Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Maybe oil is not that irrational... As shown on the chart below, Oil (purple line) keeps following the Citigroup US Macro Surprises index (yellow line)

The weaker the data, the lower the prices. Sounds logical. Source: TME

Saudi Arabia said on Tuesday it will offer tax incentives for foreign companies that locate their regional headquarters in the kingdom, including a 30-year exemption for corporate income tax

Link to Khaleej Times article: https://lnkd.in/e-zD_D-D

As highlighted by The Kobeissi Letter, options markets are suggesting that Bitcoin will hit $50,000 by January

This also happens to be the same month that Bitcoin ETF approvals are expected. Open interest for Bitcoin $50,000 strike calls is massive, as displayed below. A move to $50,000 would put Bitcoin up more than 200% from its low. Options are suggesting the run is only just beginning. Can Bitcoin continue to thrive after ETF approvals? Source: The Kobeissi Letter

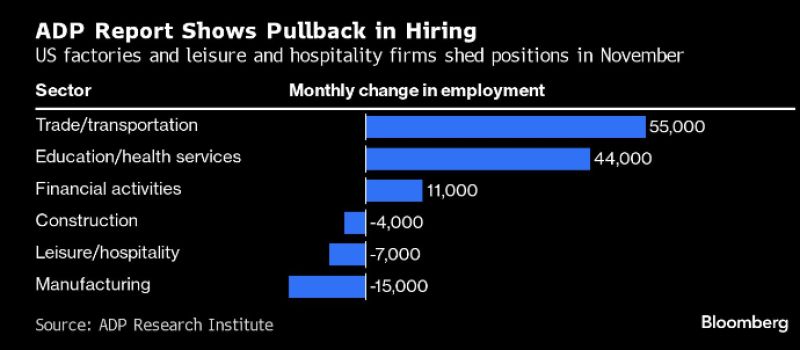

The ADP jobs report shows that the US labor market is cooling

U.S. firms scaled back hiring in November. Adding only 103k private payrolls compared 130k expected, according to ADP. Job cuts were seen in manufacturing, construction, and leisure/hospitality sectors. ADP’s report is based on payroll data covering +25 million US private-sector employees. Source: Genevieve Roch-Decter, CFA, Bloomberg

BREAKING: Crude oil prices drop below $70/barrel for the first time since July 2023

Since the September 28th high, oil prices are now down ~27%. Meanwhile, the national average gas price is down for 10-straight weeks to $3.25/gallon. Even as OPEC+ agreed to additional supply cuts last week, oil markets are selling off. A welcomed development for global liquidity, for inflation and for the Fed. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks