Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Central Banks around the world are now cutting rates at the fastest pace in more than 3 years

When will the U.S. follow suit? Source: Barchart, BofA

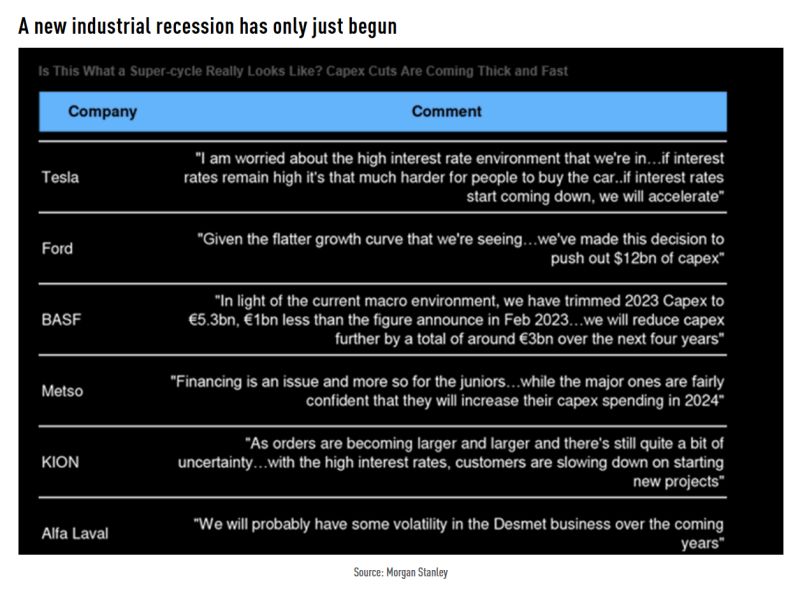

Morgan Stanley industrial team runs through their conclusions coming out of a choppy earnings season

A double-digit short-cycle slowdown is getting priced in, but ongoing inventory and incremental capex pressures are not. Source: MS, TME

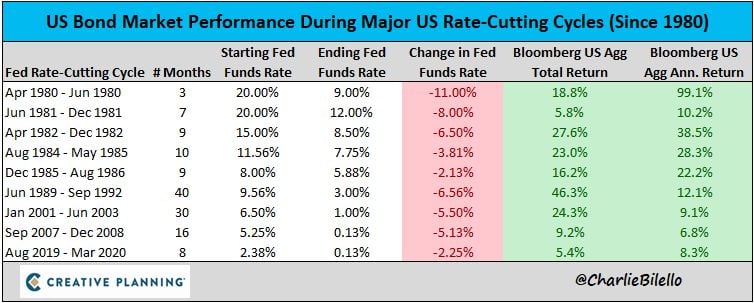

The Fed is now expected to start cutting rates in May 2024

Here's how bonds have performed during prior rate-cutting cycles... Source: Charlie Bilello

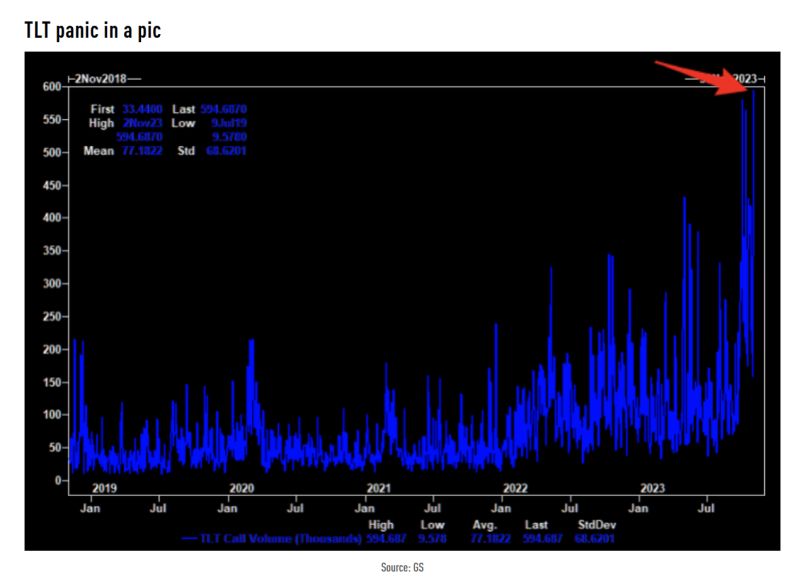

The crowd is piling into TLT (iShares US Treasuries 20y+ ETF) calls

Friday was the largest TLT call volume ever. Source: TME, GS

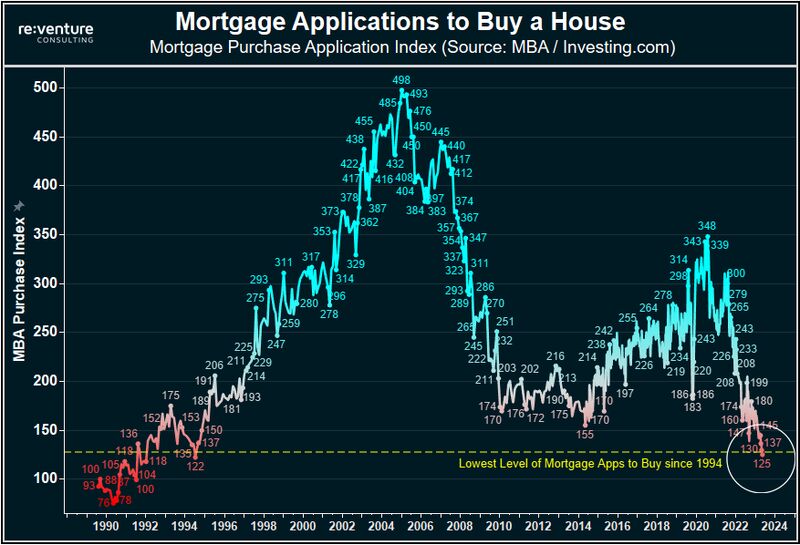

Mortgage demand is now down 50% from pre-pandemic levels and at its lowest level since 1994

From its peak in 2021, mortgage demand is down ~64%. Current mortgage demand is ~75% below the 2005 peak. The most incredible part of this? Mortgage rates are still only at their historical average. Housing market activity is coming to a halt. Source: The Kobeissi Letter

How low can the US 10-year bond yield go?

The US 10 year is breaking well below the short term trend line, hitting the 50 day right here. There is a small support here, but the bigger support is down around 4.3%. Note that the 200 day remains way lower, down around 3.95%. Source: TME

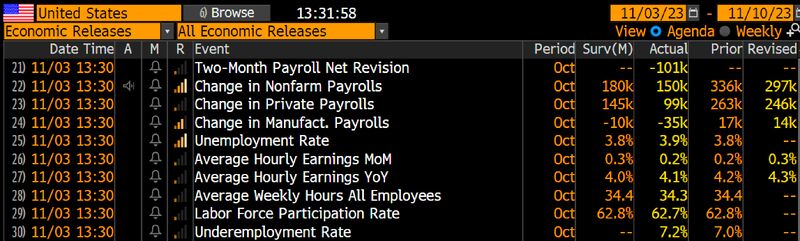

The U.S. economy saw job creation decelerate in October, confirming persistent expectations for a slowdown and possibly taking some heat off the Federal Reserve in its fight against inflation

Nonfarm payrolls increased by 150,000 for the month, the Labor Department reported Friday, against the Dow Jones consensus forecast for an increase of 170,000. The United Auto Workers strikes were primarily responsible for the gap as the impasse meant a net loss of jobs for the manufacturing industry. The unemployment rate rose to 3.9%, against expectations that it would hold steady at 3.8%. Employment as measured in the household survey, which is used to compute the unemployment rate, showed a decline of 348,000 workers, while the rolls of the unemployed rose by 146,000. A more encompassing jobless rate that includes discouraged workers and those holding part-time positions for economic reasons rose to 7.2%, an increase of 0.2 percentage point. Meanwhile, Household Survey showed a huge 348k loss in jobs during October. Dollar drops, Bond yields slide following VERY disappointing US jobs data which fuel bets Fed is done Source: CNBC, Bloomberg

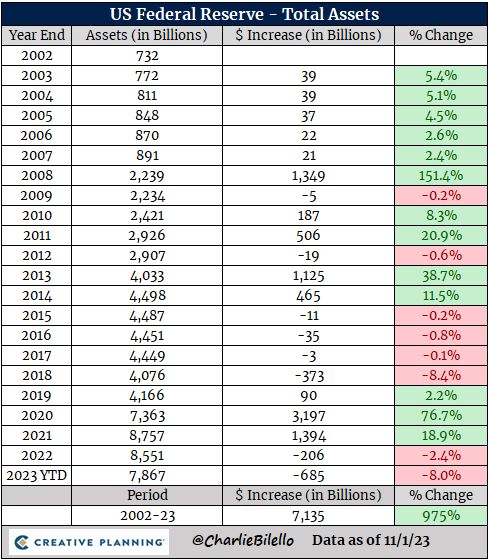

The Fed's balance sheet hit its lowest level since May 2021 this week, down $1.1 trillion from the peak in April 2022

Annual changes in the Fed's balance sheet since 2002 by Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks