Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

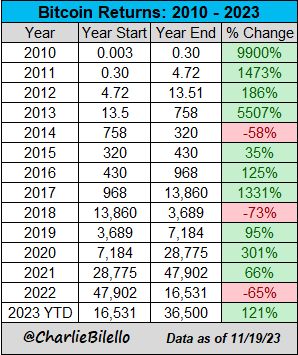

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

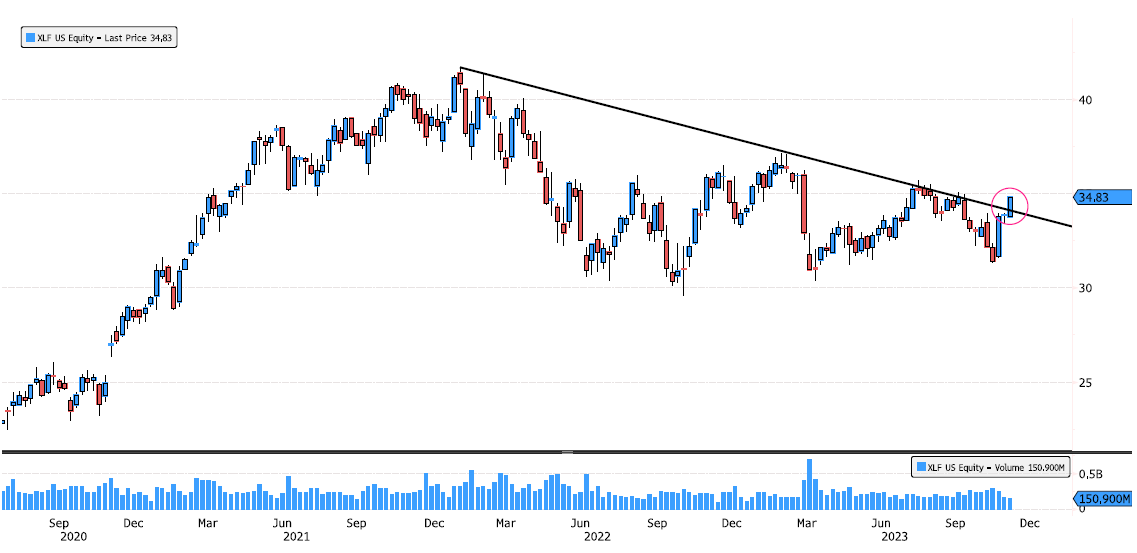

Financial Sector breakout ?

Financial Sector (XLF US) showing signs of breakout ! On this weekly chart, trading above January 2022 downtrend. Keep an eye at the closing tonight. Source : Bloomberg

US Continuing Jobless Claims Surges To 2 Year High

The number of Americans filing for jobless benefits for the first time last week jumped to 231k (from an upwardly revised 218k), up to its highest since August...Worse still, continuing claims keeps rising, to 1.864mm - the highest since November 2021... Source: Bloomberg, www.zerohedge.com

Nvidia indicated that the latest round of China restrictions will not have a meaningful impact on its business

It’s possible that this is because China frontloaded its GPU orders earlier this year in anticipation of these restrictions. It’s also possible that any lost revenue from China will be made up for by tremendous revenue growth in developed markets. Guidance for the January quarter might be indicative here. Source: Morningstar

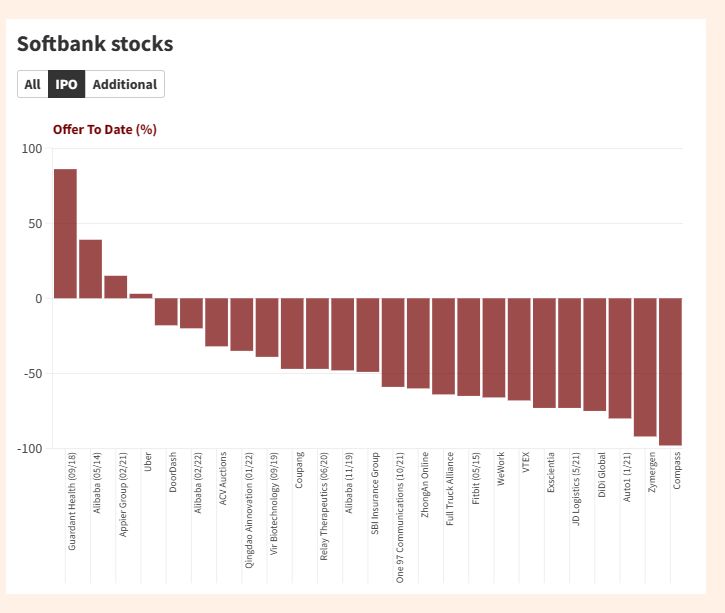

The FT has tracked all of Softbank's IPO returns. And guess what... they are terrible

source: Evan Tindell

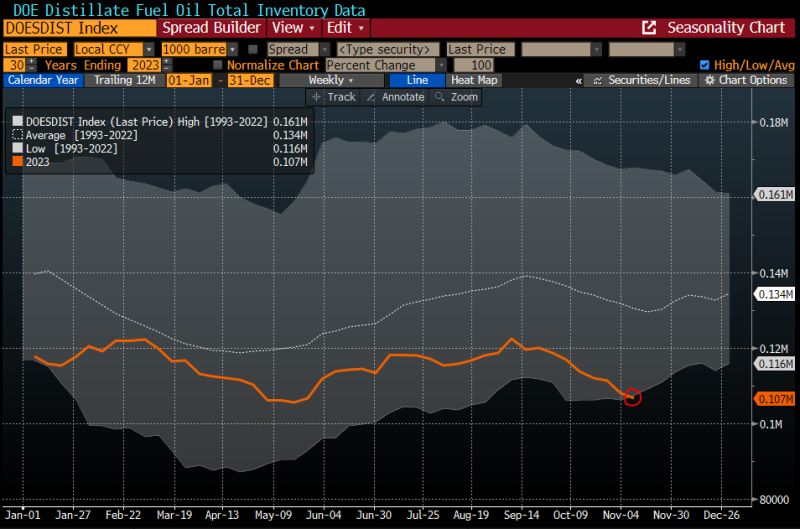

Let's hope the US economy is truly slowing down -- particularly manufacturing --, and that the winter is mild

US stocks of distillate fuel (diesel and heating oil) are ending the fall season at their lowest **seasonal** level in data since 1982 | Source: Javier Blas, Bloomberg

[Tweet by Bob Eliott] china faces the most classic dilemma in macro with an economy that is too weak and in need of additional easing and at the same time a desire for exchange rate stability

After months of keeping money too tight to stabilize the FX, at the first sign of FX strength they eased... Source chart: The Daily Shot

Investing with intelligence

Our latest research, commentary and market outlooks

![[Tweet by Bob Eliott] china faces the most classic dilemma in macro with an economy that is too weak and in need of additional easing and at the same time a desire for exchange rate stability](https://blog.syzgroup.com/hubfs/1700087239074.jpg)