Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Microsoft announces custom AI chip that could compete with Nvidia

- Microsoft is introducing its first chip for AI, along with an Arm-based chip for general-purpose computing jobs. - Both will come to Microsoft’s Azure cloud, Microsoft said at its Ignite conference in Seattle. -mThe Graviton Arm chip that cloud leader Amazon Web Services introduced five years ago has gained broad adoption. Source: CNBC, Stocktwits

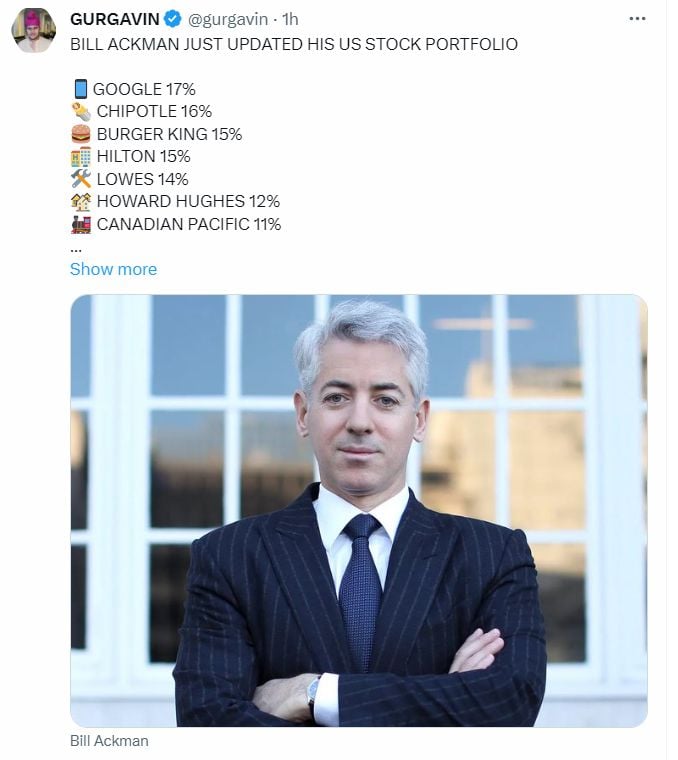

Pershing Square (Bill Ackman) discloses updated portfolio positions in 13F filing

Increased positions $GOOGL (to ~4.35 mln shares from ~2.19 mln shares), $HLT (to ~10.31 mln from ~9.33 mln), $HHH (~16.8 mln shares, from ~16.6 mln) Maintained positions in: $QSR (~23.35 mln shares), $CP (~15.1 mln shares), $GOOG (~9.38 mln shares), $CMG (~0.95 mln shares) Decreased positions in: $LOW (to ~7.07 mln shares from ~7.47 mln shares) Source: Ripster

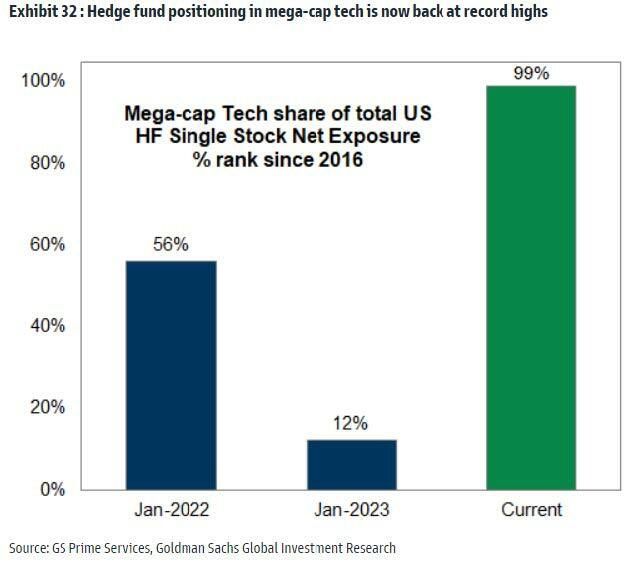

No buyers left? hedge fund net exposure to magnificent 7 was 12% at the start of the year. It is now 99%...

Source: Goldman Sachs, www.zerohedge.com

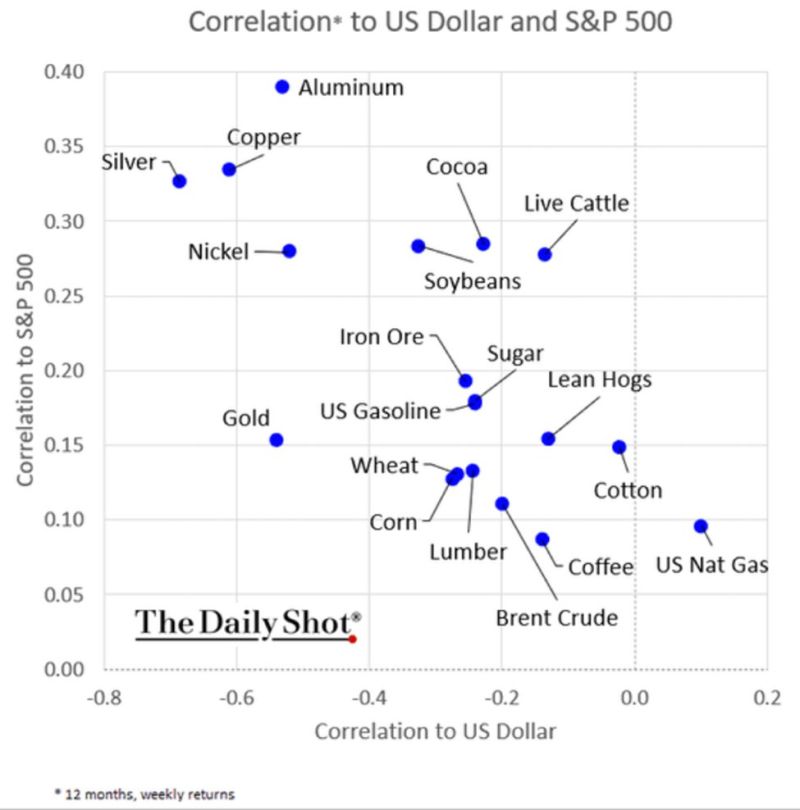

There are few assets that can provide meaningful diversification benefit in a portfolio, particularly from a real return / purchasing power standpoint

In an environment where stocks and bonds are so highly correlated, notable to see the low correlation across commodities - Source: Bob Elliott.

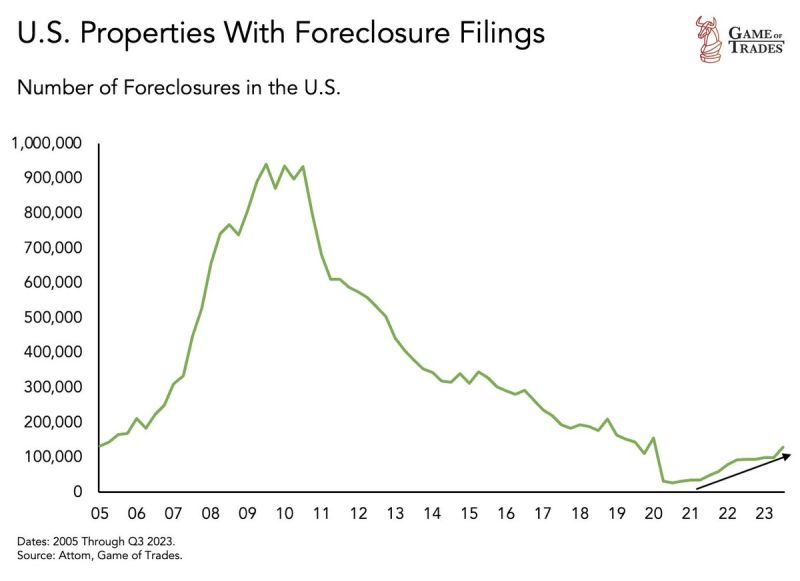

Property foreclosure filings have been increasing recently

This is the result of high interest rates resulting in rising mortgage defaults. Source: Game of Trades

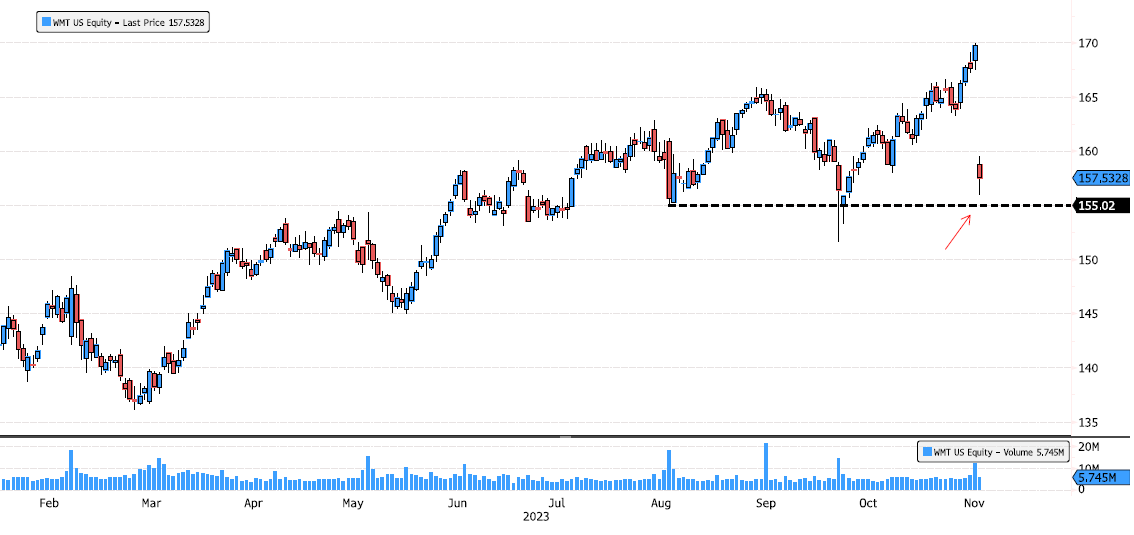

Walmart looking for support after earnings

Walmart (WMT US) is down strongly after earnings. Keep an eye at latest swing low support 155. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks