Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What a day...

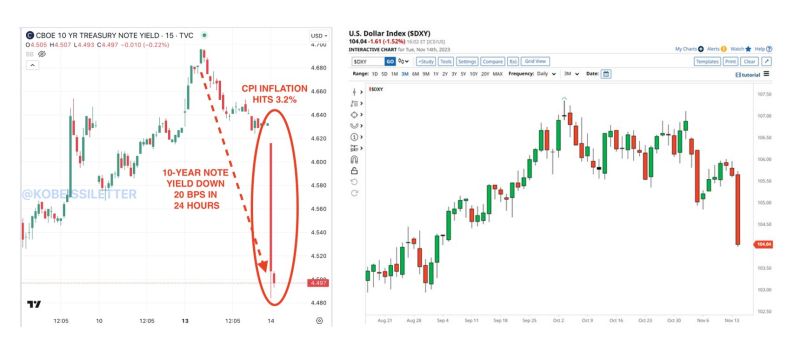

The US 10-year note yield fell sharply to 4.49%, after CPI inflation hits 3.2% in October. The 10-year note yield went down 20 basis points in 24 hours. Meanwhile, the U.S. Dollar Index $DXY had its biggest drop in more than a year. Source: The Kobeissi Letter, Barchart

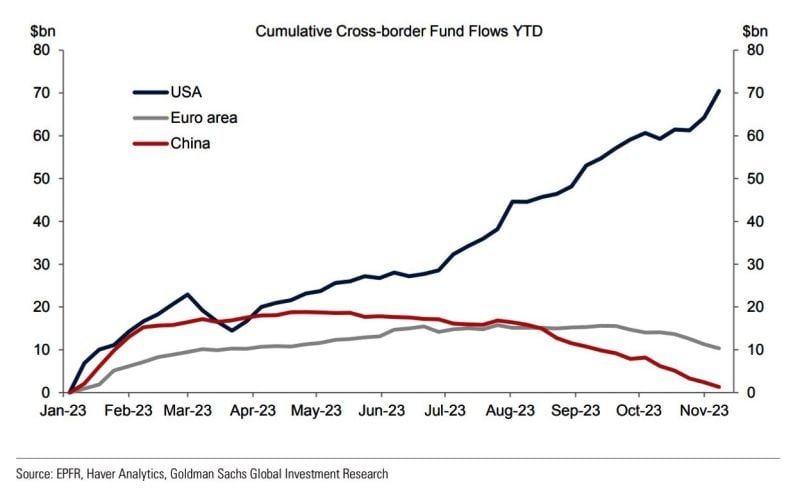

Fund flows continue to move to the US at the expense of the rest of the world

Source: Michael A. Arouet, Goldman Sachs

It looks like the bears are throwing the towel...

Burry's bet against America..

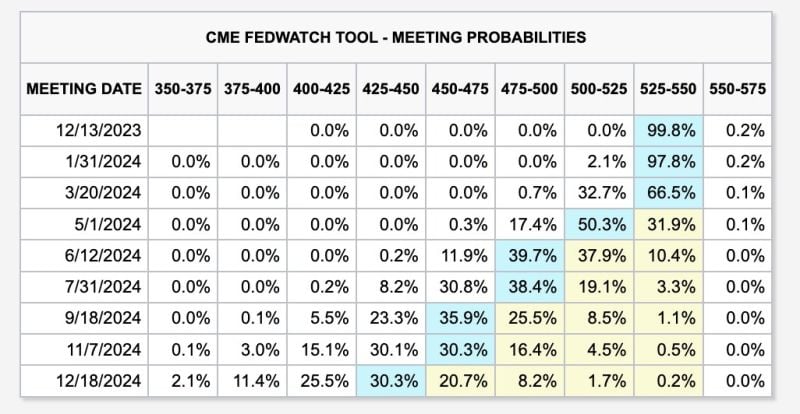

JUST IN: Futures now show a 0% chance of additional rate hikes with rate cuts beginning in May 2024

Prior to today's CPI report, there was a 30% chance of at least one more rate hike ahead. Rate cuts were expected to begin in June 2024. Now, markets are pricing-in at least 4 rate CUTS in 2024. Markets are betting that the Fed is done. Source: The Kobeissi Letter

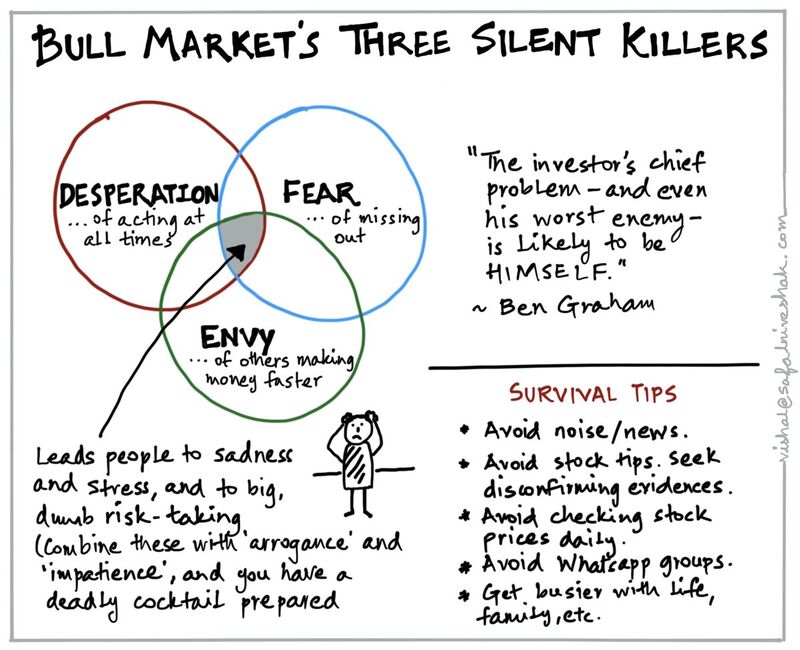

What kills bull markets

Nice visual by @safalniveshak thru Brian Feroldi

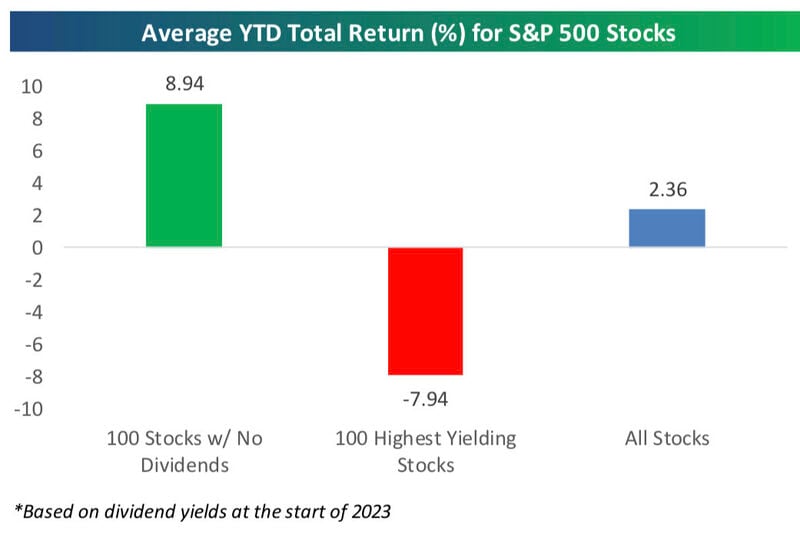

Dividend stocks have been horrendous in 2023

The 100 highest yielding stocks in the S&P had an average total return of -7.94% through last Friday compared to an average gain of 8.94% for the 100 (exactly) stocks in the index that pay no dividend. Source: Bespoke

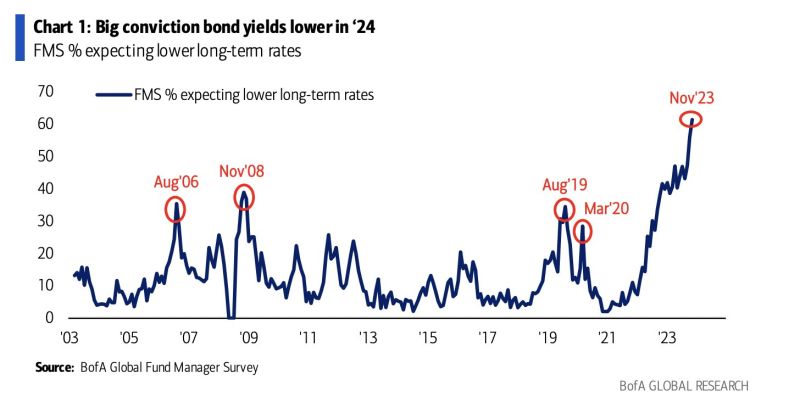

Looks like it will be one of the most crowded trades to come

61% of Fund Managers from BofA Fund Manager survey expect lower bond yields, most on record, despite 2nd highest ever saying fiscal policy is too stimulative. Source: BofA, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks