Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

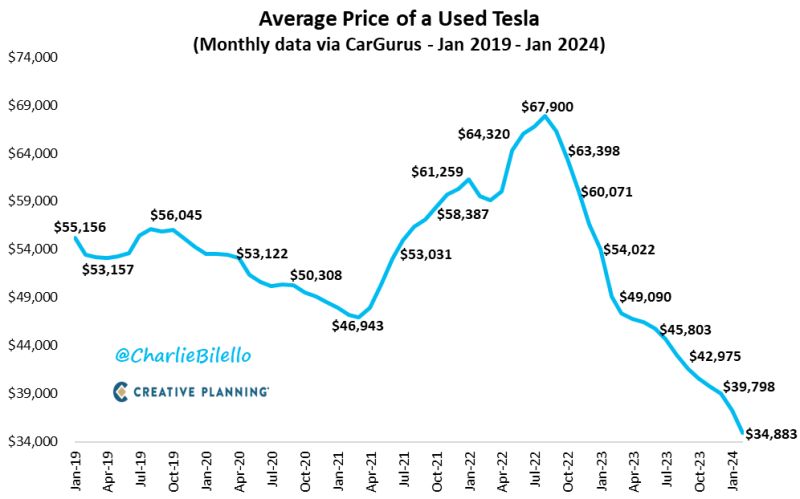

The average price of a used Tesla has declined 18 months in a row

Moving from a record high of $67,900 in July 2022 to a record low of $34,883 today (-49%). $TSLA Source: Charlie Bilello

Greece is the third country in Europe, after italy and spain, to see energy security affected by Houthi attacks to tankers in the Red Sea.

At least 3 Qatari LNG cargoes have been cancelled over the last days, impacting the Greek prospects of becoming a gas hub in europe. Source: Francesco Sassi

This isn't a crypto or a meme stock. It's New York Community Bank $NYCB, which acquired failed Signature Bank assets last year, has fallen over over 40% today.

The price of shares in New York Community Bancorp - the regional bank that purchased deposits from Signature Bank last year - crashed today, below SVB crisis lows, after reporting a surprise loss for the fourth quarter and a cut to its dividend. As Bloomberg reports, the bank lowered its quarterly payout to shareholders to 5 cents. Analysts had predicted the dividend would remain at 17 cents. A worsening credit outlook contributed to the unexpected loss, as the company boosted its loan-loss provision more than expected. Source: www.zerohedge.com

FED: DON'T SEE CUTS UNTIL MORE CONFIDENT INFLATION NEARING 2%

In a nutshell · The FOMC voted unanimously to leave benchmark rate unchanged - as expected - in target range of 5.25%-5.5% for fourth straight meeting while making significant changes to statement · However, the statement was very much more hawkish than expected, as The Fed pushed back aggressively against the dovish market stance. Market reaction: -> The 10-year Treasury yield fell more than 7 basis points to 3.98%. The yield on the 2-year Treasury was last down about 8 basis points at 4.27% -> US equity indices are retreating. Gold is paring gains, dollar is recovering. -> Odds of a March Fed rate cut plummet from 47% to 31% after the Fed interest rate decision. Our take: The U.S. economy enters 2024 from a position of strength. For instance, the S&P PMI came in higher than expected last week. Q4 GDP growth in the U.S. came in at 3.3% annualized, well above expectations of 2.0% growth. And while disinflation is firmly in place, the inflation rate remains above the central bank target. There is thus no reason for the Fed to rush. Nevertheless, we still believe they will have to cut rates at some point for the following reasons: 1/ Keeping rates too high for too long can have long-lasting effects on US economic growth 2/ Keeping rates steady while inflation is coming down imply rising real rates. Keeping positive real rates for too long at a time when Uncle Sam is facing $33T debt and surging interest rates payments is unsustainable

German inflation slows to 2.9% in January from 3.7% in December, lowest level since June 2021

Core CPI slows to 3.4% in January from 3.5% in December, lowest level June 2022. Energy in deflation, hashtag#energy prices dropped -2.8% YoY, while Food CPI slowed to 3.8% from 4.5% in December. Source: HolgerZ, Bloomberg

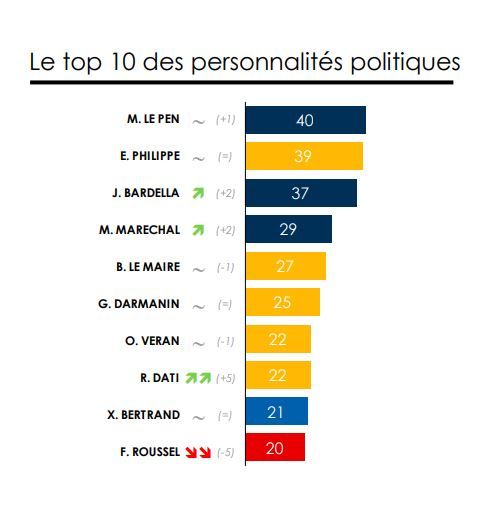

In France, 3 out of the 4 favorite political leaders are from the far right...

1) Marine Le Pen (RN) 40%; 3) Jordan Bardella (RN) 37%; and 4) Marion Marechal Le Pen (Reconquête) 29%. Source: Le Figaro Verian - EPOKA / February poll

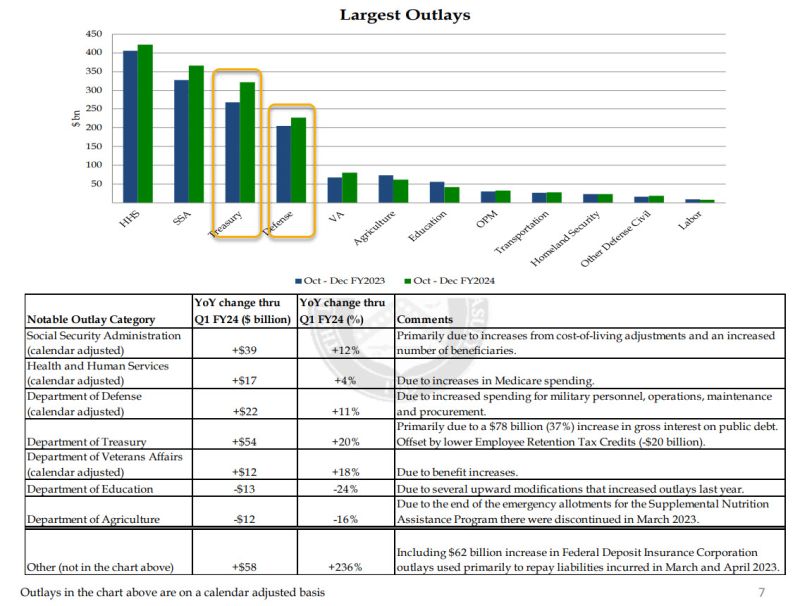

US Treasury confirms spending on debt interest now larger than entire Defense Budget.... and will soon surpass entire Social Security budget.

Source: www.zerohedge.com

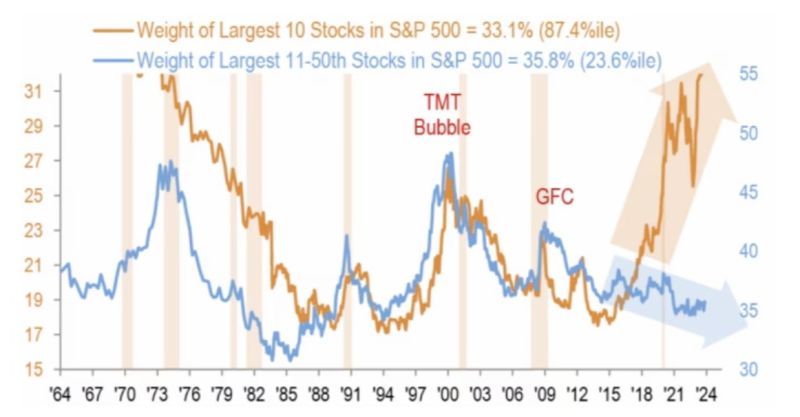

The weight of the 10 largest sp500 stocks is now 33.1% of the total $SPX, the highest level in almost 5 decades.

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks