Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

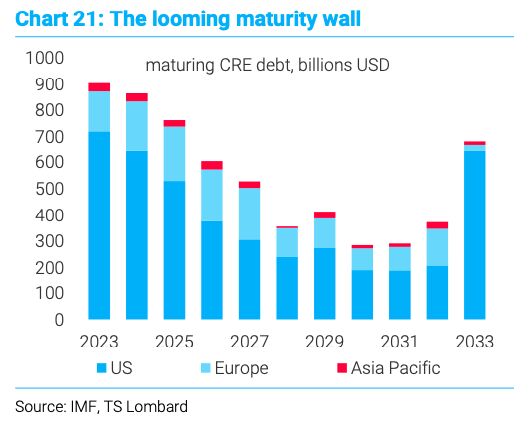

Billions of commercial real estate debt mature this year

Unlike US home loans, CRE debt is almost entirely interest-only. Borrowers tend to have low monthly payments but face a balloon payment equal to original loan on maturity. Source: Dabiel Baeza, TS Lombard

If you blinked you would have missed that one time that the US government was on track to pay down its debt...

Source: Markets & Mayhem

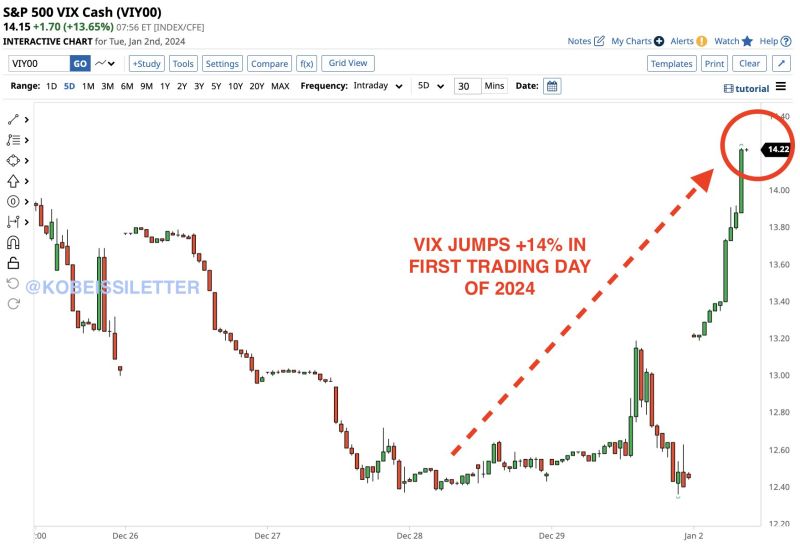

The volatility index, $VIX, is up 14% to kick off the first trading day of 2024. This puts the $VIX on track for its biggest daily jump since October 13th

Source: The Kobeissi Letter

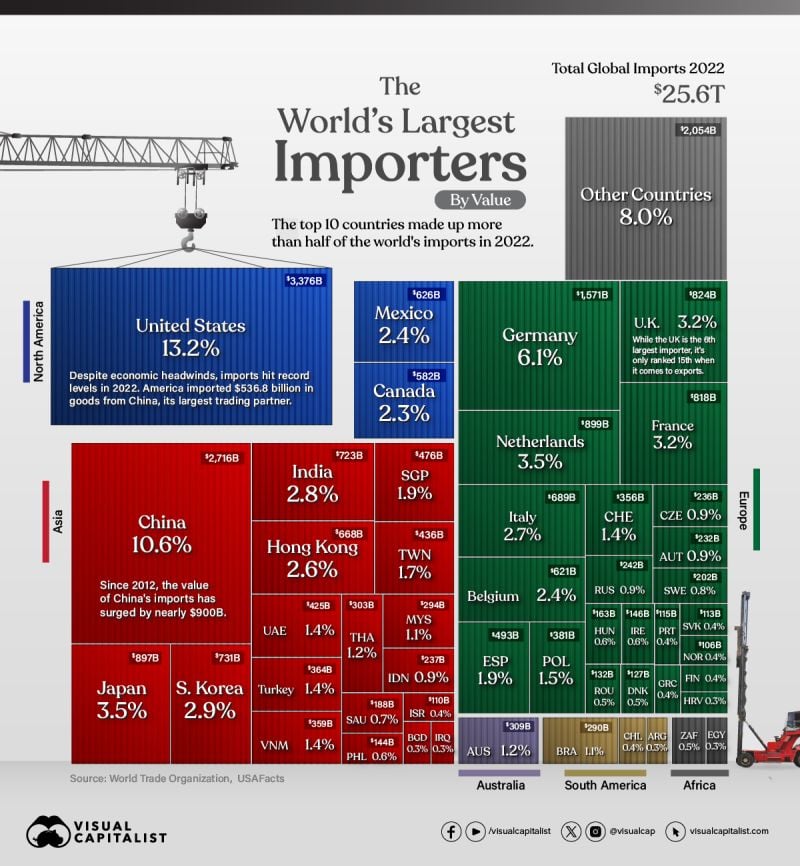

The Top 50 Largest Importers in the World by Visual Capitalist In 2022, global imports climbed to $25.6 trillion in value, or about the size of the U.S. GDP

As an engine of growth, global trade broadens consumer choices and can lower the cost of goods. For businesses, it can improve the quality of inputs and strengthen competitiveness. This graphic shows the 50 largest importers, with data from the World Trade Organization.

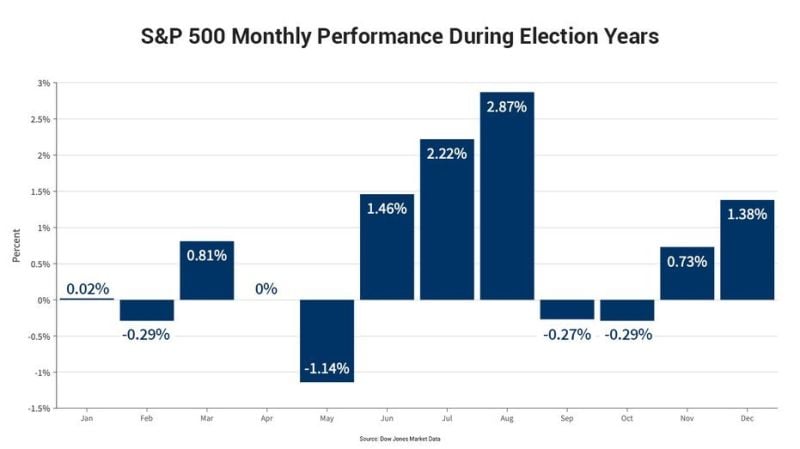

Here's how the SP500 performs during election years $SPY Buy the May dip for the summer rally?

Source: Trendspider

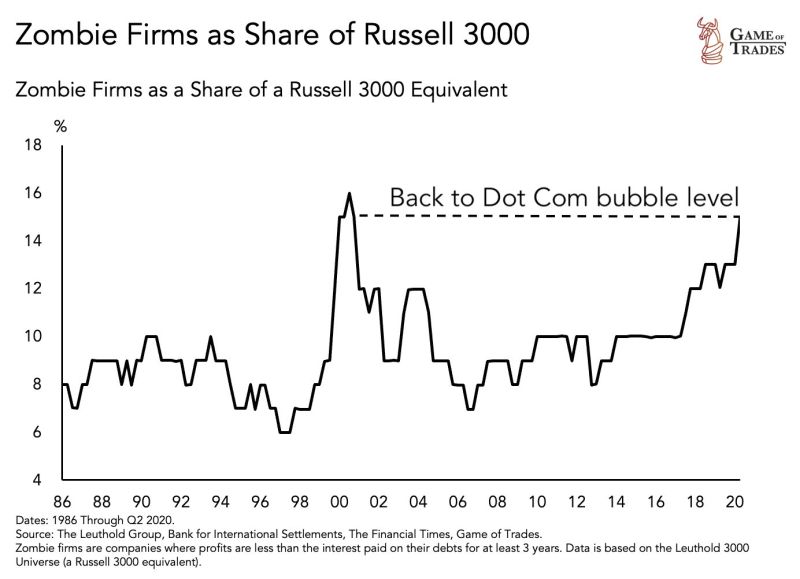

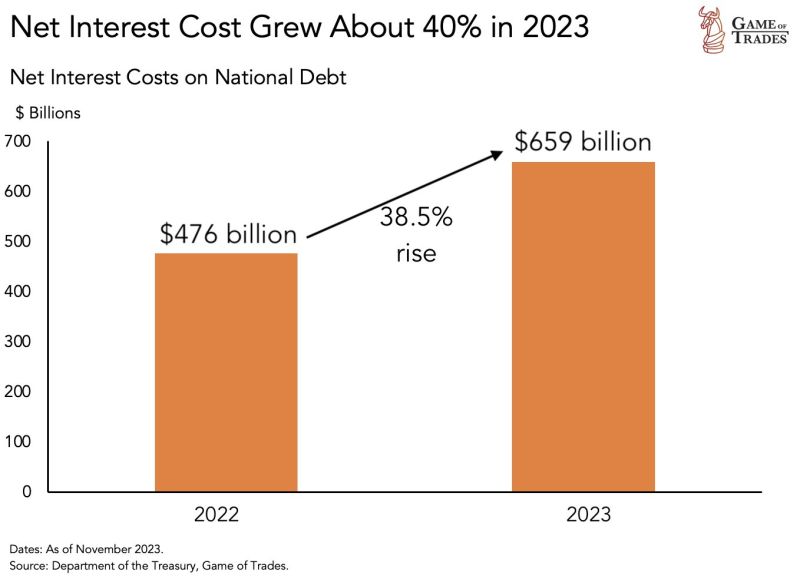

Net interest cost of US national debt grew by 38.5% just in 2023

Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks