Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

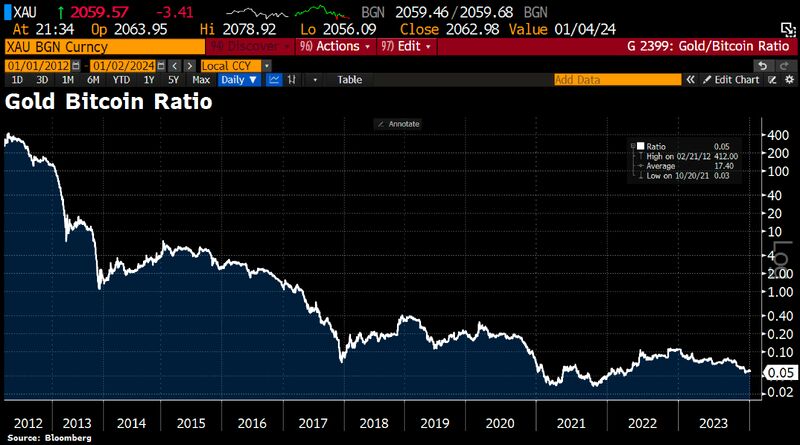

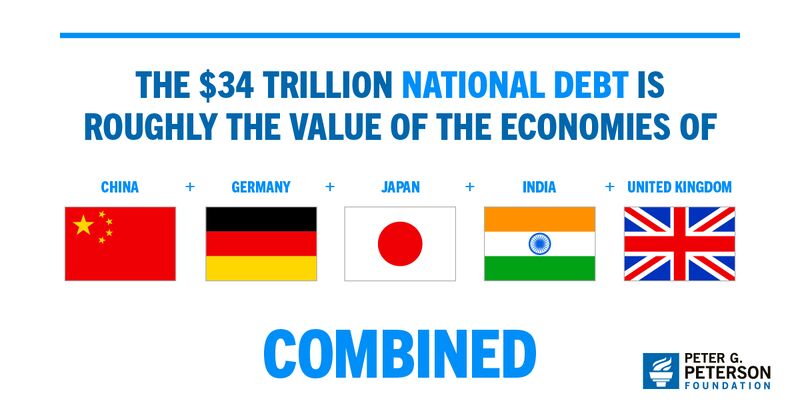

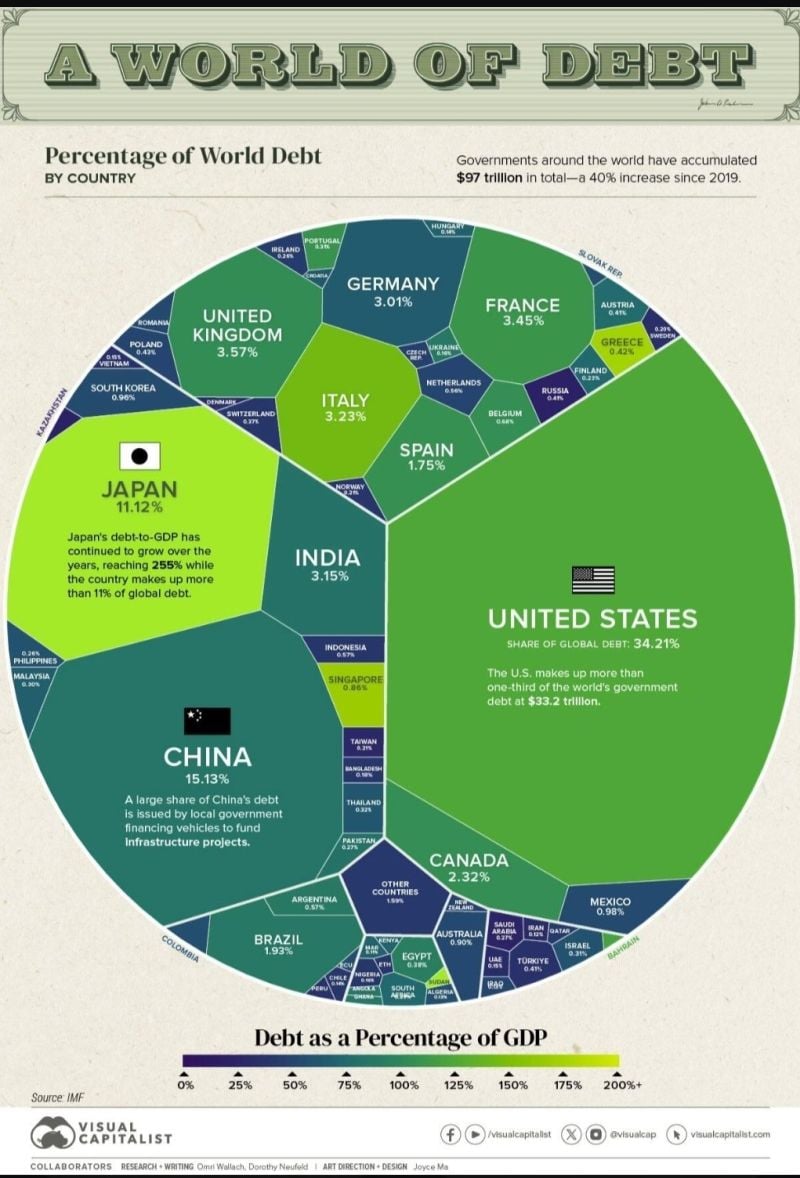

BREAKING: Total US debt hits $34 trillion for the first time in history, putting US debt up 100% since 2014

Since the debt ceiling "crisis" ended in June 2023, total US debt is up nearly $3 trillion. This debt balance is more than the value of the economies of China, Germany, Japan, India and the UK COMBINED. The US is now spending $2 billion PER DAY on interest expense alone. Debt per capita is at a record high of $101,000. Source: The Kobeissi Letter

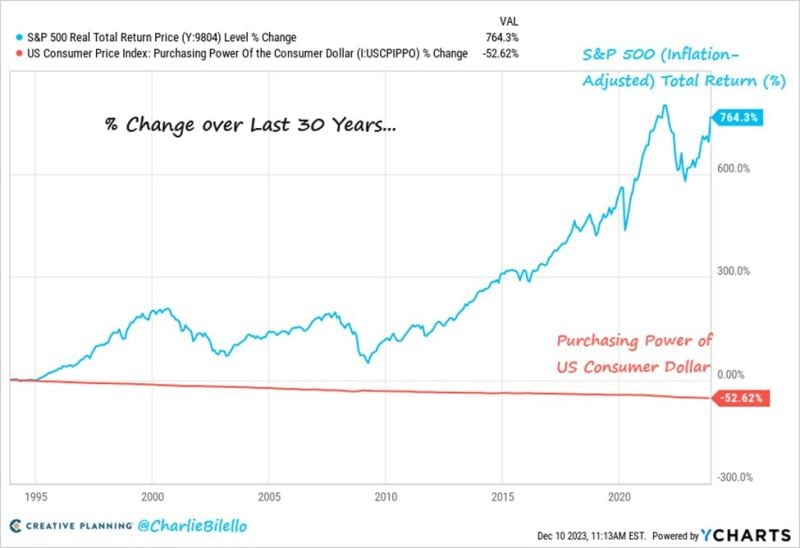

Investing in stocks is one of the best options available to protect your wealth against money debasement

Over time, the purchasing power of the dollar declines, while the stock market increases. That means you need more dollars to buy the same things. If you want to protect your purchasing power, invest in stocks for the long run. Source: Charlie Bilello thru Peter Mallouk

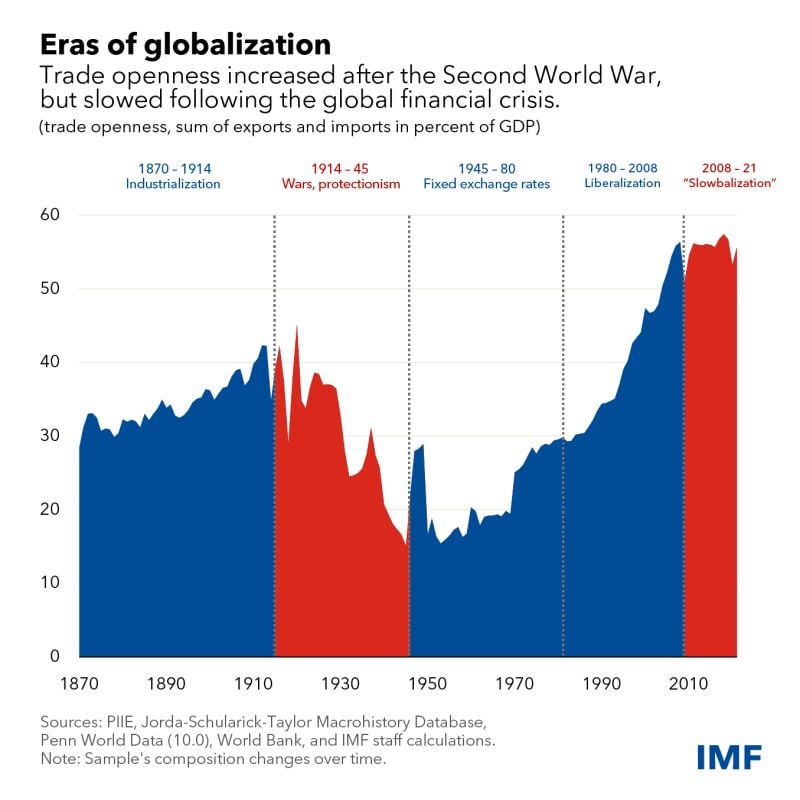

Net effect of slowbalization is growing stagflation risk

Update "slowbalization" chart by IMF.

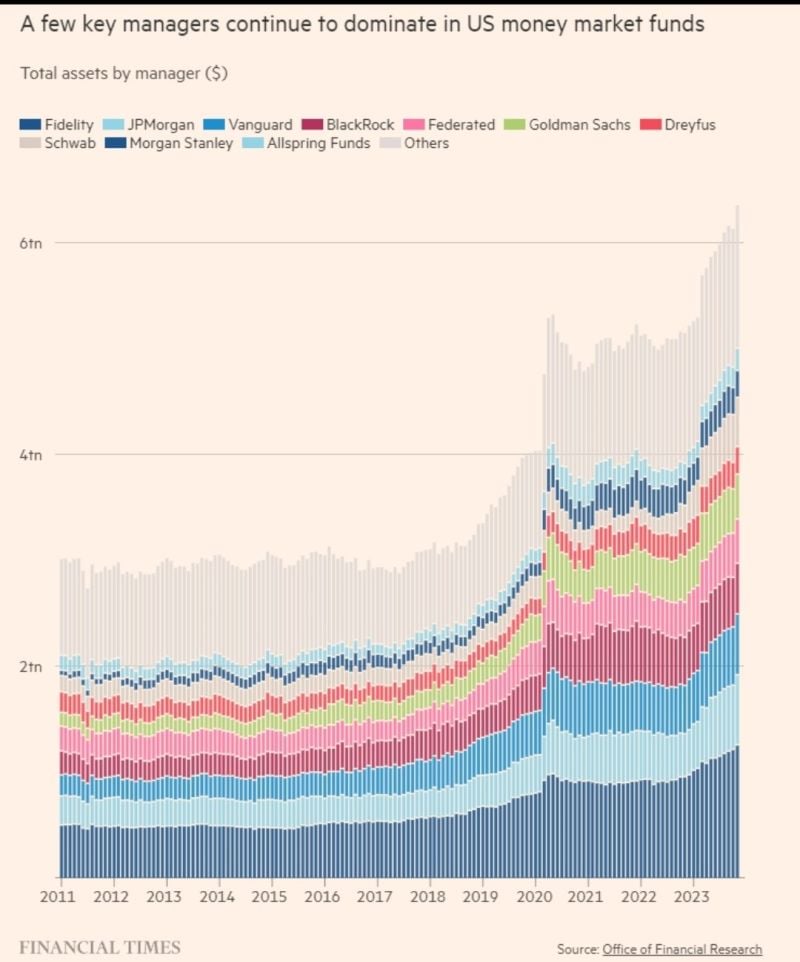

All-Time High $6.3 Trillion sitting in U.S. Money Market Funds

Source: Win Smart, CFA, FT

Investing with intelligence

Our latest research, commentary and market outlooks