Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

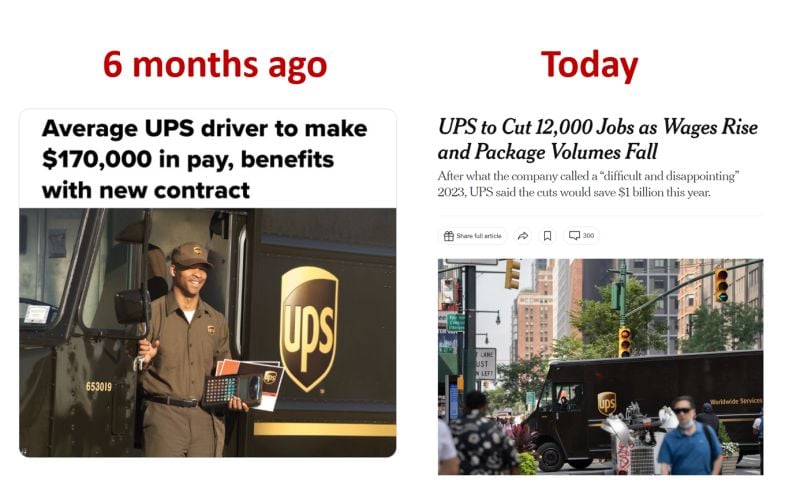

BREAKING: UPS, $UPS, to cut 12,000 jobs after what its CEO called a "difficult and disappointing" year

The company has stated that they are looking to cut $1 billion of annual costs. UPS stock was down 6% after the announcement. Over the last 3 months, layoffs have quickly spread from technology companies to just about every industry. Shipping is now the latest industry to feel the pain. Note that UPS announcement takes place 6 months after the famous 170k salary package announcement by UPS who was at the time desperate to find new drivers. Time flies... Source: The New York Times, The Kobeissi Letter

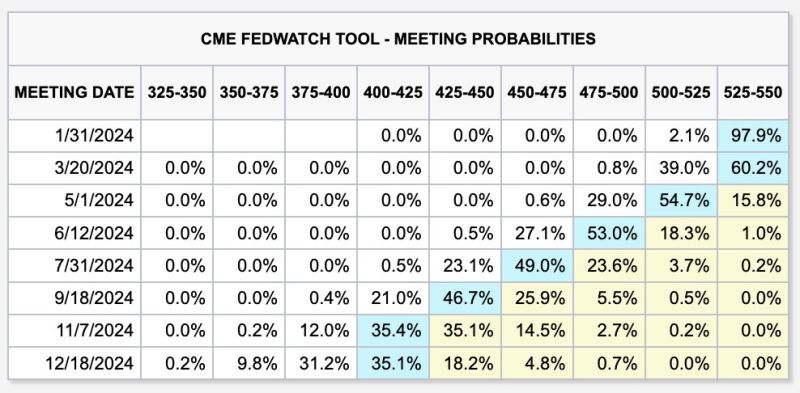

As we are less than 24 hours away from the first Fed meeting of 2024, odds of rate cuts are pulling back

Odds of a rate cut this week are down to 2% and odds of a rate cut in March are down to ~40%. This is the lowest probability of a March rate cut since November 2023. Still, futures are pricing-in a base case of 6 rate cuts for a total of 150 bps in 2024. - All eyes will be on Fed guidance on June 30zh Source: The Kobeissi Letter

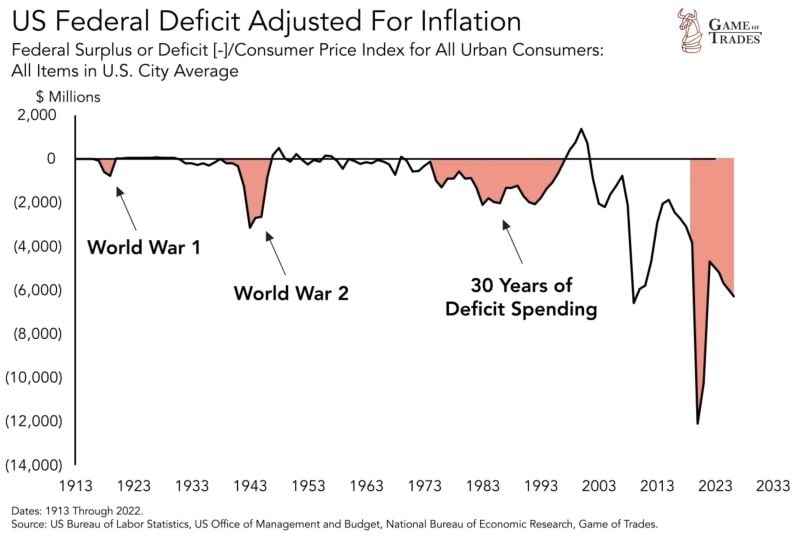

US government spending (inflation-adjusted) since 2020 has exceeded the combined spending of:

- World War I - World War II - 1970 to 1990 Is this sustainable?

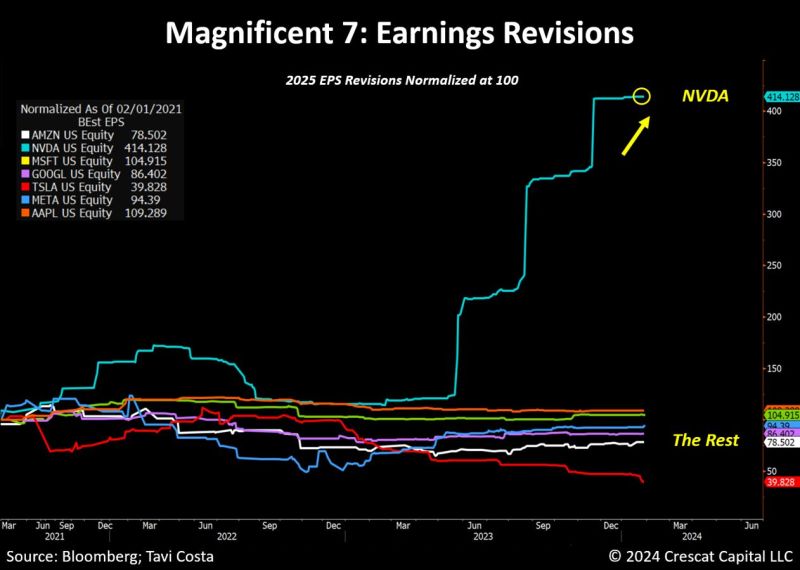

The week is THE week of BIG TECH earnings and it is time for a reality check: NVDA is the only Magnificent 7 stock seeing an increase in earnings revisions.

The company is almost the sole beneficiary of the recent AI advancements, contrasting sharply with others that have only experienced hype without any fundamental improvement. Is the Mag7 acronym already blowing out? Source: Bloomberg, Tavi Costa

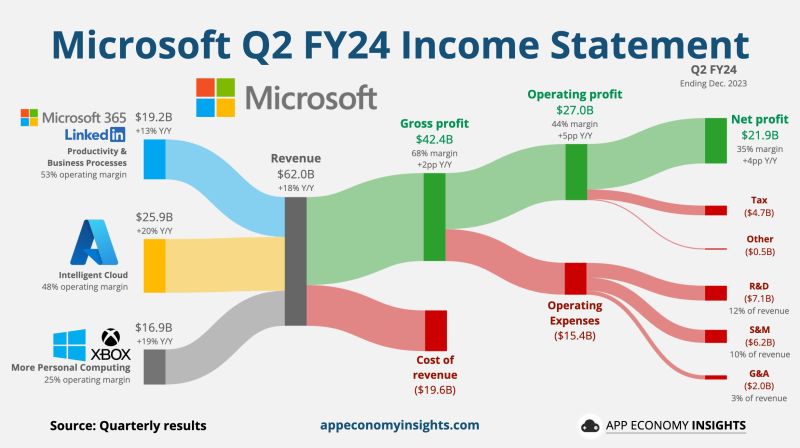

Microsoft $MSFT hitting all-time highs in extended hours trading after blowing out EPS and Revenue expectations

• Revenue +18% Y/Y to $62.0B ($0.9B beat). • Gross margin 68% (+2pp Y/Y) • Operating margin 44% (+5pp Y/Y). • EPS $2.93 ($0.16 beat). Source: App Economy Insights

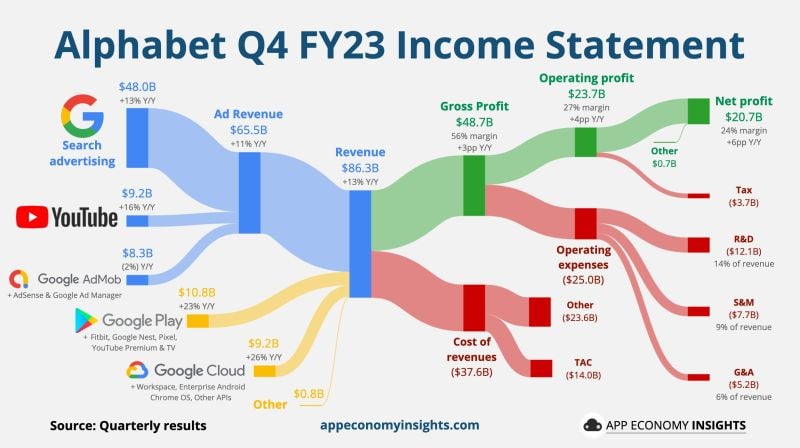

⚠️ Alphabet $GOOGL is down between -3% and -5% in extended hours trading after beating EPS and Revenue expectations

SUMMARY OF ALPHABET $GOOGL EARNINGS: 1. Revenue +13% Y/Y to $86.3B ($1.0B beat). 2. EPS $1.64 ($0.04 beat). 3. The search giant underperformed in its core ad search segment. -> Google’s advertising revenue totalled $65.52 billion, below expectations for sales of $65.80 billion. 4. Operating income also came in below expectations at $23.7 billion, compared to $23.82 billion. 5. On the bright side, Google cloud revenue topped estimates as the company spends heavily to compete with Microsoft’s Azure and Amazon’s AWS. ☁️ Google Cloud: • Revenue +26% Y/Y to $9.2B. • Operating margin 9% (+12pp Y/Y). 6. ▶️ YouTube ads +16% to $9.2B.

Market Breadth looking bullish!

Almost 84% of S&P 500 $SPX Stocks are now trading above their 100D moving average. Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks