Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

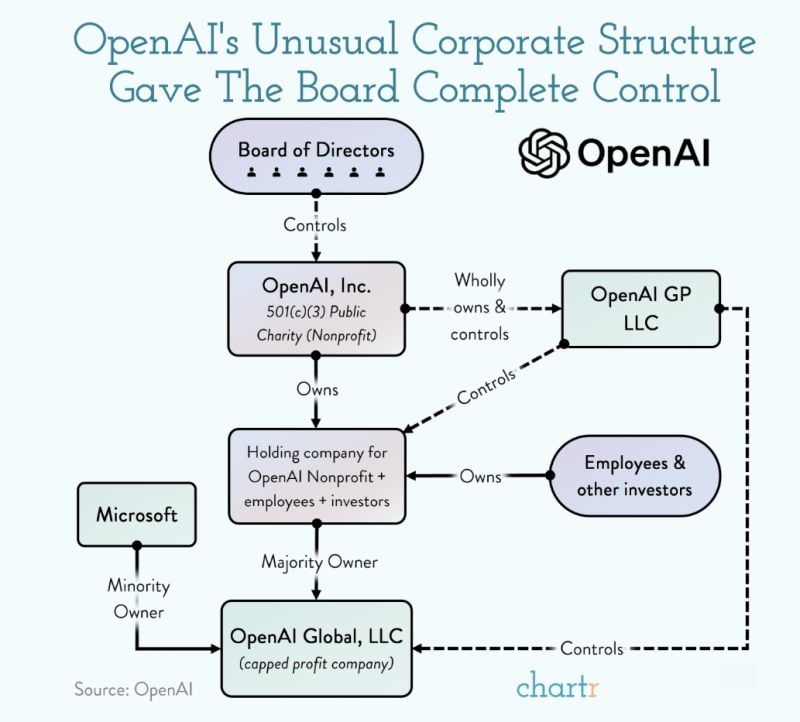

The corporate structure of OpenAI by Chartr or how a generationally-important company like OpenAI could be plunged into such chaos is partly down to its unique corporate model

Following the company's structure from top to bottom — even with a few subsidiaries thrown in — reveals that the board of directors had ultimate control to make decisions over both the nonprofit and for-profit OpenAI entities... leaving anchor investor Microsoft blindsided by Altman’s ousting just moments before the public announcement. The company that launched ChatGPT less than a year ago claims that its structure is designed to develop artificial general intelligence that’s “safe and benefits all of humanity”, with the capped profit arm of OpenAI, first introduced in 2019, able to issue equity and raise capital to further the work of the original nonprofit that was established in 2015. Source: Chartr

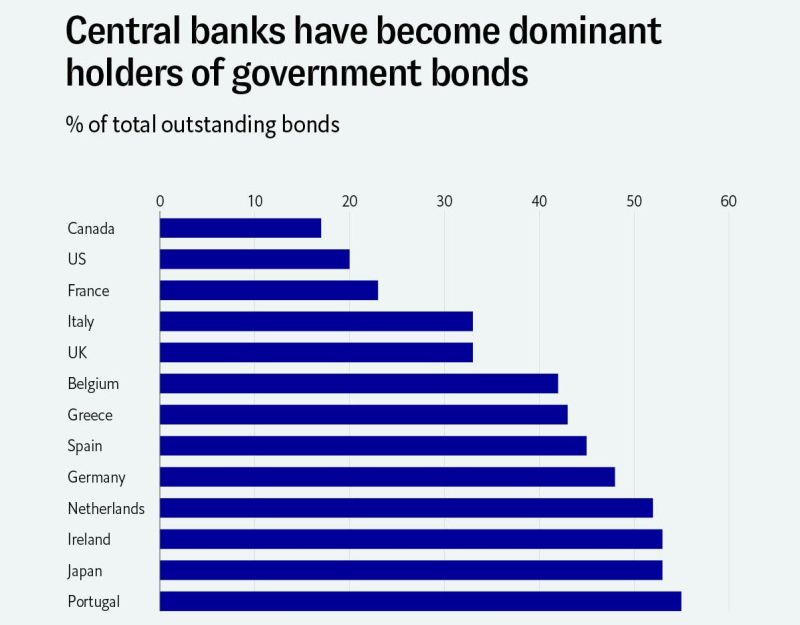

central banks have become dominant holders

Source: Michel A.Arouet

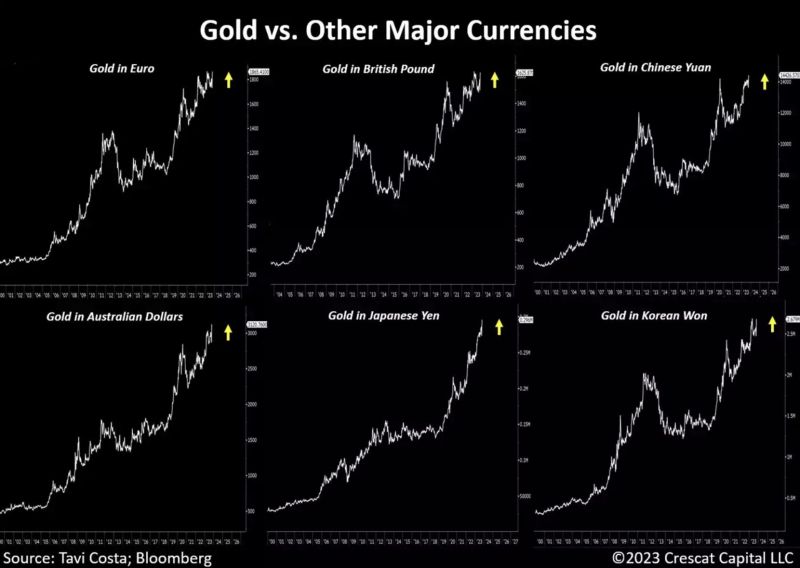

Be careful not to look at gold only against the dollar. Gold is at its highest against many FIAT currencies

But even the $2,000 an ounce level is intriguing: despite clearly positive real rates and the appreciation of the greenback, gold is close to all-time highs. Looking forward, two scenarios are possible: o 1) Gold is overvalued and should soon depreciate o 2) Gold is seen as a safe haven against geopolitical uncertainty, but also against the political disorder in Washington and the declining confidence in the Fed. If this is the case, a possible depreciation of the dollar and a fall in the real interest rate could benefit the yellow metal. Bottom-line: Gold remains an attractive portfolio diversifier Source chart: Tavi Costa, Bloomberg

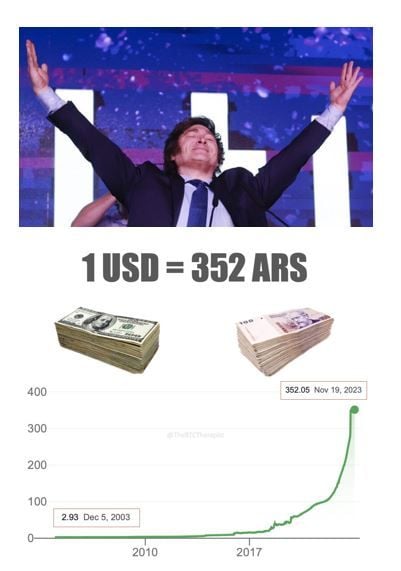

Fiat money debasement does have some strong polical and economical consequences

Javier Milei has just won Sunday’s presidential runoff against Economy Minister Sergio Massa. Javier Milei, a 53-year-old far-right economist and former television pundit with no governing experience, claimed nearly 56% of the vote, with more than 80% of votes tallied. Voters in this nation of 46 million demanded a drastic change from a government that has sent the peso tumbling, inflation skyrocketing and more than 40 percent of the population into poverty. With Milei, Argentina takes a leap into the unknown. He has promised to fix Argentina’s perennial economic problems by making drastic budget cuts, replacing the battered peso with the US dollar and shutting down the central bank. He will take office on December 10th.

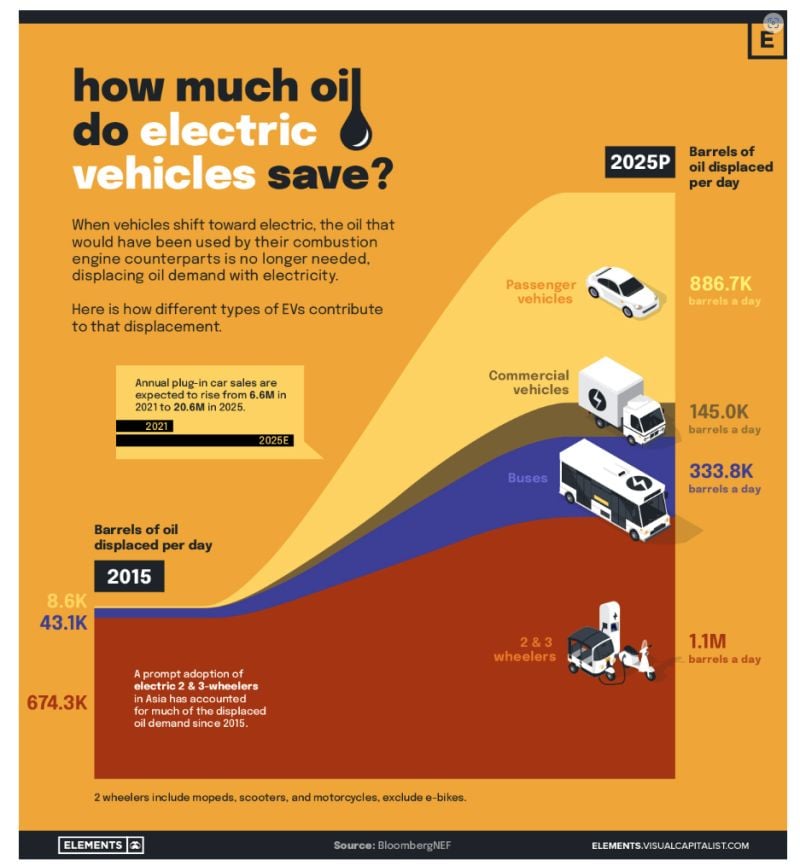

The EV Impact on Oil Consumption by E`LEMENTS / Visual Capitalist As the world moves towards the electrification of the transportation sector, demand for oil will be replaced by demand for electricity

To highlight the EV impact on oil consumption, the above infographic shows how much oil has been and will be saved every day between 2015 and 2025 by various types of electric vehicles, according to BloombergNEF. Link to full article: https://lnkd.in/eYm5iJ8d

"DeFi started on Bitcoin.

Ethereum and Solana popularized it. Now time for all of that activity to come back to the original chain". Dan Held

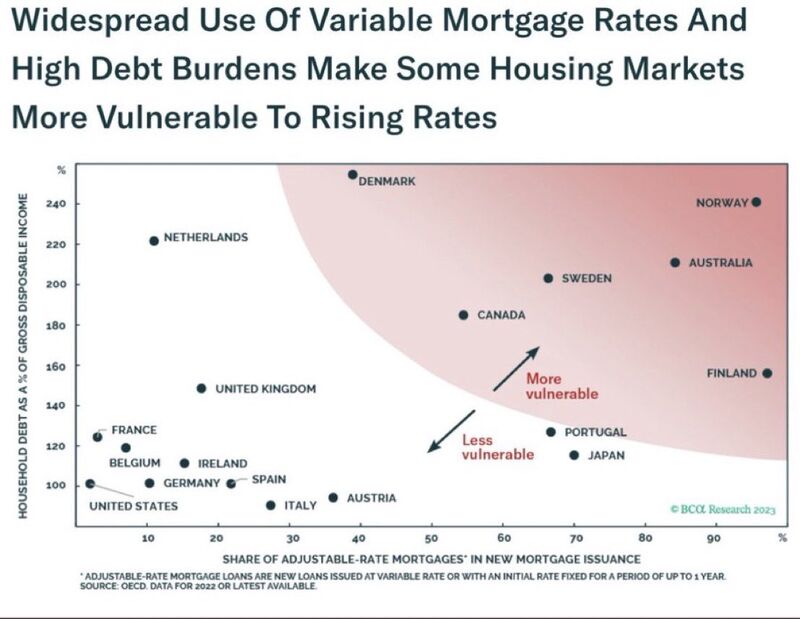

Which countries have the most rate sensitive household sectors?

Source: BCA, The Longview

Sam Altman ousted by OpenAI and moving to Microsoft:

Microsoft has hired Sam Altman and Greg Brockman to lead a team conducting artificial intelligence research, days after the pair were pushed out of OpenAI, the company they co-founded. Writing on X on Monday, Microsoft chief executive Satya Nadella said that Altman and Brockman, “together with colleagues, will be joining Microsoft to lead a new advanced AI research team”. “We look forward to moving quickly to provide them with the resources needed for their success,” he added. Altman retweeted Nadella’s post on Monday, adding: “the mission continues”. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks