Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

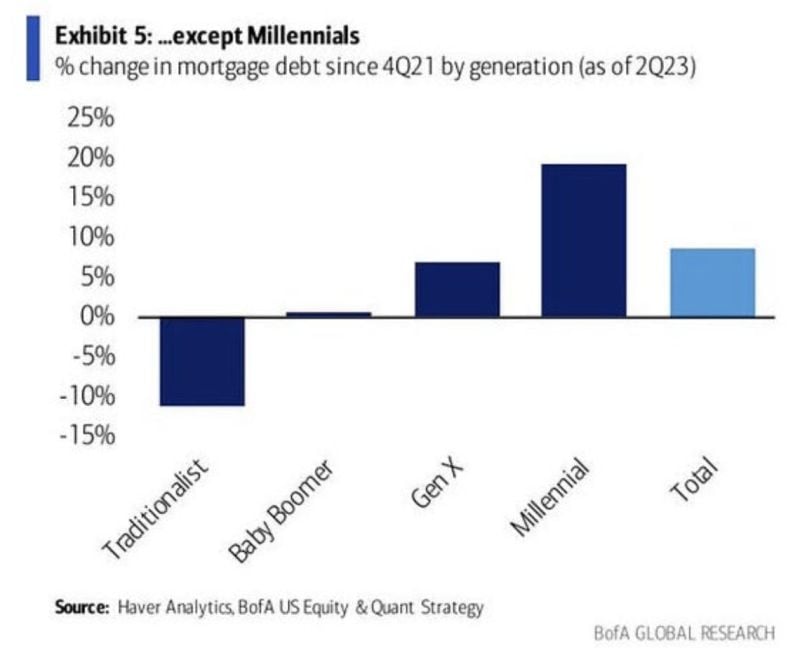

Who's buying houses with record high prices and 8% mortgage rates. The answer?

Millennials are piling in to new mortgages even with the spike in rates. Since Q4 2021, Millennials have seen a ~20% increase in mortgage debt. This is the same group of people who just had student loan payments return at an average of $500/month. It's a tough time to be a Millennial... Source: The Kobeissi Letter, BofA

Bitcoin white paper turns 15 as Satoshi Nakamoto’s legacy lives on

“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party,” Satoshi wrote in an Oct. 31 email in 2008. Bitcoin $BTC Golden Cross formation. Today, there is a Golden cross formation which just took place on $BTC - see chart below. Source: Barchart

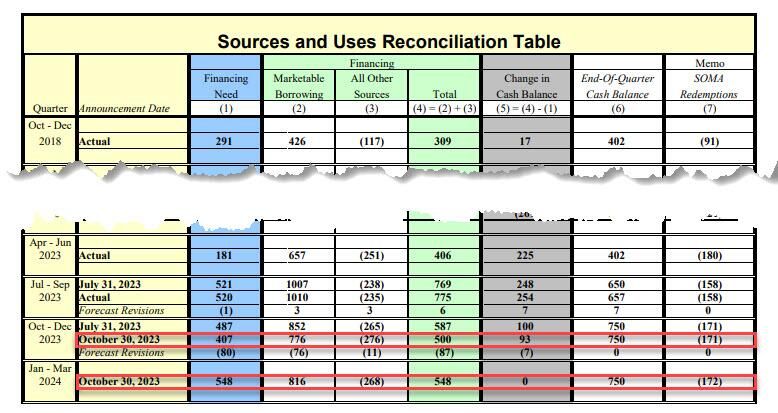

US To Borrow $1.5 Trillion In Debt This & Next Quarter, After Borrowing A Massive $1 Trillion Last Quarter

During the October – December 2023 quarter, Treasury expects to borrow $776 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $750 billion. The borrowing estimate is $76 billion lower than announced in July 2023, largely due to projections of higher receipts somewhat offset by higher outlays. During the January – March 2024 quarter, Treasury expects to borrow $816 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $750 billion. Source: www.zerohedge.com

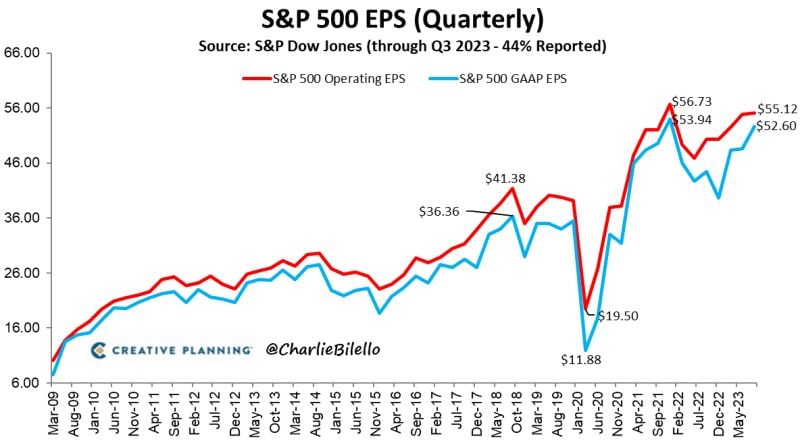

S&P 500 Q3 GAAP earnings per share are 18% higher than a year ago, the 3rd straight quarter of positive YoY growth. Quarterly earnings are now just 2% below the record high from Q4 2021

Source: Charlie Bilello

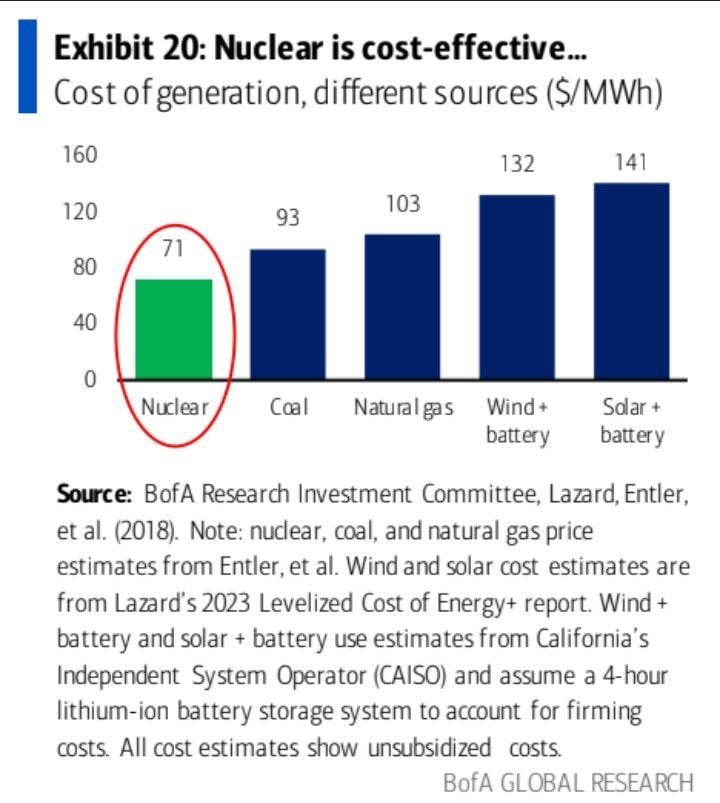

Bank of America research:

"Industry research suggests that, after accounting for efficiency, storage needs, the cost of transmission, and other broad system costs, nuclear power plants are one of the least expensive sources of energy." Source: BofA Global Research, Gustavo Philippsen Fuhr

Investing with intelligence

Our latest research, commentary and market outlooks