Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

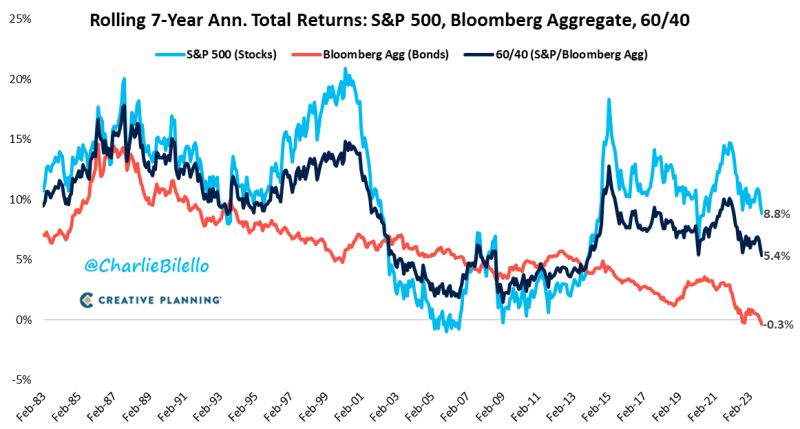

Annualized Total Returns over the last 7 years...

US Stocks: +8.8% US Bonds: -0.3% US 60/40: +5.4% Source: Charlie Bilello

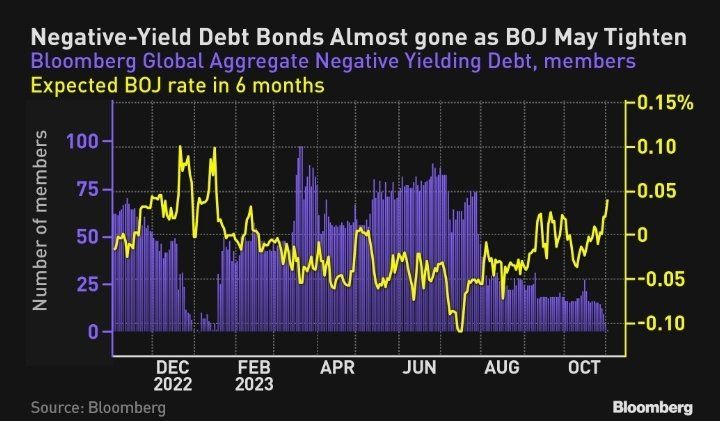

The negative bonds world is gone, with also a Japanese bond maturing in 24 trading at 0% yesterday

Source: From Macro to Micro

Feed a family of 5 (hamburger, fries, shake) for $2.25 in June 1961

BLS CPI calculator says that's same as $23.24 today... Inflation calculator -> Source: Rudy Havenstein

While there are reasons to turn tactically bullish on long dated US Treasuries ->

Let's not forget that Treasury supply (at the time of QT and waning demand stemming from China, Saudi and the likes) remains a headwind for the bond market

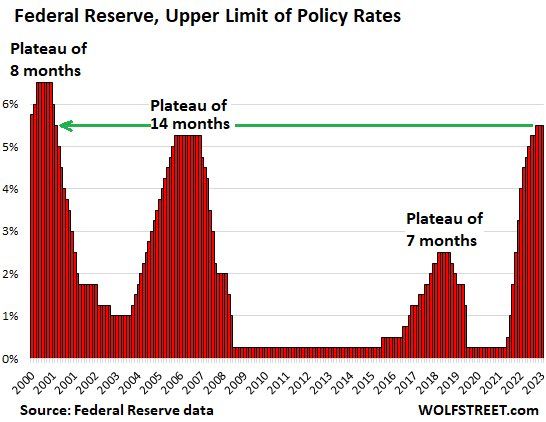

The end of the rate hikes is typically followed by plateaus before rate cuts begin

The end of the rate hikes may not be here yet, and the Fed has already said a many times for months that the plateau is going to be “higher for longer". How long will the plateau be this time? Source: Wolfstreet

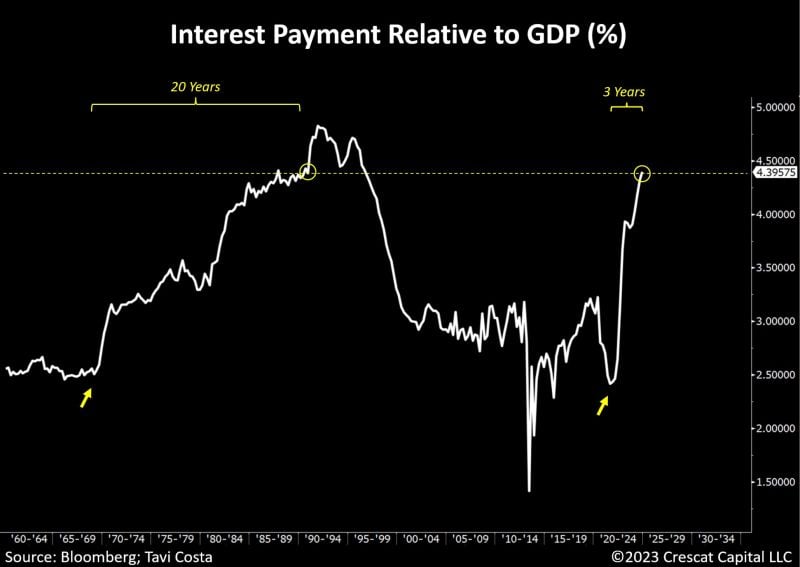

It took 20 years for US interest payments to reach 4.5% of GDP in the 1970s and 80s

Today, achieving the same level will take less than 3 years. This starkly highlights the speed of the rise in Treasury yields and the magnitude of the debt problem. Source: Tavi Costa, Bloomberg

Geberit rebounds after earnings

Geberit (GEBN SW) is rebounding strongly after earnings. Stock is up 8% today and more than 12% since October low. Keep an eye at next resistance zone 468.80-476 represented by February downtrend resistance. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks