Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

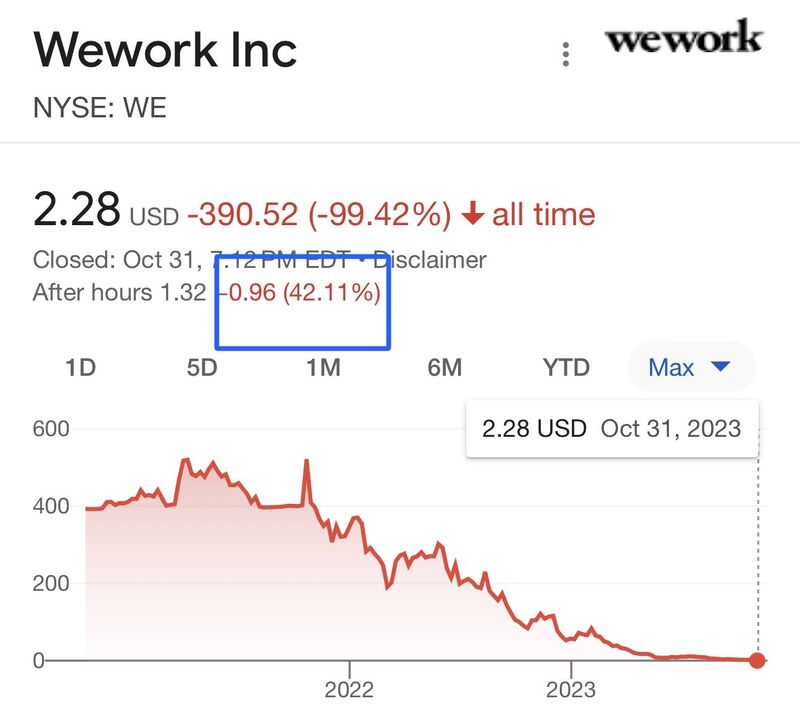

WeWork has officially filed for bankruptcy

From a $47 billion private market valuation to a $9 billion IPO via a SPAC in 2021, and now trading at $1.32 a share in after hours, marking a jaw-dropping 99% drop from its IPO price. The co-working space drama continues to unfold, reminding us that even unicorns can stumble in the real world of business. Source: Michael Burry Stock Tracker

Orange juice hit another all-time high this week

Source: Tradingview

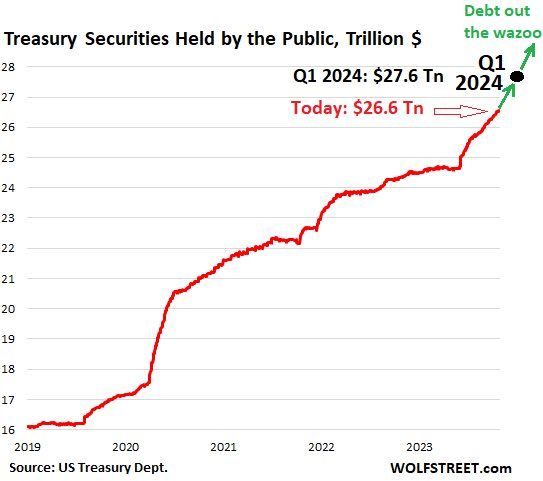

Marketable US Treasury Debt to Explode by $2.85 Trillion in the 10 Months from End of Debt Ceiling to March 31, 2024

In total, over those two quarters marketable debt will have increased by $1.59 trillion! This follows the $1.01 billion increase in Q3, and the surge in June after the debt ceiling ended. At the beginning of Q4, marketable debt outstanding was $26.04 trillion. The government will add $1.59 trillion to it, pushing it to $27.6 trillion by March 31, 2024. Source: Wolfstreet, WallStreetSilver

The SP500 $SPX continues trading inside the almost perfect channel that has been in place since July highs

So far this is just a reversal off the lower part of the channel. First resistance is around the 200 day moving average, currently at 4260ish. Note the 50/100 day cross very much in "force". Source: TME, Refinitiv

“Millions of my people will die, but that's a sacrifice I'm willing to make" - Egypt’s Prime Minister

Source: WSJ, Wall Street Silver

Beware the short squeeze... CTAs are now short $25 billion of US equities, one of the largest short positions in the 8 years...

Source: Barchart

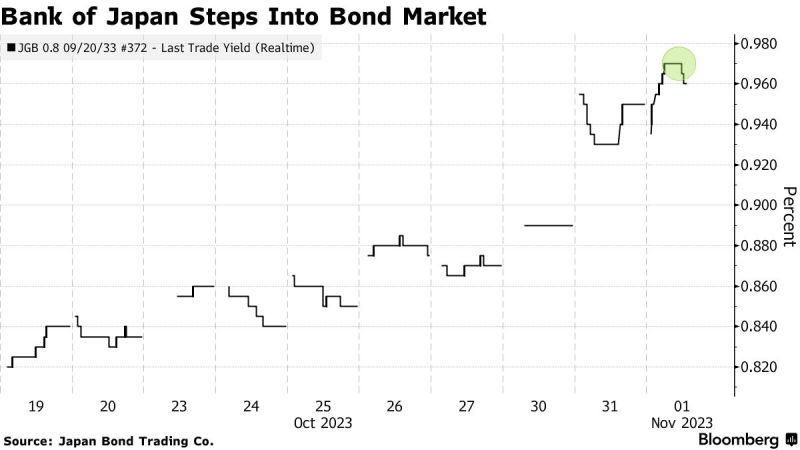

*BREAKING* BOJ Buys More Bonds to Slow Rising Yields a Day After Tweak Central bank acts after 10-year yield touches decade high - BLOOMBERG

The Bank of Japan stepped into the bond market unexpectedly Wednesday to curb the pace of gains in sovereign yields, just a day after announcing it was loosening its grip on debt prices. The central bank’s unscheduled purchase operation statement came as the benchmark 10-year bond yield touched 0.97% — a fresh decade-high but still below the 1% cap it removed in favor of a more flexible policy setting. There was very little immediate market reaction to the move, with traders trimming one basis point off the 10-year yield before it recovered half of that. Bond futures pared losses and the yen, which is sensitive to shifts in interest rates, shed a fraction of its advance versus the dollar.

The US equity market ultra-dominance

Source: Michel A.Arouet, Bloomberg, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks