Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

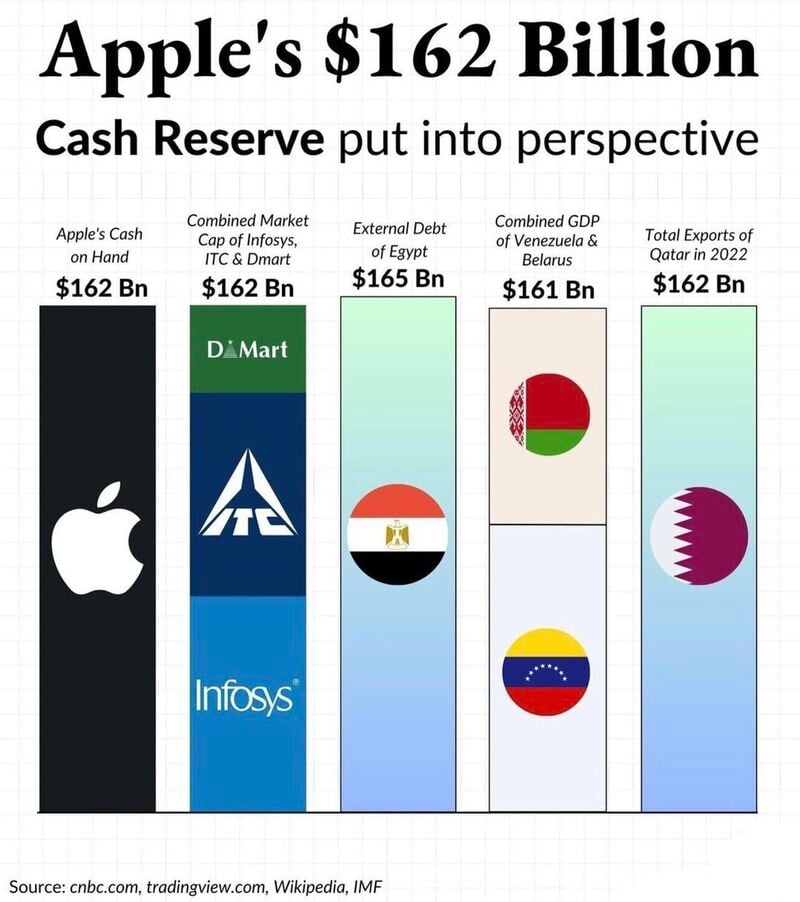

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Siemens breakout on earnings

Siemens (SIE GY) broke out this morning October last swing high at 139.34. It also broke recently the June downtrend after a 28% consolidation. Source : Bloomberg

President Joe Biden and China’s President Xi Jinping have their first in-person meeting in about a year

This is the first time since 2017 that Xi has stepped foot on American soil. Although the US-China relationship is breaking, experts and U.S. officials caution not to expect markedly improved relations post-meeting. Mrs Yellen might be rather in favor of some kind of cooperation... Source image: Michel A.Arouet

Stoxx 600 Index unable to break resistance

Stoxx 600 Index (SXXP) wasn't able to break 457 resistance. Trend remains in a downtrend for the moment. Keep an eye at that level. Source : Bloomberg

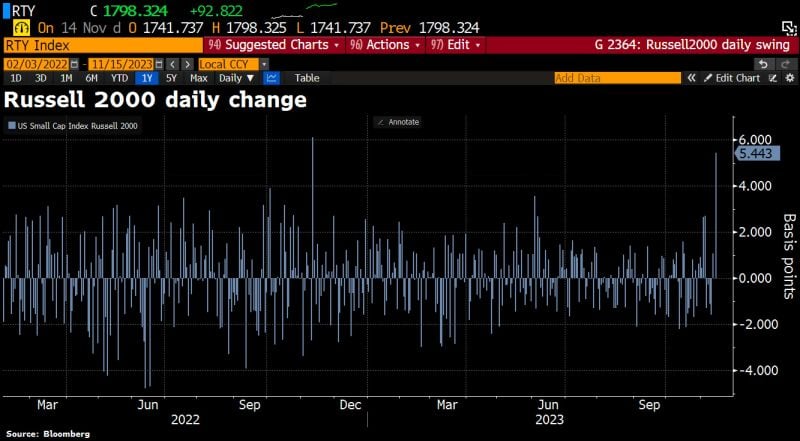

In case you missed it: Tuesday's rally was not driven solely by the Magnificent 7

Russell 2000 index of small-cap stocks soared a staggering 5.4%, as investors bet the Fed is done raising rates and could be cutting interest rates much sooner than expected. Source: HolgerZ, Bloomberg

China on Wednesday reported better-than-expected retail sales and industrial data for October, while the real estate drag worsened

- Retail sales grew by 7.6% last month from a year ago, above the 7% growth forecast by a Reuters poll. Retail sales, sports and other leisure entertainment products saw sales surge by 25.7% in October from a year ago, the data showed. Catering, as well as alcohol and tobacco, saw sales surge by double digits. Auto-related sales rose by 11.4% from a year ago. - Industrial production rose by 4.6% year-on-year in October, faster than the 4.4% pace predicted by the Reuters poll. - Fixed asset investment for the first 10 months of the year grew by 2.9% from a year ago, missing expectations for a 3.1% increase. - Investment into real estate fell by 9.3% during that time, a steeper decline than the 9.1% drop reported for the first nine months of the year. - The urban unemployment rate was 5%, the National Bureau of Statistics said. That was unchanged from September. The bureau has suspended reports of the unemployment rate for young people since summer. Source: CNBC

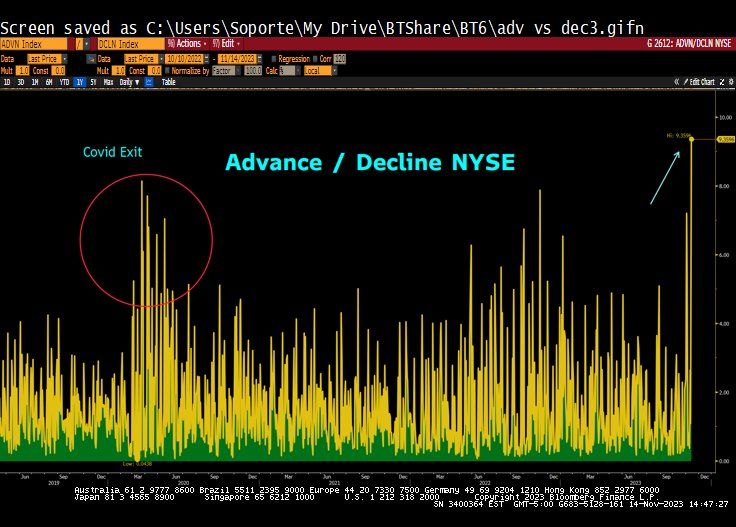

Yesterday was the best market breadth day in the US since the Covid-19 stress exit...

Source: Lawrence McDonald, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks