Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Looming Threat to Japanese Bonds: A Setback for the Global Fixed-Income Rally?

Amidst the impressive year-end rally in the global fixed-income market, a significant development last night casts a shadow over this upward momentum. The yield on the Japanese 10-year bond surged by 12 basis points, driven by comments from BOJ Governor Kazuo Ueda and Deputy Governor Ryozo Himino, instigating a belief that change might unfold sooner than anticipated. The probability of the BOJ ending its negative rates policy this month skyrocketed to nearly 45%, as Himino's speech was perceived as relatively hawkish, amplifying the significance of the BOJ's December meeting to a live event. Adding to the market tension, the Japan 30-Year Bond Sale recorded its lowest bid-cover since 2015. Notably, the sharp steepening of the Japanese curve, from 20 bps in March to 80 bps at the end of October, coincided with a significant increase in US Treasury yields over the same period... Source: Bloomberg

Most of this year's Dax rally is driven by higher EPS expectations, not P/E expansion. Dax has gained 18% year-to-date while Dax P/E has expanded only 6% from 11.5 to 12.2

Source: Bloomberg, HolgerZ

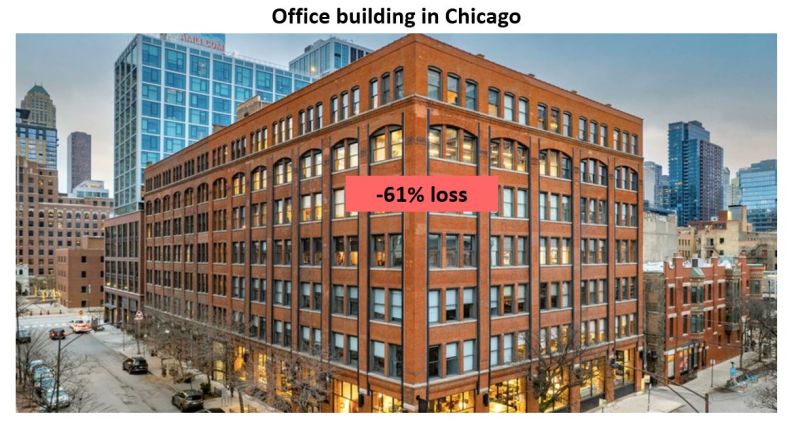

Here's one illustration of the US commercial real estate market meltdown: values of commercial real estate continues to get destroyed in Chicago...

A 155k SF office building in Chicago just sold for $17 million, or $109 per SF The seller took a huge 61% loss, paying $44 million for the building in 2017 Here's a worrying snippet from Crain's: "Thanks to remote work and higher interest rates, real estate investors can buy downtown office buildings on the cheap these days. Add a motivated seller trying to unload all of its office stock and the discount gets even steeper. Many office properties in the heart of the [Chicago] are now worth less than the mortgages tied to them, fueling a historic wave of distress." It will be interesting to see how bad the US commercial real estate meltdown gets (particularly in office) but it's certainly a story to keep an eye on in 2024 as big opportunities emerge". Source: TripleNetInvest

Volkswagen finally breaking out

Volkswagen has consolidated more than 60% over the last 30 months !!! End of October it rebounded on 2015 major support zone. It's now trying to breakout March 2021 downtrend. Keep an eye. Source : Bloomberg

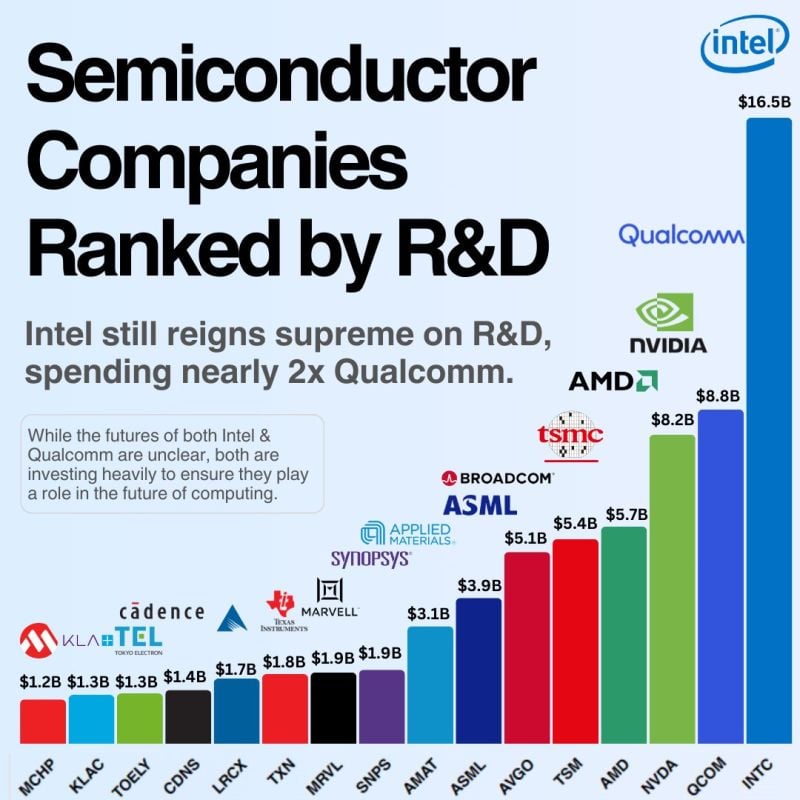

High R&D spending does NOT guarantee growth and/or high shareholder returns

The chart below courtesey of Eric | AI & Tech Investing shows semiconductor companies ranked by R&D over the last 12 months. $INTC $QCOM $NVDA $AMD $TSM lead the way. Intel has spent over $100B in R&D over the last decade. Despite that, they have the 2nd lowest shareholder return of all these companies (see addt'l chart below). Intel has generated $52.9B in revenue over the last twelve months. A decade ago, Intel generated $52.4B in revenue. An important cautionary tale for investors: R&D doesn't guarantee growth. Source: Eric | AI & Tech Investing

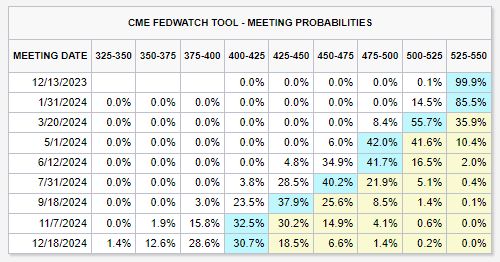

Odds of rate cuts beginning as soon as January 2024 are rising quickly

There is now a ~15% chance of rate cuts beginning next month. The base case shows a ~56% chance of rate cuts beginning in March 2024. Markets are currently expecting a total of FIVE 25 basis point rate cuts in 2024. Still, the Fed has yet to discuss the possibility of any rate cuts at all. Markets are fully bought in to the "Fed pivot." We believe that the economy will continue to slow down and that rate cuts will take place next year. However, a lot pof these cuts are already priced in. This could generate some volatility for bonds and stocks in case of disappoinment (aka macro data surprising on the upside). Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks