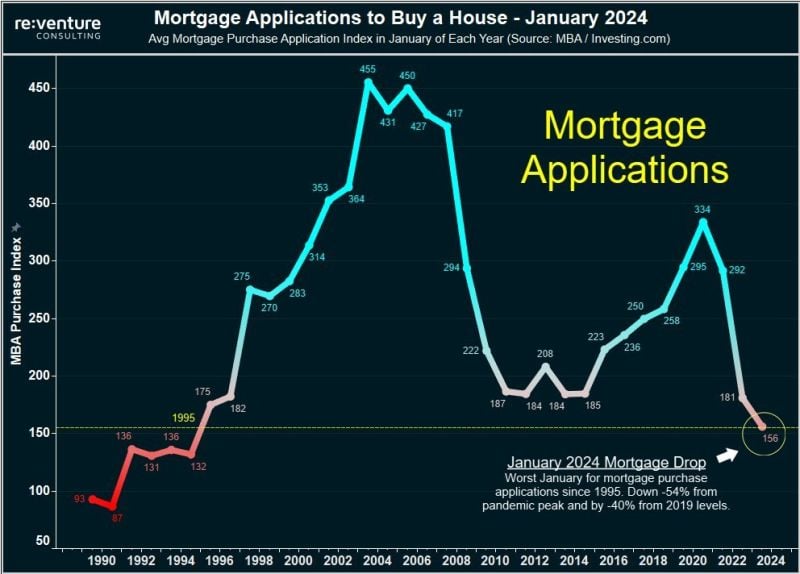

BREAKING: Mortgage demand fell to a new 30-year low in January 2024, down 54% from the pandemic peak, according to Reventure.

Mortgage demand is down 14% over the last year and 40% from pre-pandemic levels. Source: The Kobeissi Letter, re:venture

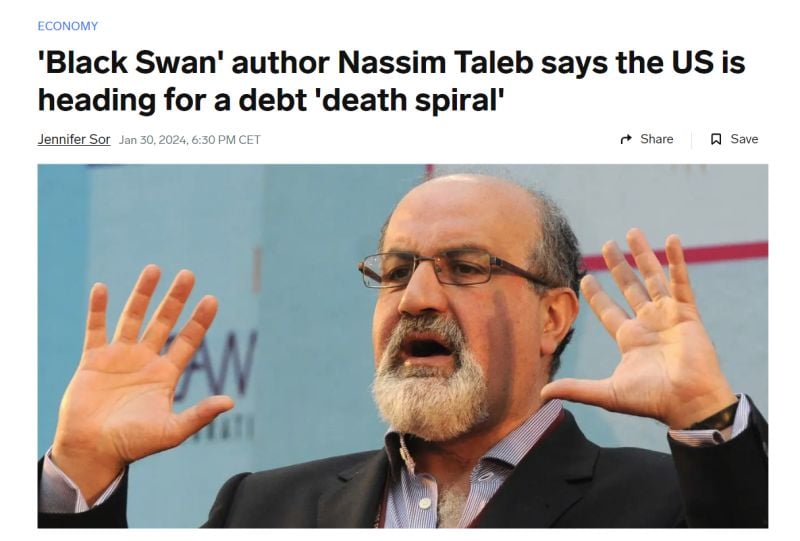

The US is facing a "death spiral" as a result of its mounting debt and the inability of politicians to confront the issue, according to "The Black Swan" author Nassim Taleb.

Per Bloomberg, the Universa Investments advisor who correctly called the 2008 financial crash cast a dire warning about the US debt situation, which has seen the federal debt balance notch $34 trillion for the first time ever to start the year. As long as Congress keeps up its rapid pace of spending, those debts are going to continue to pile up, which could have disastrous consequences for the US economy, Taleb said this week at an event held by Universa Investments. In fact, rising debt in the US is a "white swan," Taleb said, and is an event that poses an obvious risk to markets versus a "black swan" event, which can occur without much warning. That death spiral would necessitate "something to come in from the outside, or maybe some kind of miracle," Taleb said, when asked how the shock would play out, adding that the situation has made him more pessimistic about the political system in the West. Source: Business Insider

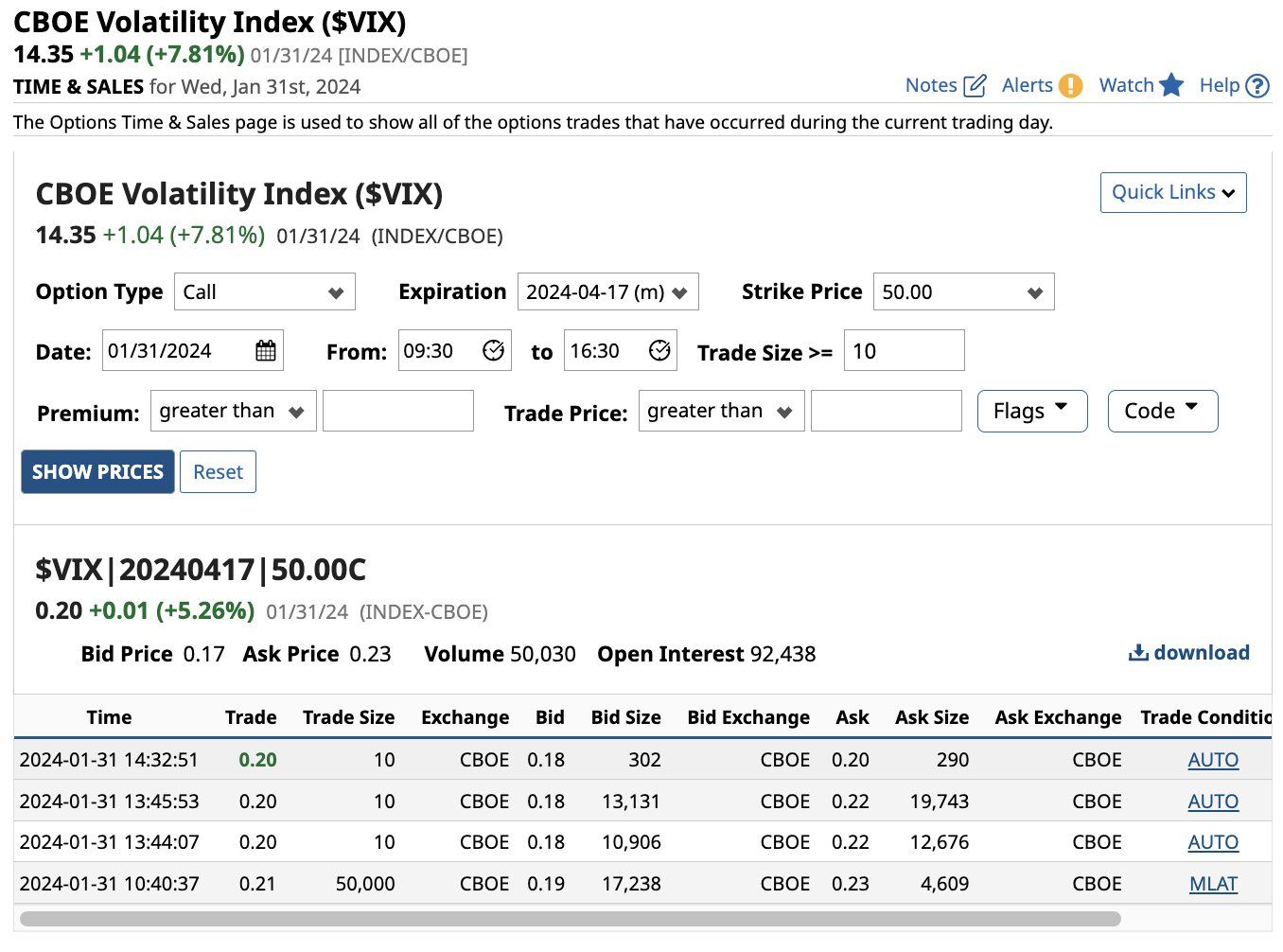

A Trader bought 50,000 CBOE Volatility Index $VIX April expiry 50 strike calls for $0.21 which is a total premium of just over $1 million.

Source: Barchart

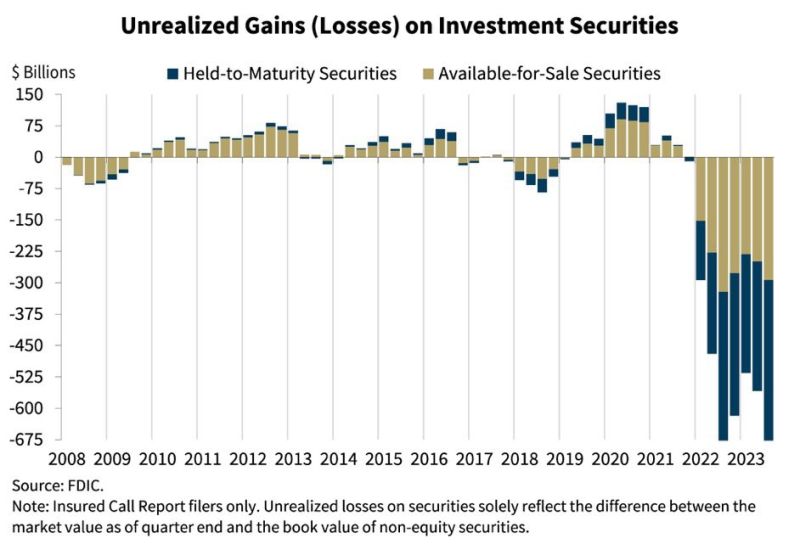

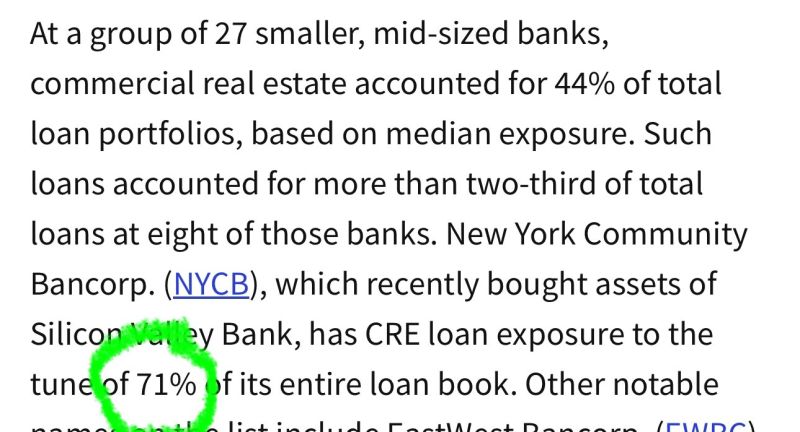

U.S. Banks are facing unrealized losses of roughly $685 billion (updated as of Q3).

This problem isn’t going away any time soon until the Federal Reserve begins cutting. New York Community Bancorp $NYCB might be the next victim. Source: Barchart

NEW YORK COMMUNITY BANK SHARES WERE DOWN AS MUCH AS 40% ON WEDNESDAY.

THE BANK POSTED A SURPRISE LOSS FOR THE FOURTH QUARTER AND ALSO CUT ITS DIVIDEND. THIS IS THE SAME BANK WHO BOUGHT SIGNATURE BANK LAST YEAR AFTER IT COLLAPSED. NOTE IT HAS COMMERCIAL REAL ESTATE (CRE) LOAN EXPOSURE TO THE TUNE OF 71% OF ITS ENTIRE LOAN BOOK.

Germany troubles in one chart. Retail sales have fallen by 4.4% in Dec YoY.

This means that even Christmas sales fell through. Germans have gone on a buyers' strike since the outbreak of inflation & have even cut back on gifts for children during the Christmas season. This also explains why Germany has some of the toughest competition in the retail sector and the lowest profit margins there. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks