Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

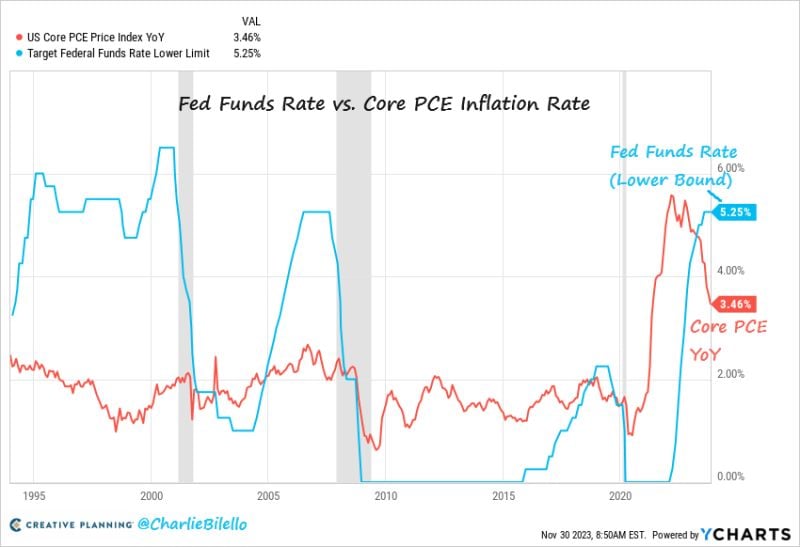

The Fed's preferred measure of inflation (Core PCE) moved down to 3.5% in October, the lowest since April 2021

The Fed Funds Rate is now 1.8% above Core PCE, the most restrictive monetary policy we've seen since 2007. Source: Charlie Bilello

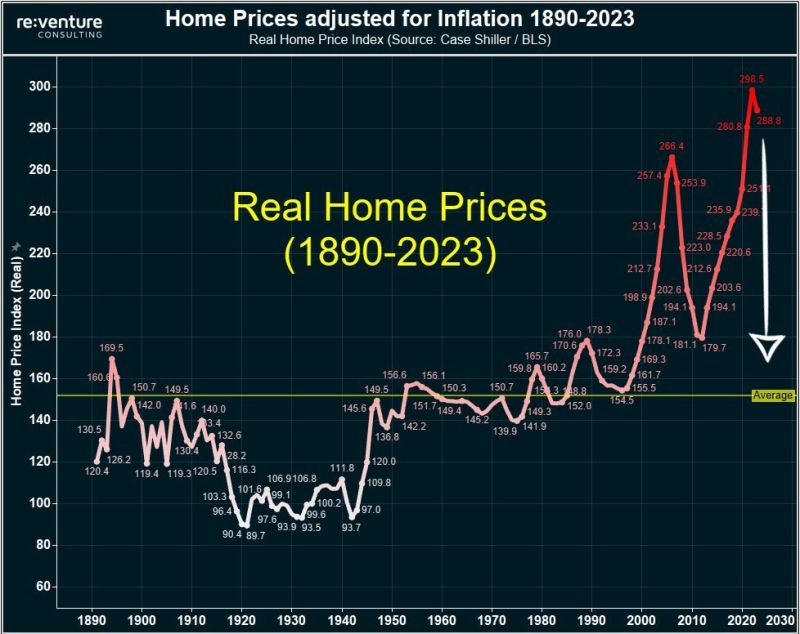

As highlighted by The Kobeissi Letter, the US housing market is having its historical moment

The US housing market is having its historical moment. Indeed, Real home prices in the US are currently almost 10% MORE expensive than they were in 2008. In fact, real home prices are now 80% ABOVE the 130-year historical average, according to Reventure. This means that even on an inflation adjusted basis, home prices have never been more expensive. Meanwhile, housing supply is 40% below the historical average. All while mortgage demand is at its lowest since 1994 and the median homebuyer now has a $3000/month payment. Source: The Kobeissi Letter, Reventure

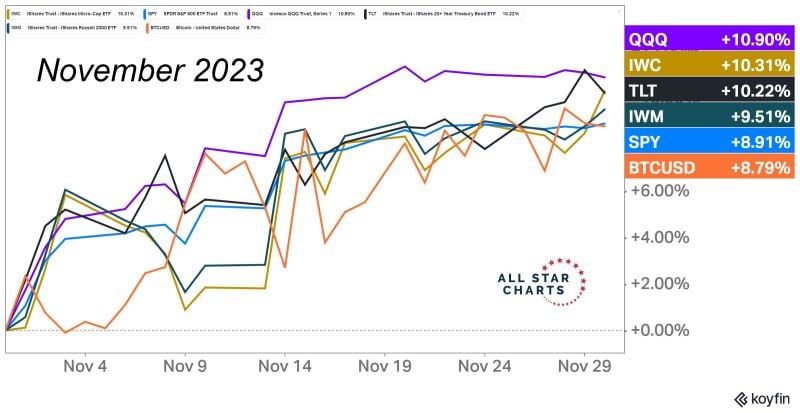

As of the end of October, investor's sentiment index was almost at maximum fear

But November turns out to instead be among one of the greatest months in stock market history. Source: J-C Parets

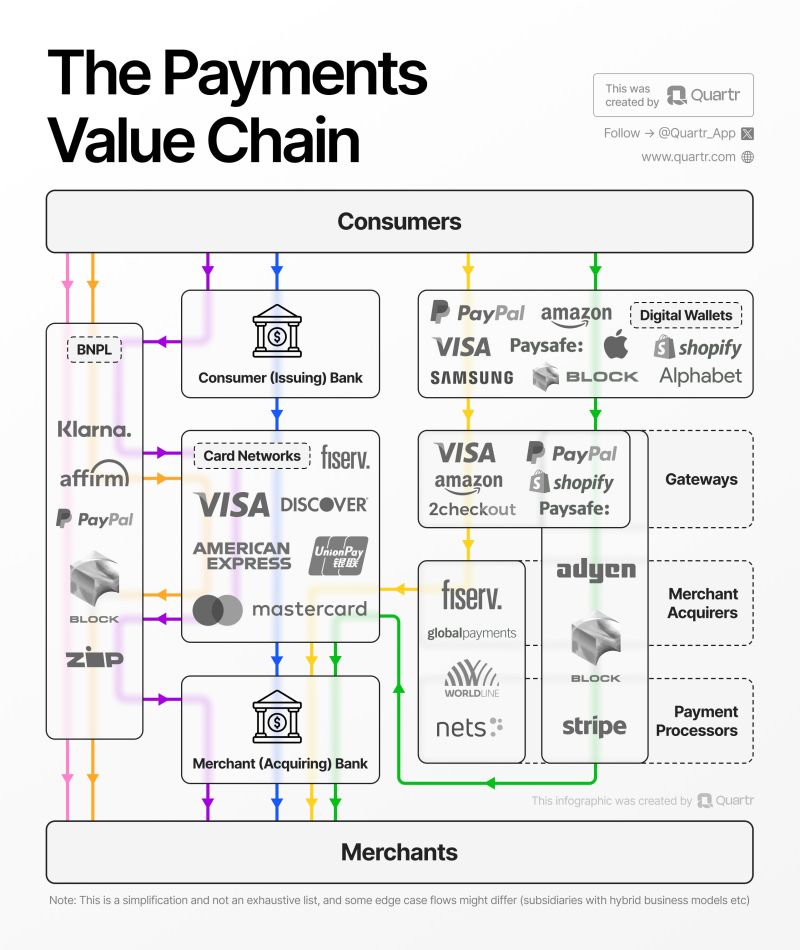

The Payments Value Chain by Quartr

They jave updated our highly appreciated infographic explaining the complex payments layer between consumers and merchants. It illustrates how and where key players such as $V, $MA, $FISV, $ADYEN, $AMZN, and $PYPL fit in. Source: Quartr

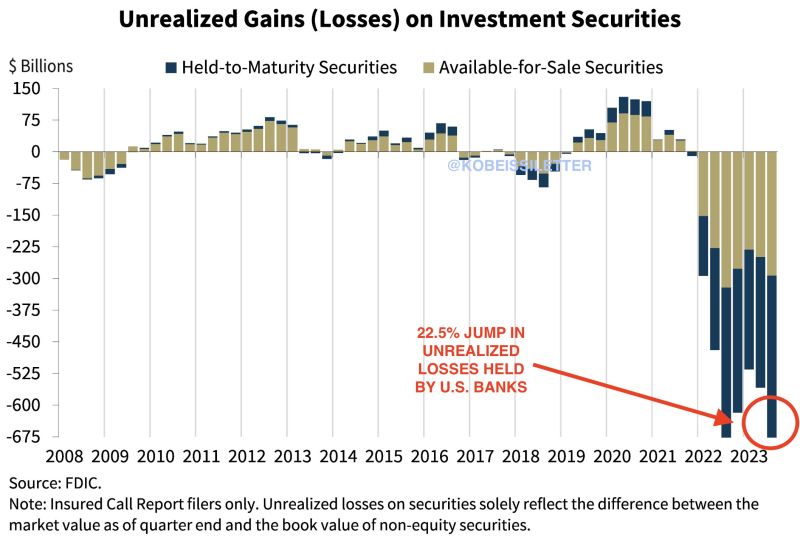

Is the US banking crisis really over?

Unrealized losses on investment securities held by US banks hit $684 billion in Q3, according to the FDIC. This marks a 22.5% jump compared to unrealized losses seen last year. The jump was primarily driven by rising mortgages rates reducing the value of mortgage-backed securities held by banks. Despite these challenges, the FDIC states that banks remain "well capitalized." This comes as usage of the Fed's emergency funding facility for banks hit another record high of $114 billion. Source: The Kobeissi Letter

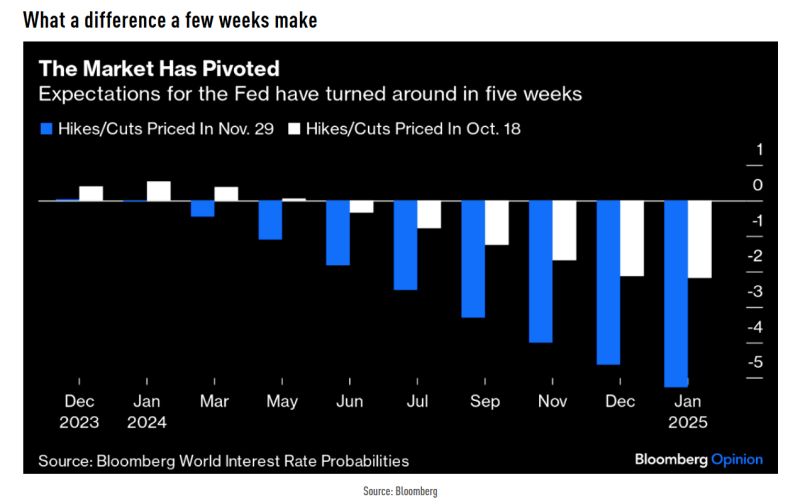

Massive change over the past 5 weeks when it comes to what the market is pricing from FED

Source: TME, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks