Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

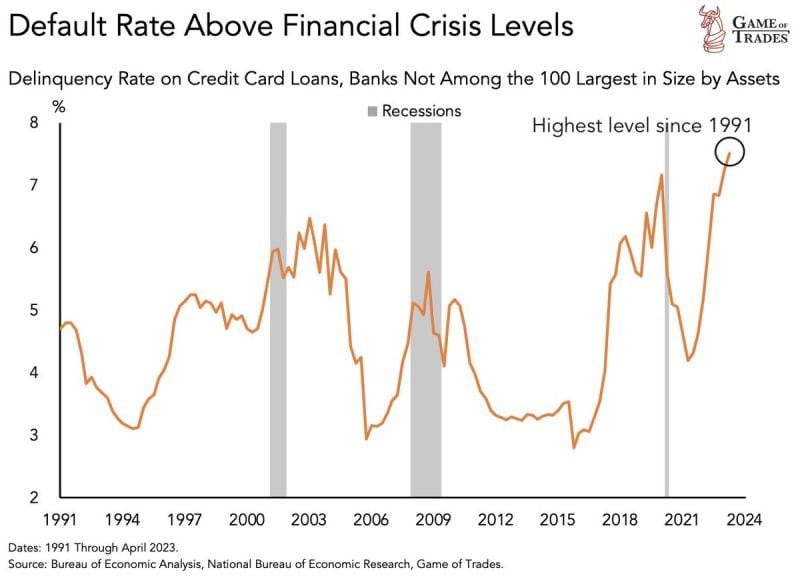

The consumer is borrowing more than they can afford to pay

The consumer default rate on credit card loans from small lenders has seen a sharp spike to 7.51% This level is higher than the: - Dot Com bubble - Financial Crisis - C-19 With credit card interest rates still above 20%. Consumers are going to continue feeling the pressure. Source: Game of Trades

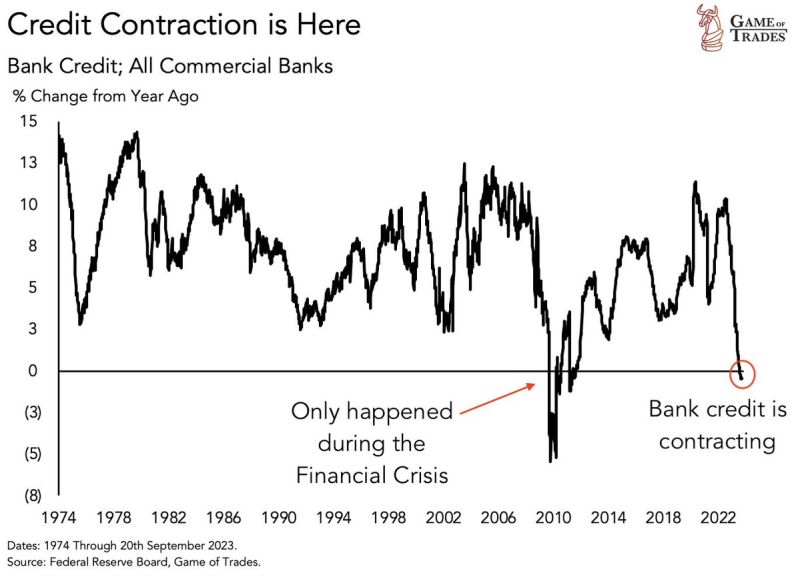

Bank credit has now entered contraction territory. After witnessing one of sharpest declines on record

Since 1974, this has only happened ONCE: → The Financial Crisis. Back then, this metric reached levels as low as -5%. At the current rate, the risk of a credit event is on the rise. Source: Game of trades

Prices paid to US producers rose by more than forecast in September

The PPI for final demand advanced 0.5% from a month earlier, according to the Bureau of Labor Statistics. The cost of gasoline increased 5.4% The biggest driver of today's PPI beat: a near record surge in PPI Deposit Services. In other words high rates (and inflation) lead to higher rates (and inflation) Source: www.zerohedge.com

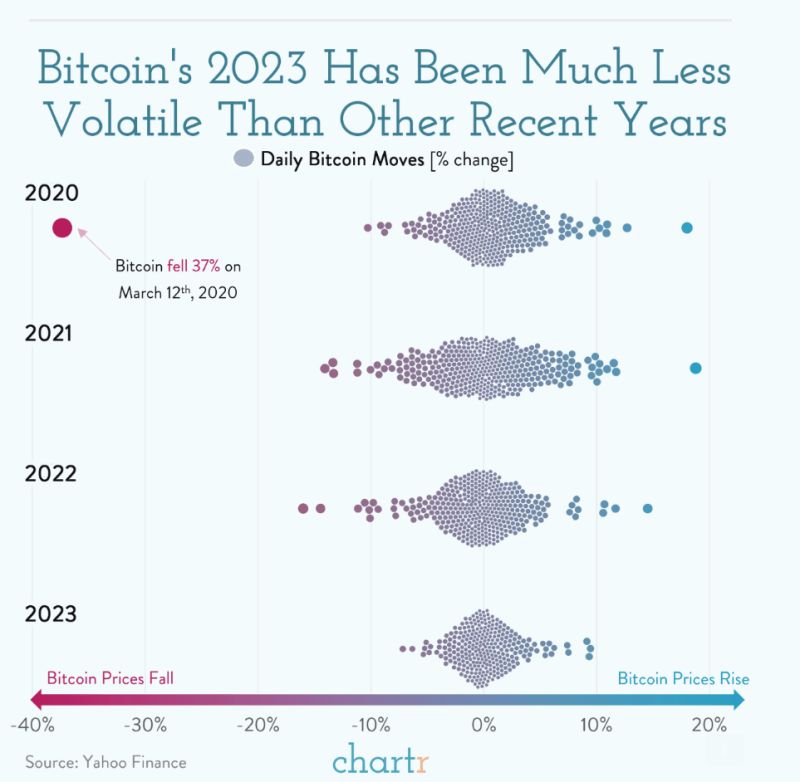

Chartr on bitcoin volatility

For the most prominent cryptocurrency, the chaos of the 2020-2022 era seems long gone. Bitcoin, which was often criticized for being too volatile, hasn’t seen a daily gain or loss of more than 10% this year. That's in stark contrast to 2022 and 2021 when it swung outside this range 9 and 11 times, respectively. All told, the price of Bitcoin has risen more than 60% this year, despite the continued crackdown on major exchanges such as Binance and Coinbase. But, even though Bitcoin is looking a little bit more stable, enthusiasm for the sector more broadly looks to have vanished, with venture capital funding for crypto companies and projects falling to a 3-year low.

Birkenstock opening is even uglier than the shoes...

Birkenstock stock opens 11% below $46 IPO price in trading debut flop. The German sandal maker’s debut is the worst opening for a listing of $1bn or more in New York in over 2yrs, Bloomberg reports. Out of more than 300 US IPOs of that size in the past century, only 9 have fared worse, the last being AppLovin, which opened 12.5% below its IPO price in April 2021, BBG data show. Source: HolgerZ, Bloomberg

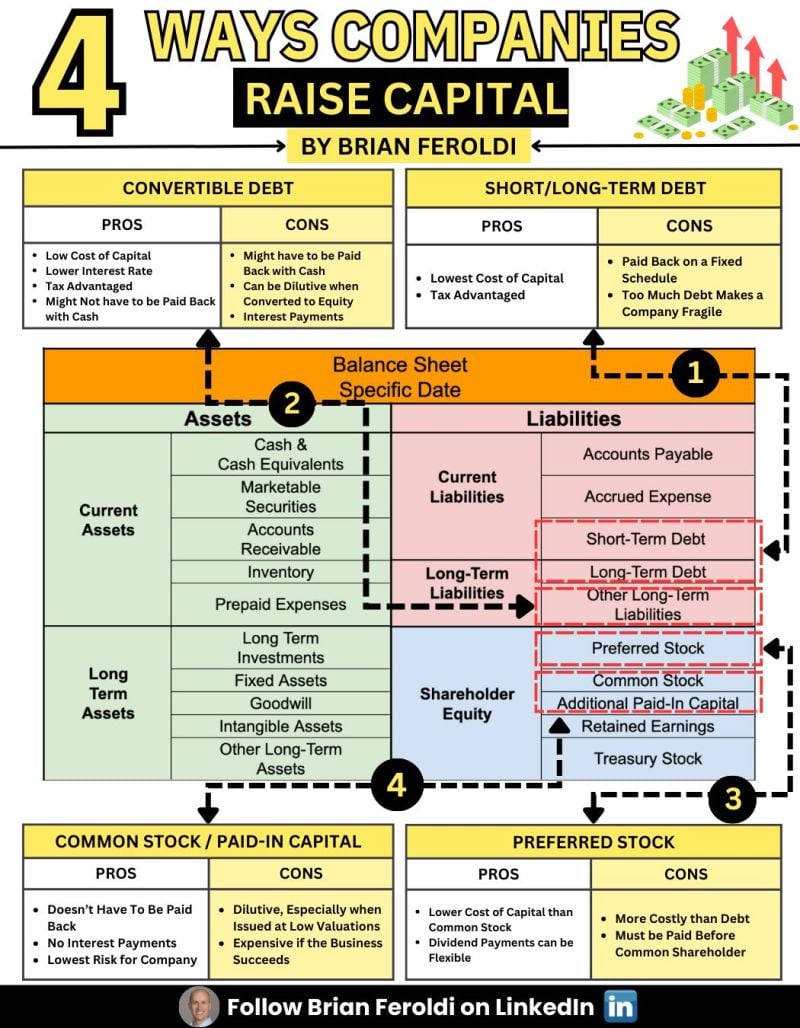

How Companies Raise Capital

Watch these four balance sheet categories: by Brian Feroldi

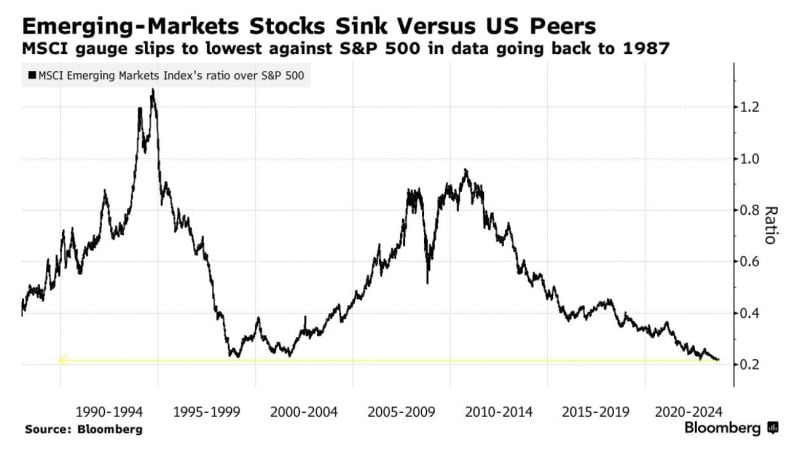

Emerging market stocks have fallen to their lowest valuation relative to the S&P 500 in AT LEAST 36 years

Source: Barchart, Bloomberg

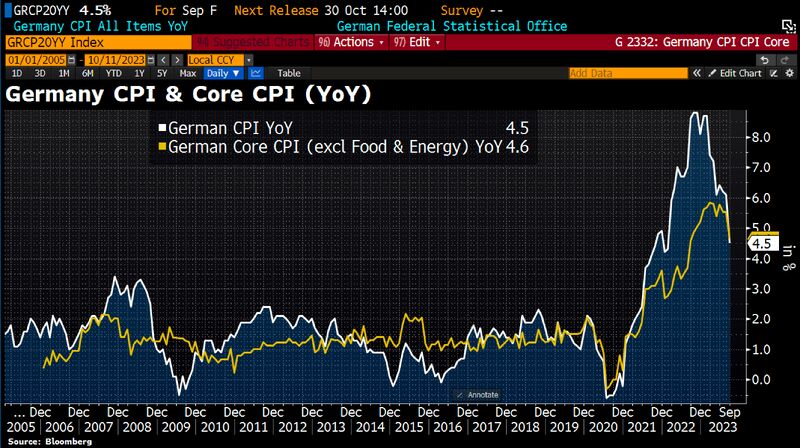

German inflation in September fell to its lowest rate since outbreak of war in Ukraine, confirming prior estimates

CPI slowed to 4.5% in September YoY from 6.1% in August. Headline CPI is now lower than Core CPI BUT food prices are already on the rise again. Compared to previous month, food has become 0.4% more expensive. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks