Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

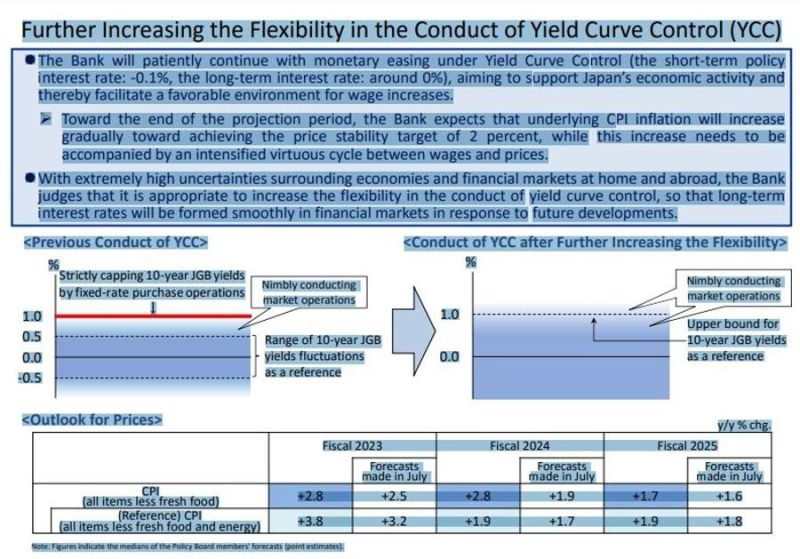

BREAKING: The yen falls near 150 after the Bank of Japan makes only modest tweaks to its yield control program, defying market expectations

Japan’s centralbank decided to make its yield curve control (YCC) policy more flexible, shifting the language used to describe the upper bound of the 10-year Japanese government bond yield. The BoJ said it will patiently continue monetary easing under YCC to support economic activities. BOJ makes the decisions on YCC by an 8-1 vote. The decision is sending the $USDJPY back to above 150.

Interesting development which has been taking place recently with bitcoin rising despite Tech stocks losing ground

Source: J-C Parets

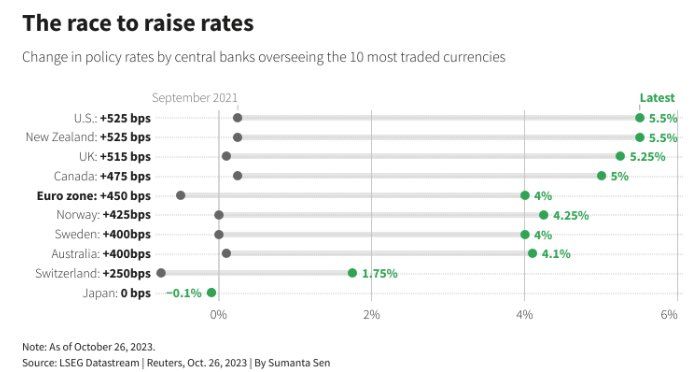

The race to raise rates summarized in one chart

Source: LSEG Datastream, Reuters

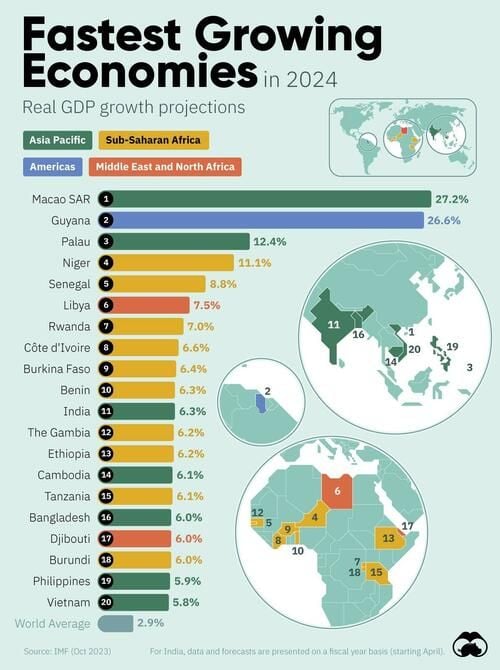

Visual Capitalist's Marcus Lu created the following chart, visualizing GDP growth forecasts from the IMF’s October 2023 World Economic Outlook

Unsurprisingly, many of these countries are located in Asia and Sub-Saharan Africa—two of the world’s fastest growing regions.

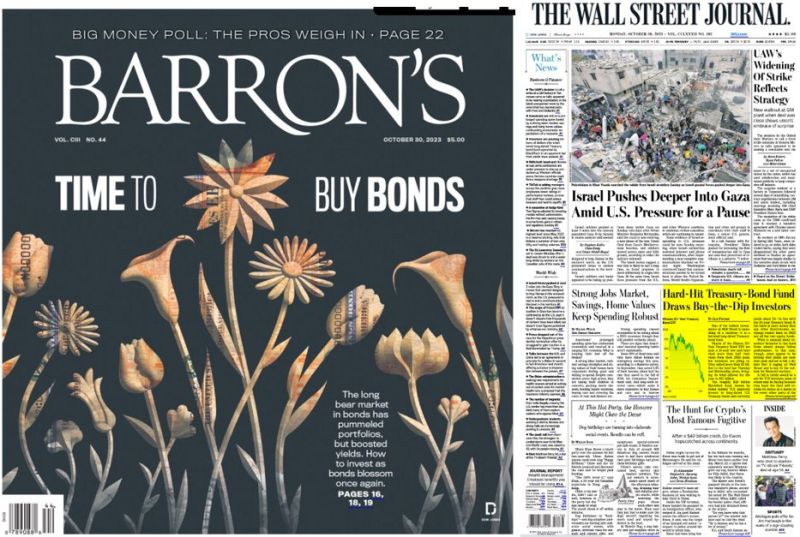

With the US 10-year yield close to 5%, long duration bonds start to look attractive

There is one issue though: sentiment on long-dated bonds look too optimistic E.g 1/ not a single sell-side analyst does have a 10-year target yield above 5% for the next 6 months; 2/ Long-dated bonds funds are enjoying record inflows; 3/ Magazine cover pages look upbeat on bonds (source: J-C Parets). The consensus is not always wrong but so much optimism is usually not a good sign from a contrarian perspective.

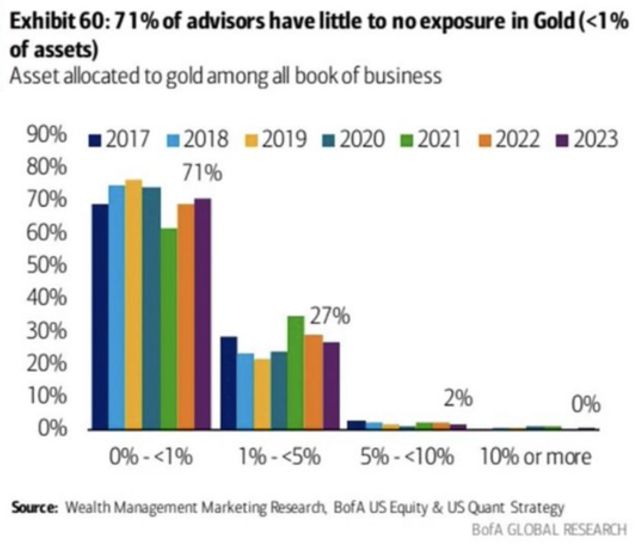

As highlighted by Tavi Costa, despite the recent push toward new highs, gold remains severely under-allocated

In fact, 71% of US advisors have little to no exposure to the metal. Similar to how Central banks continue to aggressively accumulate the metal, conventional investment portfolios have yet to take steps to find true diversifiers. Sources: Tavi Costa, BobEUnlimited

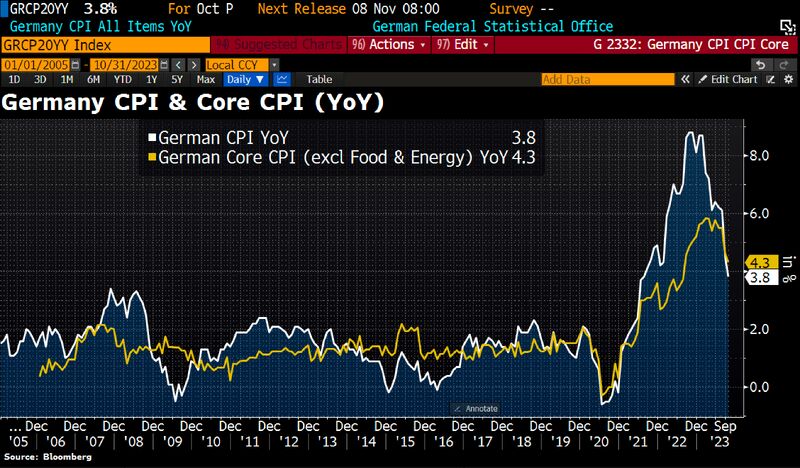

Germany's inflation slowed to 3.8% YoY in Oct from 4.5% in Sep vs 4% expected and lowest since Aug 2021 as energy prices dropped 3.2% YoY and food inflation slowed to 6.1% YoY

German October Core CPI dropped to 3.8% from 4.6% in September. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks