Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

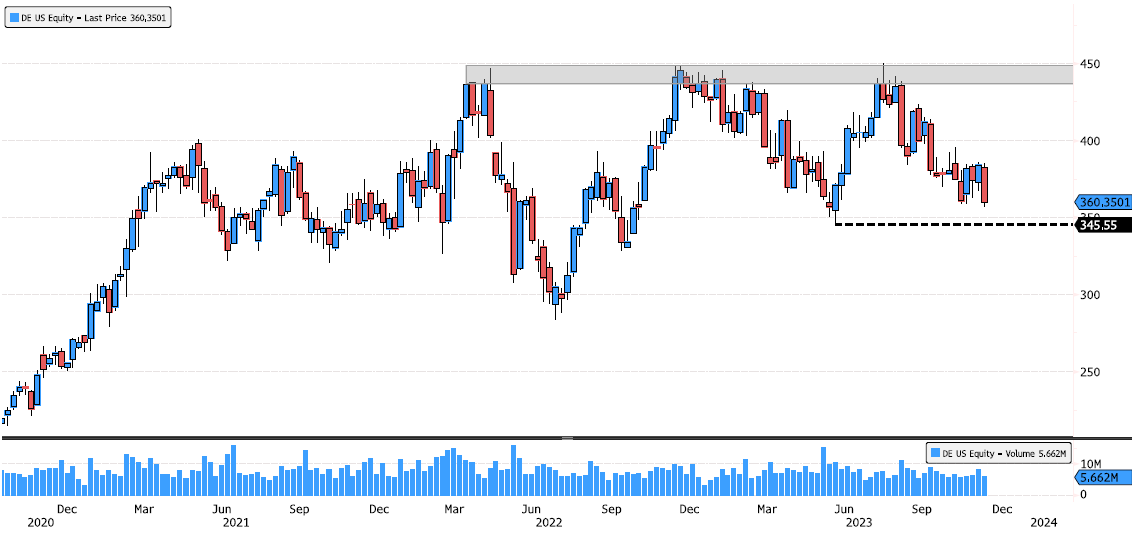

Deere looking for support after earnings

Deere (DE US) is down 6% today and testing first support 358.80. If it breaks, next level to look at will be 345.55. Source : Bloomberg

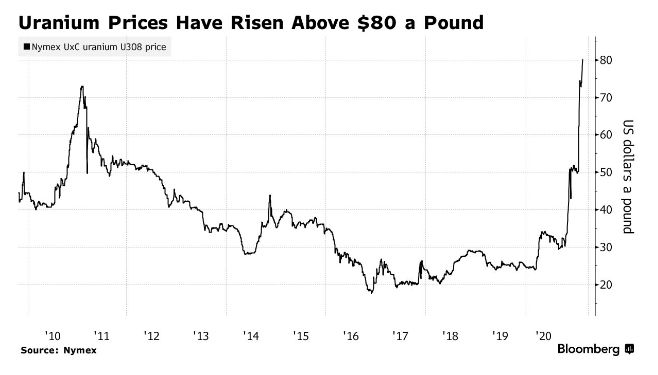

Uranium surges above $80 for the first time in more than 15 years

Source: Barchart, Bloomberg

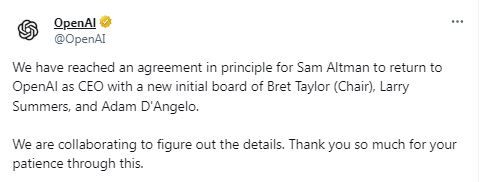

BREAKING: In a sudden turn of events, OpenAI signs agreement to bring Sam Altman back to the company as CEO

There will be a new board of directors initially consisting of Bret Taylor, Larry Summers, and Adam D'Angelo. Less than 1 week after Sam Altman was fired, OpenAI is welcoming him back. In a statement from the company, they are "collaborating to figure out the details."

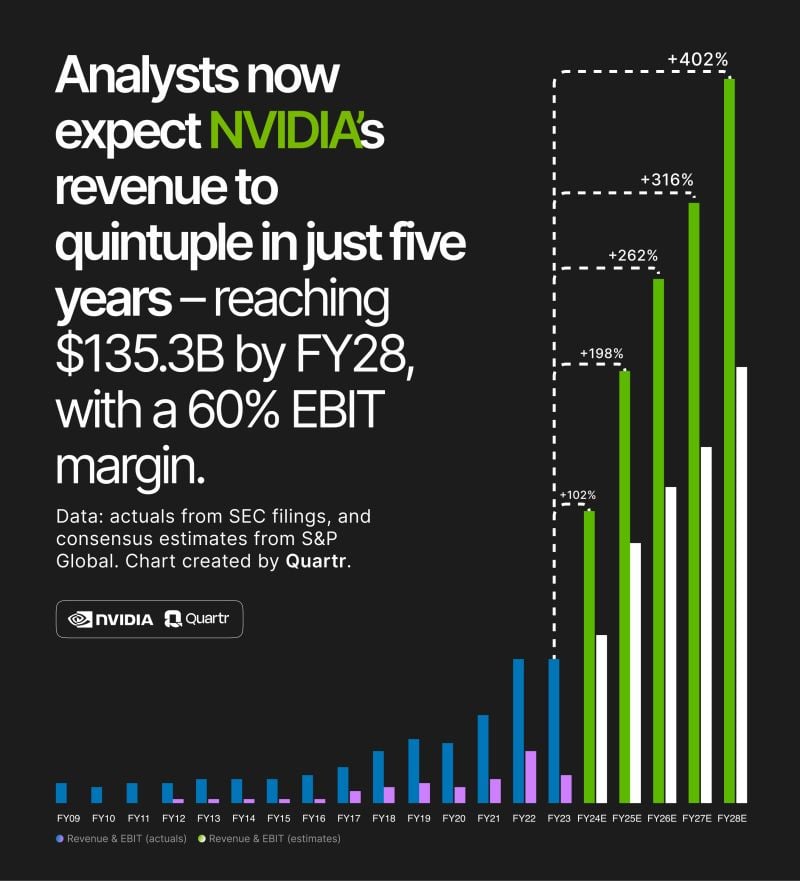

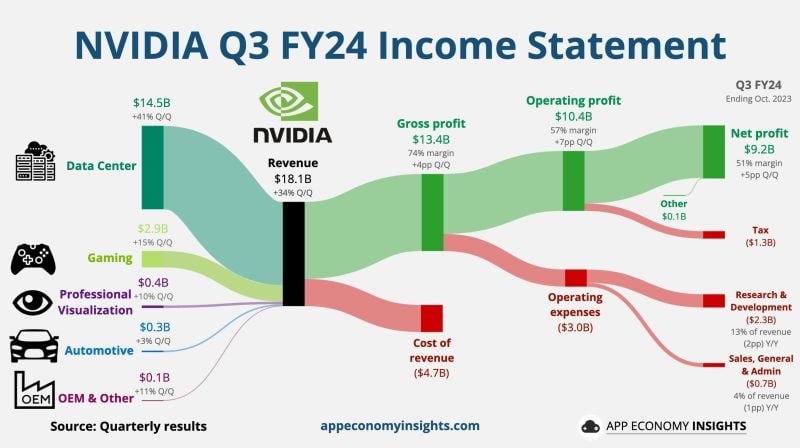

$NVDA Q3'24 Highlights

"NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines in full throttle. The era of generative AI is taking off" – Co-founder & CEO, Jensen Huang Revenue +206% *Data Center +279% *Gaming +81% *Professional Vis. +108% *Automotive +4% EBIT +1,633% *marg. 64% (26%) EPS +1,274% Source: Quartr

Binance CEO Changpeng Zhao (CZ) is out, but Binance survives as part of a DOJ settlement

-> Binance CEO Changpeng Zhao has agreed to step down from his role at the world's largest crypto exchange as part of a settlement with the U.S. Department of Justice. -> He also plans to plead guilty to violating criminal U.S. anti-money-laundering requirements that would potentially allow the exchange to keep operating, people familiar with the matter have told the Wall Street Journal. -> Zhao will appear in federal court in Seattle on Tuesday to enter his guilty plea, the sources told the news outlet. Binance, the international crypto exchange that Zhao founded and owns, will plead guilty and pay $4.3 billion in fines and settlements with authorities. It's amazing how US markets keep pricing cuts. When the Minutes reiterate, yet again, that while the Fed are cautious they still have a tightening bias. Source: Decrypt

SUMMARY OF FED MEETING MINUTES (11/21/23):

1. All Fed Members agree to “proceed carefully” 2. Fed sees rates “remaining restrictive for some time” 3. Fed sees upside risks to inflation 4. Fed sees downside risks to growth 5. Meeting by meeting approach to resume It's amazing how US markets keep pricing cuts. When the Minutes reiterate, yet again, that while the Fed are cautious they still have a tightening bias.

Moments ago nvidia reported blowout Q3 earnings with revenue tripling as AI chip boom continues

However, it warns of "significant" China slowdown, guidance matches whisper range; stock is down 1% after-hours... The blowout earnings were certainly good news... but the warning about declining China sales and the guidance which only tagged the top end of the whisper guidance, that was not quite as exciting, and as a result, the stock initially dumped as much as $30 after hours, before recovering most of its losses, but has since resumed drifting 1% lower, setting up the stock for its first post-earnings drop since the advent of ChatGPT almost exactly one year ago. Source: App Economy Insights

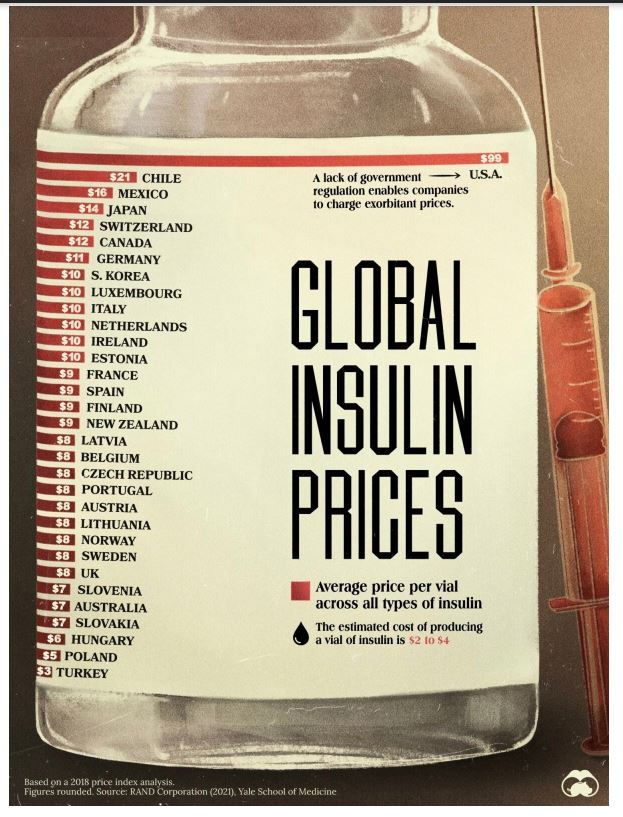

Charted: The Average Cost of Insulin By Country by Visual Capitalist

Drug prices in the U.S. are notoriously high for many important medications, including insulin. When comparing the cost of insulin by country, we see that the difference is not even close. This chart shows the average cost of insulin across OECD countries, based on a 2021 publication by RAND Corporation.

Investing with intelligence

Our latest research, commentary and market outlooks