Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

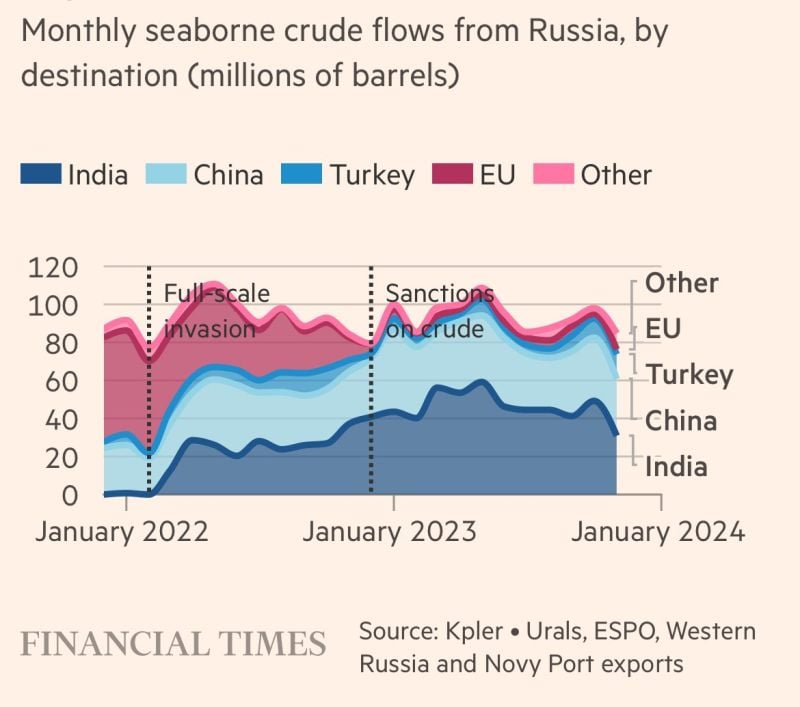

Russia replaced oil exports to the EU with exports to India and China

Source: FT

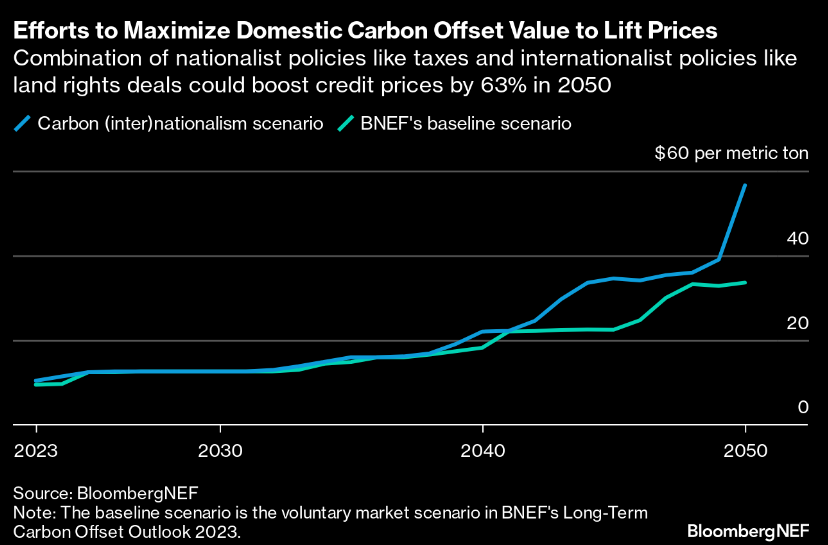

Goldman, Citi ready Trading Desks for new wave of Carbon deals

As the carbon offset market gets a new lease on life from the COP28 climate summit in Dubai, bankers from Wall Street and the City of London are positioning themselves to get a chunk of the dealmaking they say is coming.

Banks that have been building up carbon trading and finance desks include Goldman Sachs Group, Citigroup, JPMorgan Chase and Barclays.

Source: Bloomberg

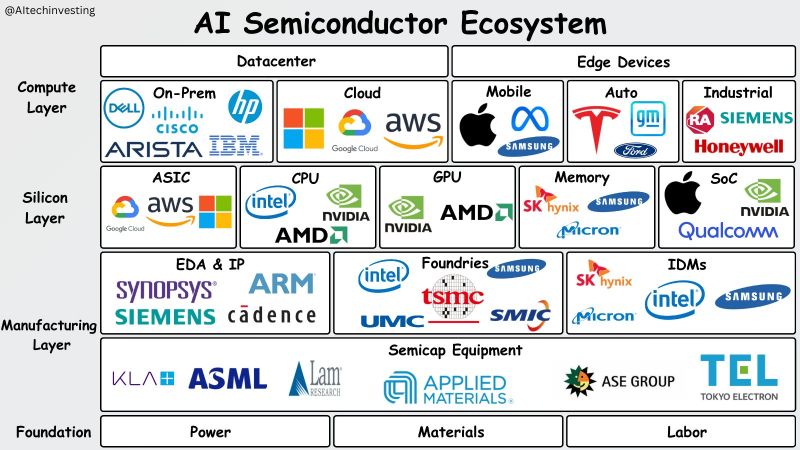

Breaking down the AI semiconductor ecosystem:

While $NVDA gets most of the attention, AI is additive to most of the semiconductor industry. Source: Eric AITechInvesting

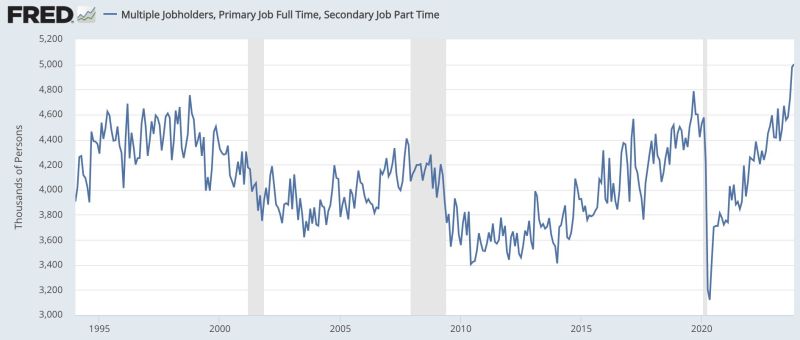

The number of Americans with a second job is again at all-time highs

Source: Fred, Win Smart

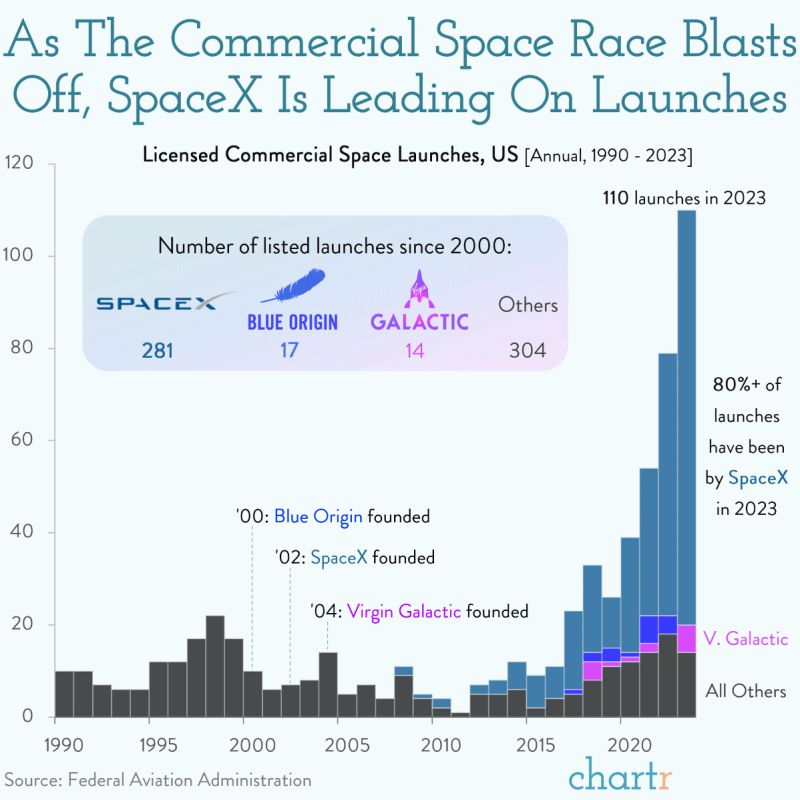

SpaceX Leading on Launches

A chart by Chartr. SpaceX, which has a wide-ranging set of commercial interests beyond taking tourists to the edge of space, continues to move forward — with a tender offer reported last week that could value it at $175bn. Plans for thousands of internet satellites, commercial travel to the moon, a base on the lunar surface and even loftier goals to turn the human race into an interplanetary species by colonizing other planets, are all ambitions of the California-based company. SpaceX has catalyzed much of the excitement about space tourism. The company’s two-stage Falcon 9 rocket is able to launch a kilogram into low-Earth orbit for just ~$1,500, a 10-20x decrease in cost in roughly as many years. That's due to its (partial) reusability — a breakthrough that’s helped SpaceX dominate commercial launchpads in the US. Indeed, FAA data reveals that SpaceX has completed 281 licensed launches since 2000 — 9x as many as Blue Origin and Virgin Galactic have managed between them. Source: Chartr

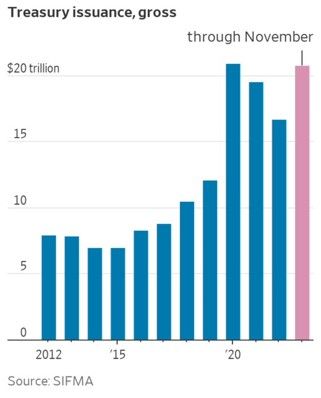

HEAVY SUPPLY REMAINS AN ISSUE FOR US TREASURIES

The US Treasury is selling $108 billion of 3-year, 10-year and 30-year bonds on Monday and Tuesday, along with $213 billion of shorter-term bills. This year’s Treasury sales are poised to surpass the record set in 2020. Source: Lisa Abramowitz, WSJ

Investing with intelligence

Our latest research, commentary and market outlooks