Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

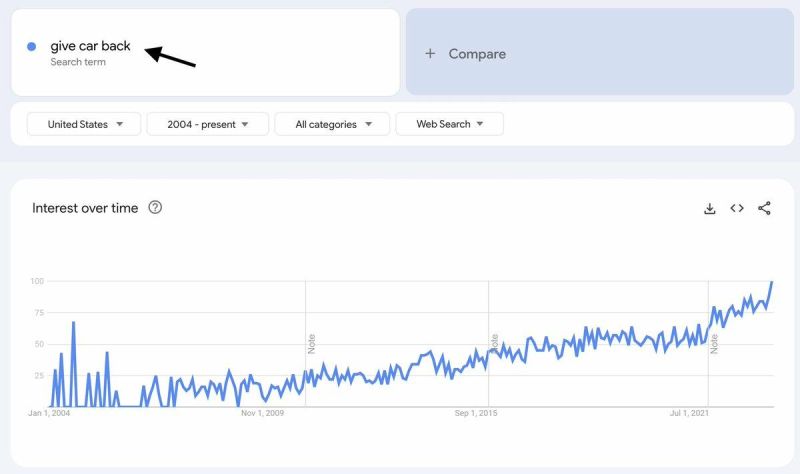

Americans Panic Search "Give Car Back" As Subprime Auto Loan Delinquency Erupts

Recent data from Edmunds reveals that an unprecedented 17% of American car purchasers now have monthly car payments of $1,000, a significant increase from just 7% three years ago. This trend highlights the extent to which consumers, despite being financially stretched, are willing to take on massive auto debt in these uncertain economic times as macroeconomic headwinds pile up. New Google data, first revealed by X user CarDealershipGuy, shows Americans are searching "give car back" on the internet has soared to a record high. Source: Google search

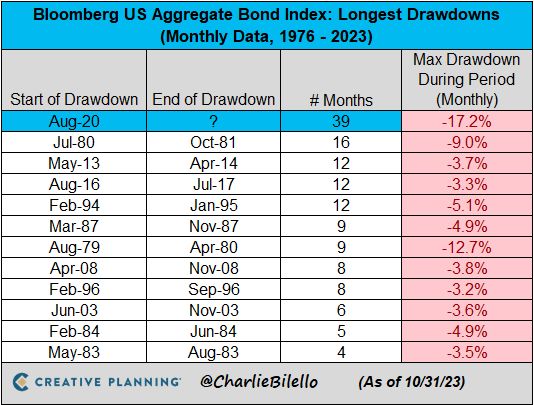

The US Bond Market has now been in a drawdown for 39 months, by far the longest bond bear market in history

Source: Charlie Bilello

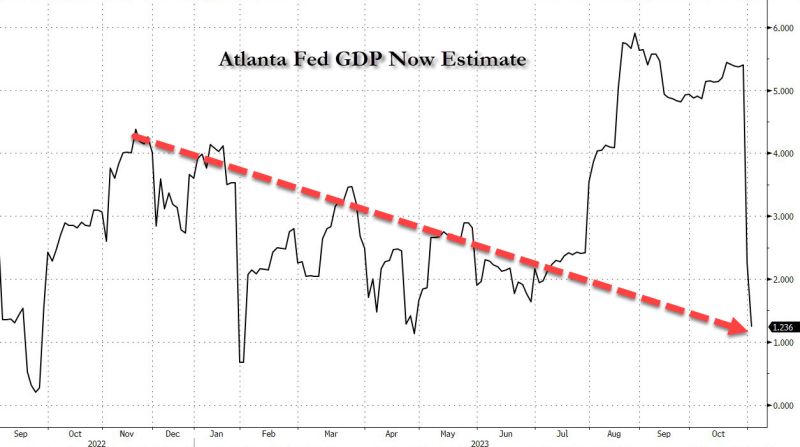

And we're back to Bidenomics trendline

Source: www.zerohedge.com

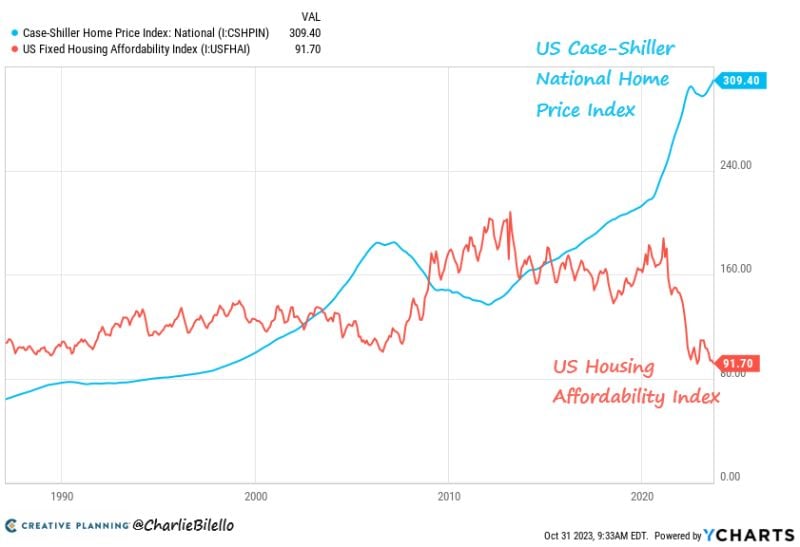

US Home Prices hit a new all-time high in August while affordability has plummeted to record lows...please explain...

Source: Charlie Bilello

No change as expected

Nothing really new except that they acknowledge strong growth and strong wage gains versus September, effectively upgrading their economic assessment. This is the 3rd time they upgrade their view on growth. Our view is unchanged: we are due for a long pause. High rates is the new normal.

Investing with intelligence

Our latest research, commentary and market outlooks