Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

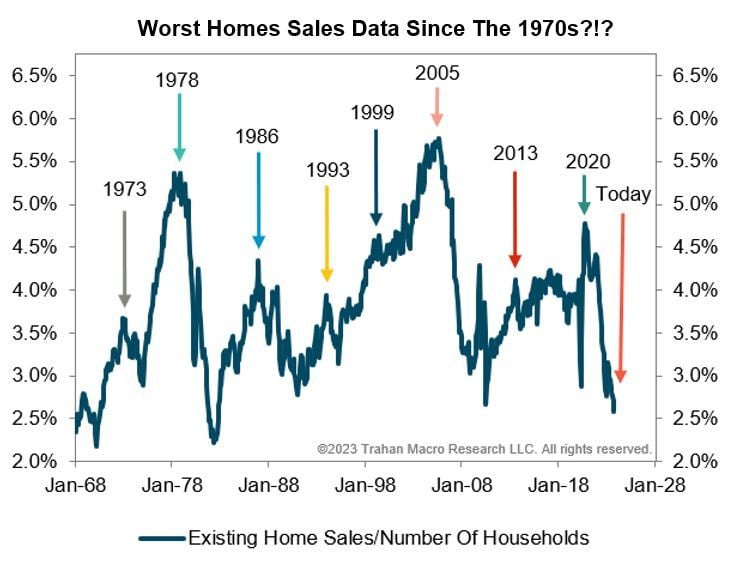

Existing Home Sales Crash To Slowest Since 2010

Sales actually fell 4.1% MoM (far worse than expected and down for the 20th time in the last 23 months) with September's 2.0% MoM decline revised even lower to -2.2% MoM. That decline left existing home sales down 14.6% YoY... Fewer US existing homes are selling today than at any point since 2010. The 3.79 million annual rate is even below the lowest level of sales during the 2020 covid shutdowns (4.01 million). The chart below by Francois Trahan puts things in greater perspective and shows that when adjusting for population, this is one of the worse housing profiles we have seen in decades. On this "per household" basis October existing home sales data was worse than the lowest reading seen at the depths of the GFC. Source: François Trahan

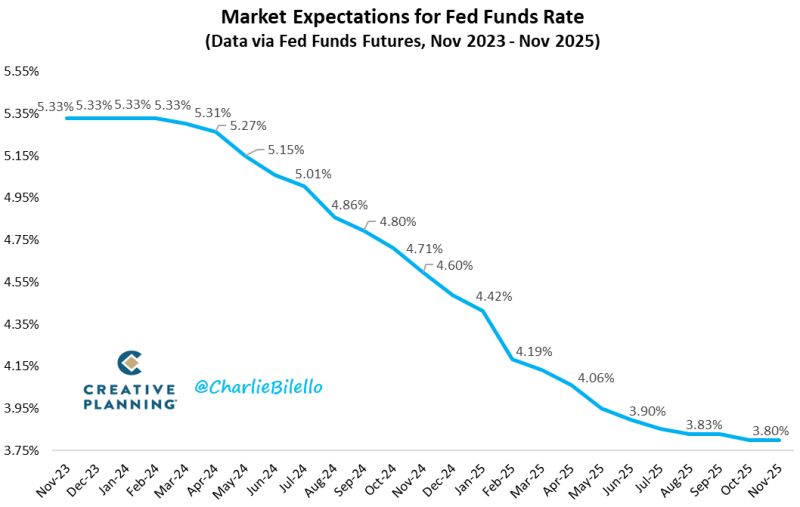

Ahead of Fed minutes... The market is now pricing in a 0% probability of a rate hike in December and rate cuts starting in May 2024

Source: Charlie Bilello

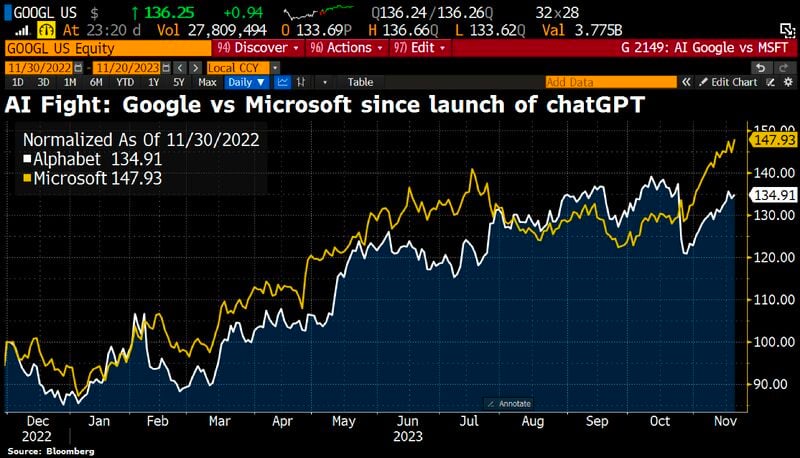

Microsoft is now clearly ahead of Alphabet again in the AI race on the stock market

Source: HolgerZ, Bloomberg

Today is the BIG DAY with Nvidia ($NVDA) earnings results after the bell

With the Nasdaq up more than 13% from the lows, $NVDA at all-time-high, 95% of sell-side analysts with a BUY rating on $NVDA (!) sentiment of AI probably at record optimistic level after Microsoft "aqui-hire" of openai and the $VIX historically low at 13.5, there is indeed room for a short-term pullback... Source: www.investing.com, kakashiii111

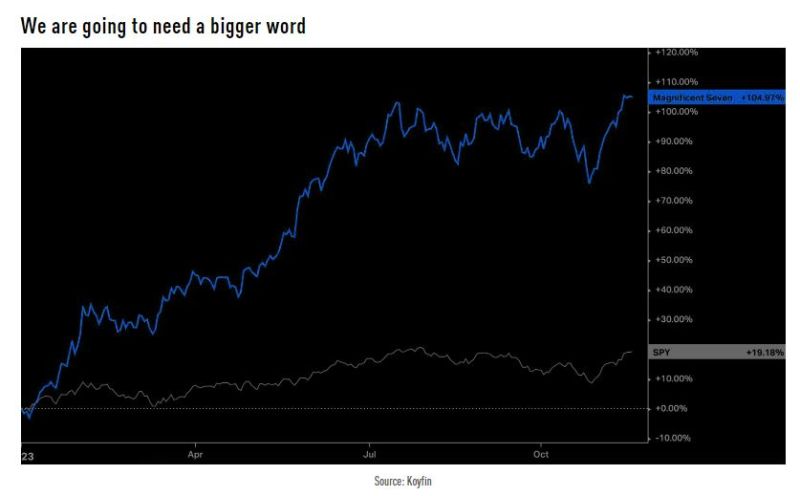

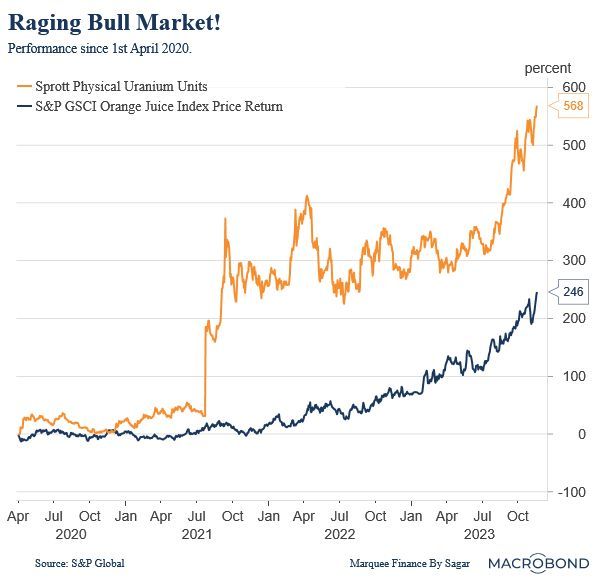

The biggest bull market post-COVID has not been in the Magnificent 7 or any other equity markets; it has been in these two commodities:

1) Orange Juice: 246% 2) Uranium: 568% Source: Macrobond, Sagar Singh Setia

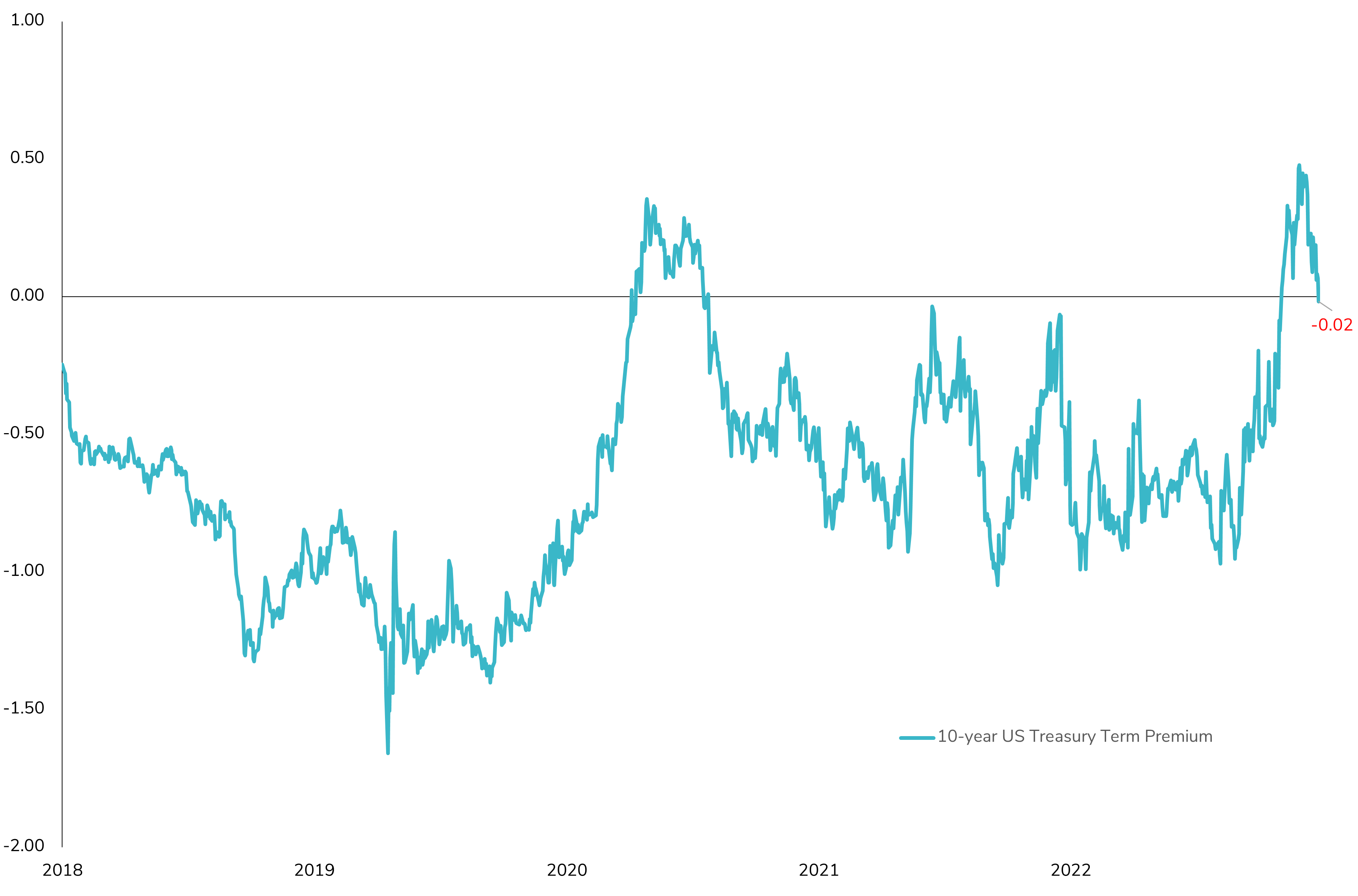

10-Year US Term Premium Dips Back into Negative Territory! 📉🔍

The term premium, a metric reflecting the additional yield demanded by investors for holding longer-term bonds rather than rolling over shorter-dated securities, turned negative last week. This shift could be interpreted as a signal that the market is anticipating a recession in the US in 2024, with rate cuts by the Federal Reserve (1% fully discounted already by the market). Given the recent rally of more than 50 basis points on the 10-year US Treasury yield and the term premium now in negative territory, coupled with still very high rate volatility, the question arises: Will the rally in long rates temporarily come to a halt? 🤔 Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks