Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

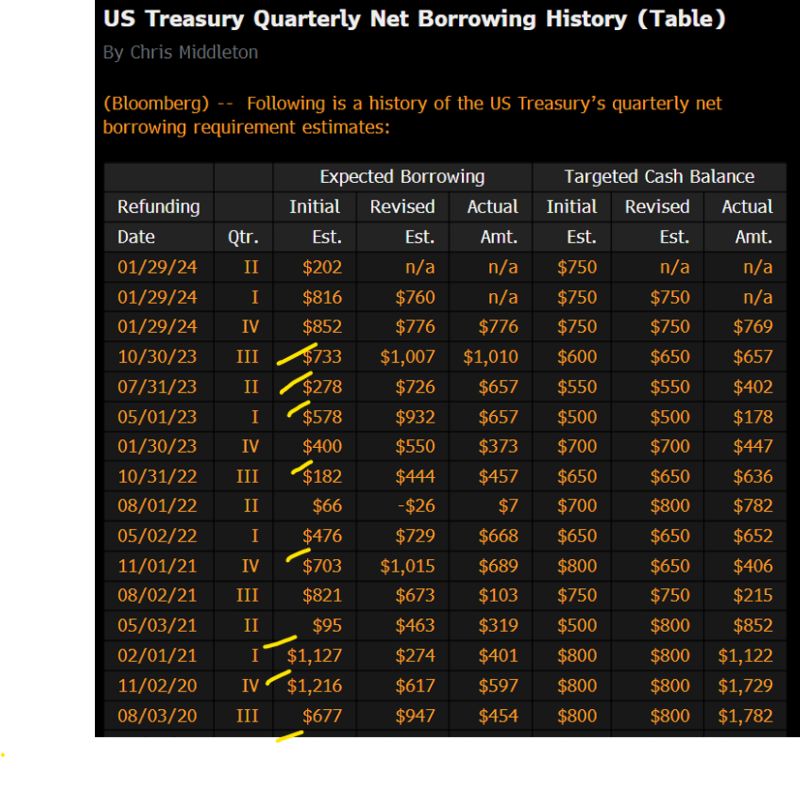

Equity futures spiked while bond yields dropped yesterday after the close after US Treasury unexpectedly slashed borrowing estimates:

- For Q1, US Treasury now expects to borrow "only" $760 billion in debt, which is $55 billion lower than what it expected in October 2023, and is about $30BN below wall street estimates. The difference the Treasury explained is "largely due to projections of higher net fiscal flows and a higher beginning of quarter cash balance." In other words, Treasury expects higher taxes to more than make up the $55BN difference from the previous estimate. - For Q2, the Treasury now expects to borrow only $202 billion in debt. While there was no previous Treasury forecast for this period, Wall Street expected a number somewhere in the $500BN vicinity, so clearly this is far lower than preciously expected. Source: Bloomberg, Chris Middleton, Lawrence McDonald, www.zerohedge.com

BREAKING‼️ BlackRock and VanEck Bitcoin ETF ads LIVE on Google

In accordance with Google’s latest policy regarding crypto, starting from January 29, 2024, advertisements on Bitcoin ETFs are allowed. Initially, the publication will be limited to the United States, but a subsequent expansion at a global level is planned.

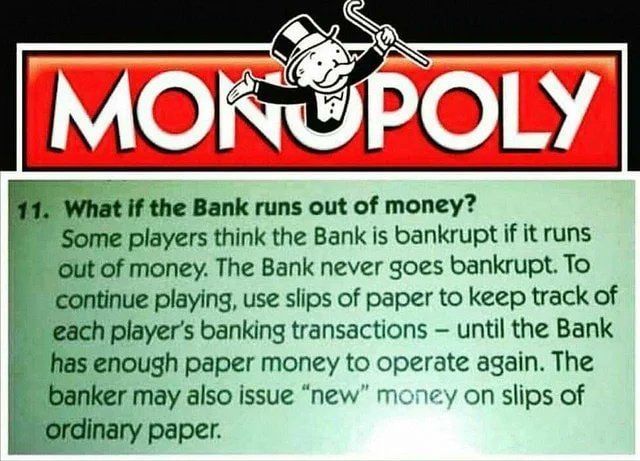

As a reminder. The bank never goes bankrupt and G7 countries will NOT default on their claims. Adjustment takes place through money debasement

There are 3 ways to invest at a time of FIAT currency: 1/ Spend 2/ Invest in risk assets 3/ Invest in store of values

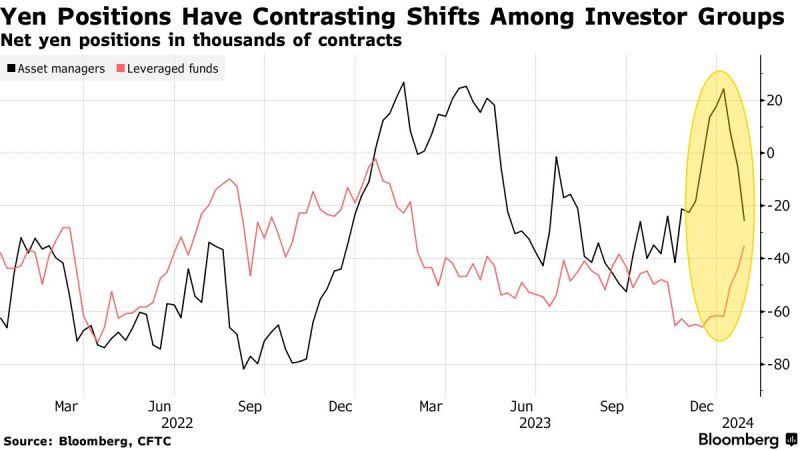

🇯🇵 Hedge Funds, Asset Managers Take Opposite Yen Bets Amid BOJ Talk - Bloomberg, C.Barraud

Hedge funds and asset managers were split on their yen views as the Bank of Japan laid the ground for an end to its negative-rate policy. Leveraged funds cut net yen shorts to the lowest level since February 2023 in the seven days ended Jan. 23 when BOJ announced its last policy decision, according to a report from the Commodity Futures Trading Commission. In contrast, asset managers, such as pension funds and insurance companies, boosted net shorts by the most since May when the investors switched to shorts from longs.

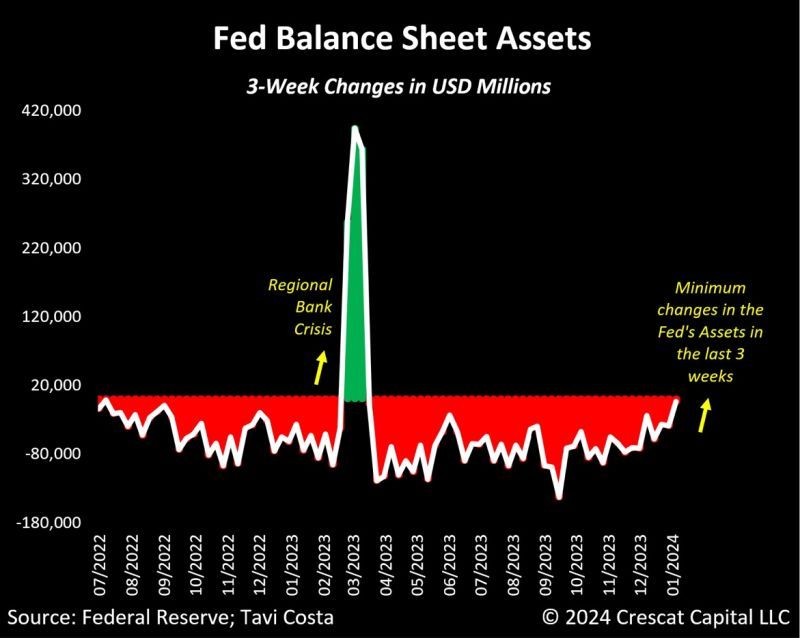

The Fed did almost no QT in the last 3 weeks

As highlighted by Tavi Costa, this was the smallest change in their balance sheet since the regional bank crisis in March 2023. Source: Bloomberg, Crescat Capital

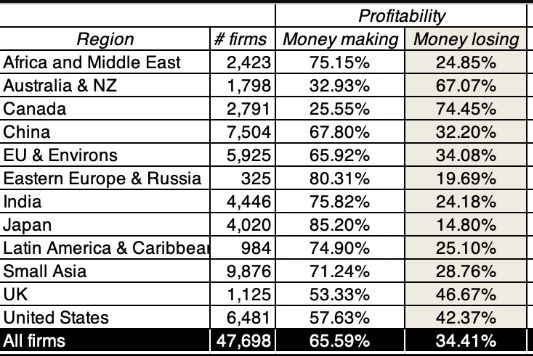

"Australia (67%) and Canada (74%) have the highest percentage of money losing companies in the world and Japan (15%) has the lowest" - via @AswathDamodaran

Source: Charlie Munger Fans

Investing with intelligence

Our latest research, commentary and market outlooks