Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

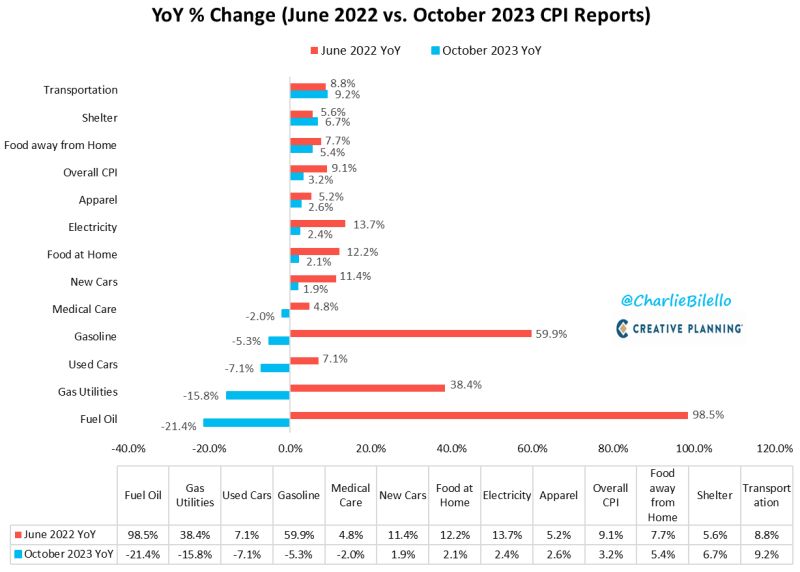

US CPI has moved down from a peak of 9.1% in June 2022 to 3.2% today

What's driving that decline? Lower rates of inflation in Fuel Oil, Gas Utilities, Used Cars, Gasoline, Medical Care, New Cars, Food at Home, Electricity, Apparel, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022. Source: Charlie Bilello

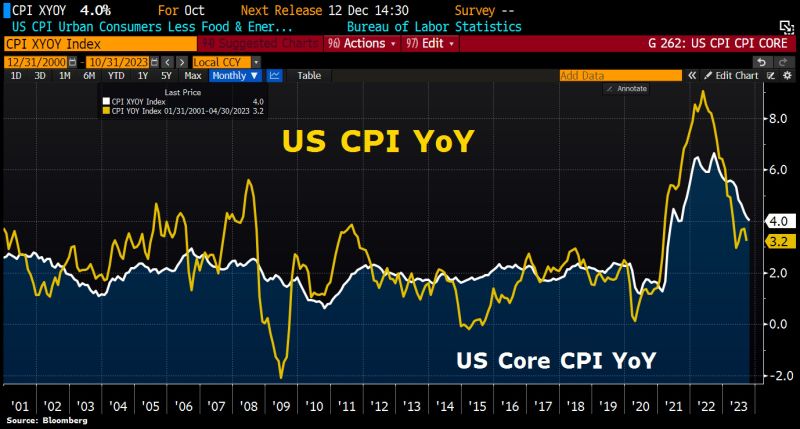

US inflation data for Oct undershoot consensus

Headline dropped to +3.2% from 3.7% in Sep vs 3.3% expected, Core CPI dropped to 4.0% from 4.1% vs 4.1% expected. Dollar and Yields plunge. - Following two months of higher than expected US CPI numbers (mainly driven by higher energy prices and healthcare costs), the October CPI print was expected slow materially (from 3.7% to 3.3% yoy on headline CPI) while the core was expected to remain unchanged at 4.1%. But today’s CPI print is a miss across the board with both headline and core numbers coming in below expectations on both a sequential and annual basis. - Headline CPI came in at 3.2%, below the 3.3% expected, while MoM CPI also missed expectations, being vs. consensus at +0.1% and sharply below last month's 0.4%. Source: Bloomberg, HolgeZ, www.zerohedge.com

Has there been a better pairs trade than long US, short world... ever?

This relationship has generated steady alpha for a decade and a half now. Growth over value and large over small have also been excellent long / short pairs. Source: Steven Strazza

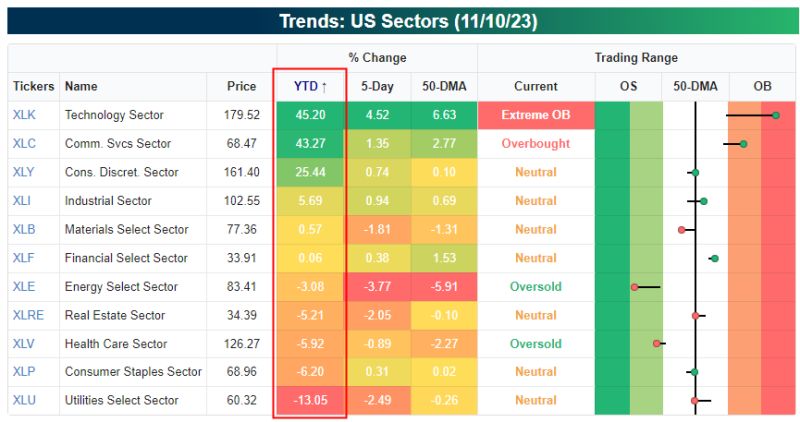

When the book on 2023 closes, extreme sector divergence will surely be considered one of the major plot points

Technology and Communication Services are each up more than 40% YTD, while five of eleven sectors are in the red on the year. Source: Bespoke

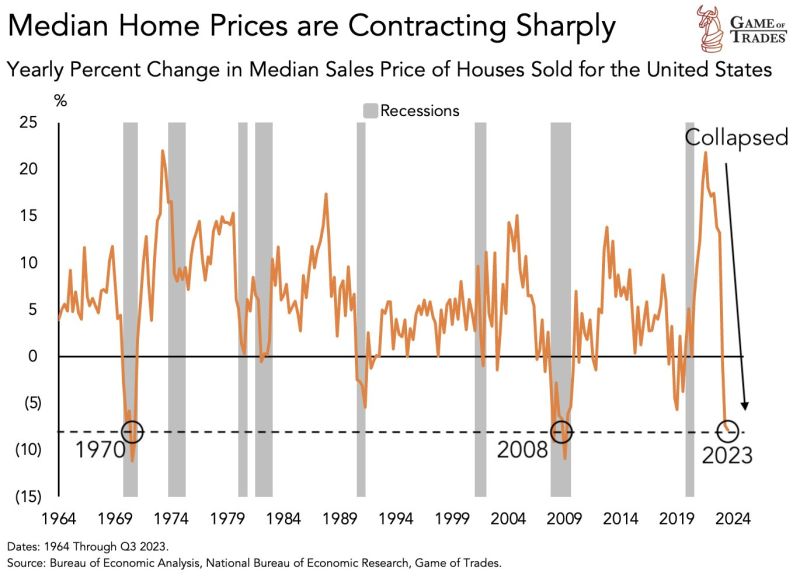

US median home prices are contracting aggressively. In just 2 years, the % has gone from over 20% to -7.9%. This is THE sharpest collapse on record

Current levels have occurred ONLY 2 times in the last 60 years: 1. 1970 2. 2008 Both instances ended with equities declining more than 30%. Source: Game of Trades

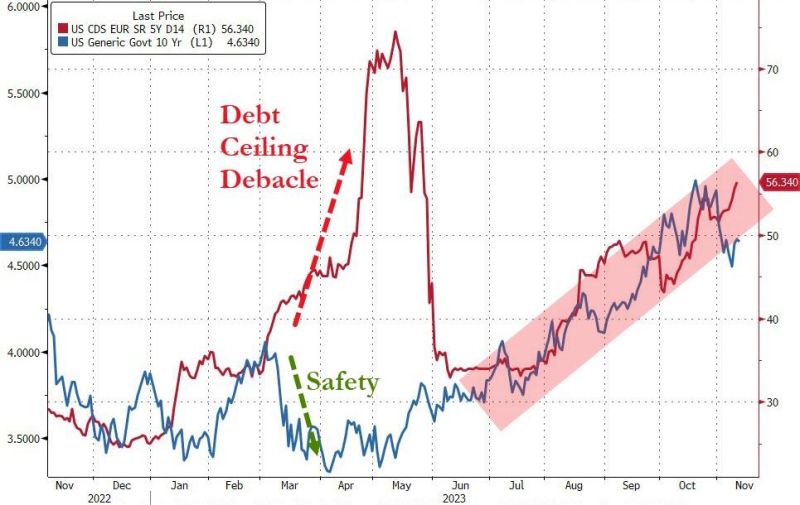

In a regime-shift from historical norms, the US Treasury yields are broadly trending higher with USA Sovereign credit risk...

Source: www.zerohedge.com, Bloomberg

Tech relative to small caps JUST hit the highest level EVER seen This ratio is higher than even the peak of the Dot Com bubble

Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks