Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

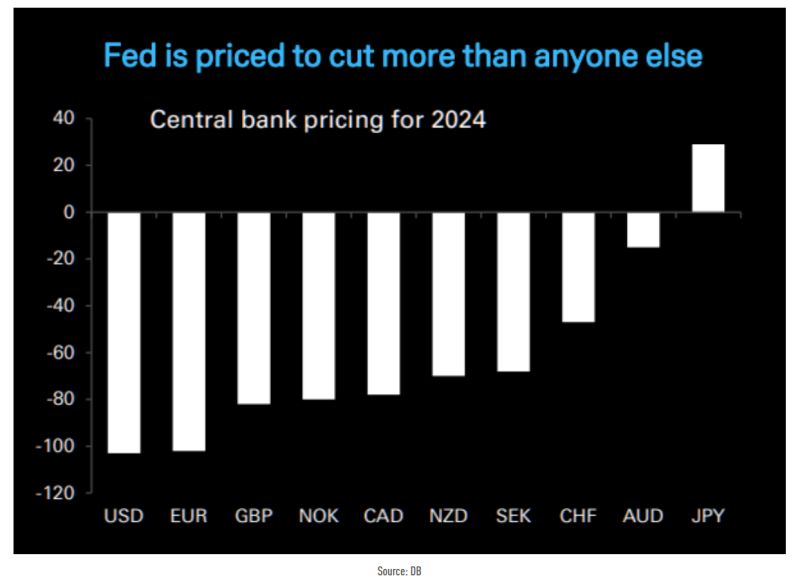

Too much, too fast? Markets is seeing the FED being the most aggressive in terms of rate cuts next year

Source: DB, TME

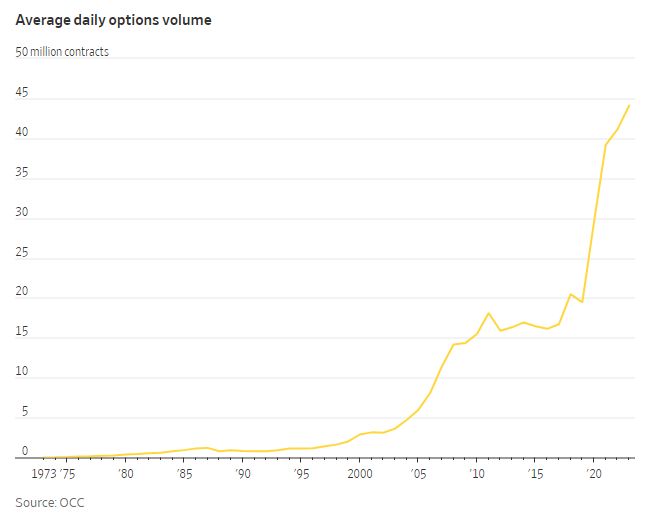

Record Options Volume !

Average daily stock options volume this year is 44 million contracts, on track to be the highest in history and more than double what it was 5 years ago. Source: barchart

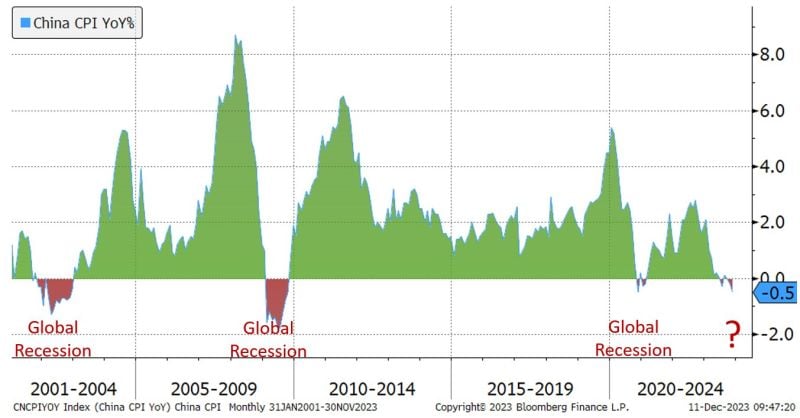

Each time inflation in China turned negative the global economy was in a recession: 2001, 2008-09, 2020... Is this time different?

Source: Jeffrey Kleintop, Bloomberg

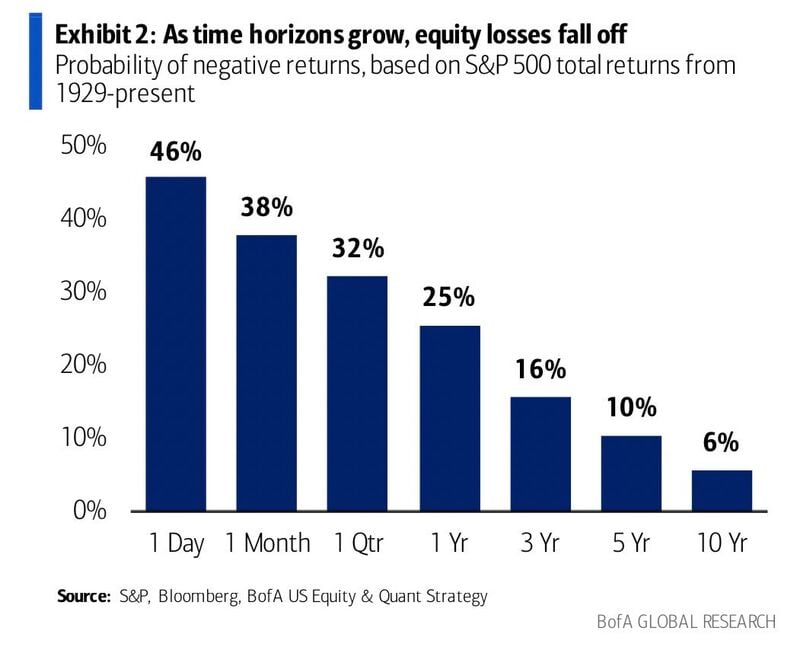

How to not lose money in the stock market? Answer: keep a long-term time horizon

Source: BofA

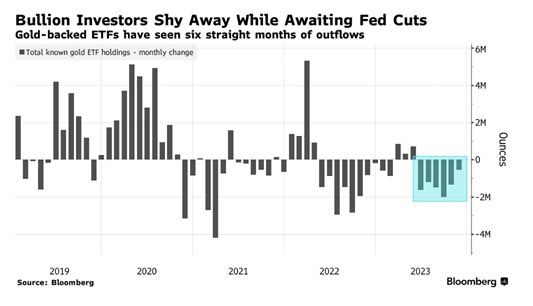

Gold rallying to 2k$ despite investors selling gold is remarkable. Is it all driven by central banks demand?

Source: Michel A.Arouet, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks