Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Bitcoin (XBTUSD) Keep an eye at support

Bitcoin (XBTUSD) remains in a bull trend since mars 2023 but be carreful at this pullback as it's testing latest swing support 40'968.50 . This level needs to hold for the trend to remain valid. Source : Bloomberg

Hang Send Index reaching a multisupport zone

Hang Seng Index (HSI) is retesting October 2022 low. It's also on 1989 uptrend support !!! Keep an eye at this zone 14'600-15'200 over the next few days. Source : Bloomberg

CBOE Volatility Index $VIX jumps to highest level in more than 2 months

Source: Barchart

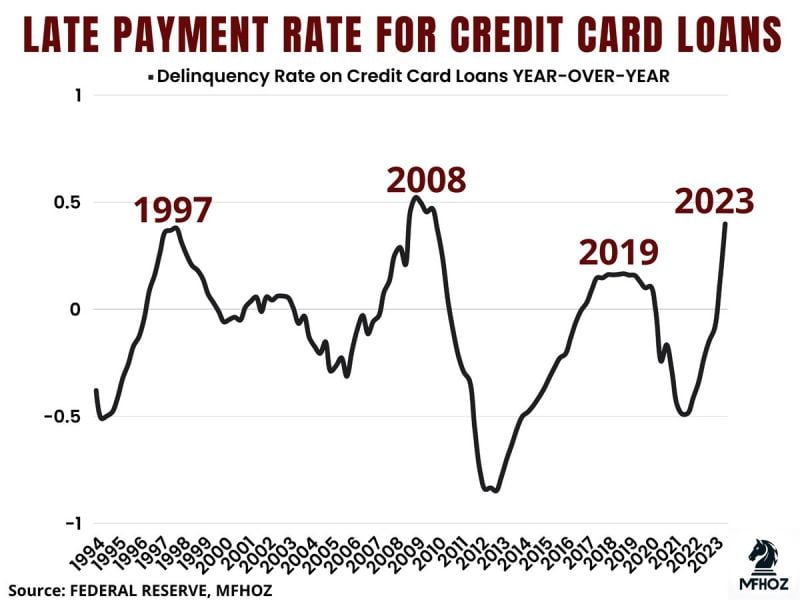

🟥 The delinquency rate for credit card loans in 2023 has risen sharply

Which, based on historical patterns, suggests that the economy might be heading towards a recession.

You've probably heard Chinese stocks are cheap. This chart takes that to a whole new level.

The Hang Seng Index's P/E is now below the Nasdaq's P/B. Those two valuation ratios should not even be anywhere close one another. Source: David Ingles, Bloomberg

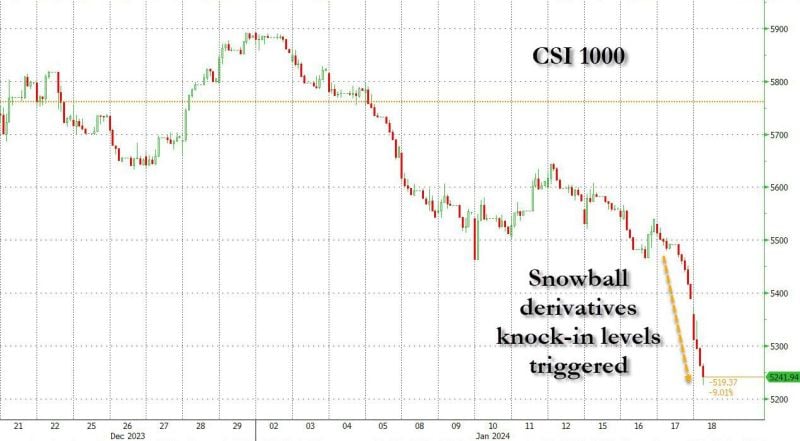

Another day, another loss for chinese stocks.

According to Guotai Junan Futures, there are about 30 billion yuan ($4.2 billion) of snowball derivatives products tied to the CSI 1000 Index are near levels that trigger losses at maturity, according to Guotai Junan Futures Co, as the stock rout in China's stock market pushes the derivatives to near knock-in levels. Another 60 billion yuan of the derivatives are 5%-10% away from their knock-in thresholds! Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks