Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

Private equity firms are redirecting their focus from mega buyouts to businesses such as private credit as higher interest rates disrupt their strategies

Over the past year, buyouts have been halted due to the impact of higher rates, resulting in private equity firms being burdened with portfolio companies acquired at high prices. In response to this challenging environment, some of the industry’s largest firms are venturing into new areas, including lending to companies, which has become more lucrative as central banks raise interest rates to combat inflation. Top executives from Apollo and Blackstone recently highlighted the potential of private credit and infrastructure investing at the annual IPEM industry conference in Paris. https://lnkd.in/exw5bqWp. Source: https://lnkd.in/eSMS2Q-k

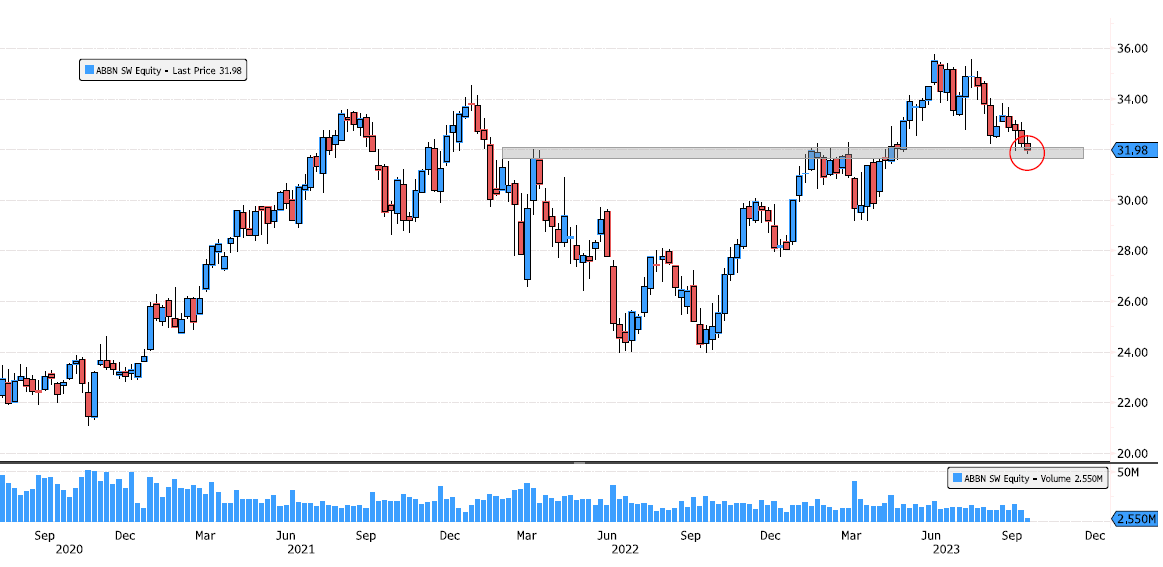

ABB is back on strong support zone

ABB (ABBN SW) is back on major support zone 31.65-32.05. This level was the May breakout. Source : Bloomberg

In June 2023, the most visited website in the world is Google

The top website receives 152 billion visits monthly, almost equalling the next 4 websites combined. Source: Genuine Impact

Do you remember what Larry Summers said last year about soft landing?

This story of second marriage and the triumph of hope vs. experience seems to find an echo at the FED level...

The business outlook in Germany has improved slightly amid a shrinking economy

Source: Bespoke

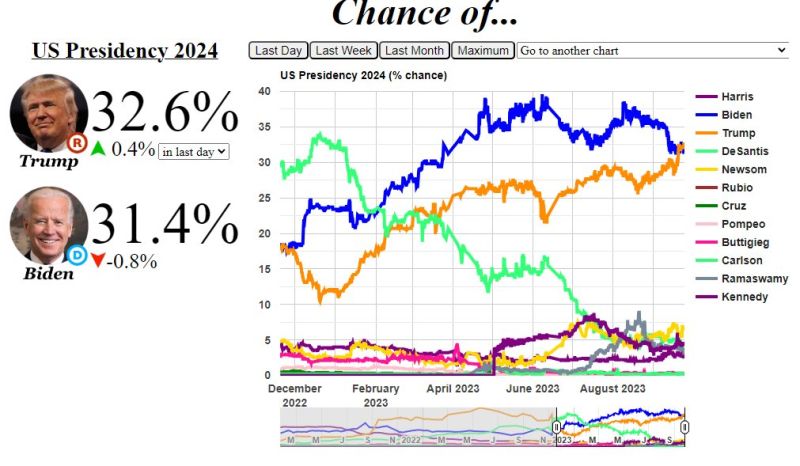

First time in 2023 that ElectionBettingOdds has had Trump in the lead

Source: Bespoke

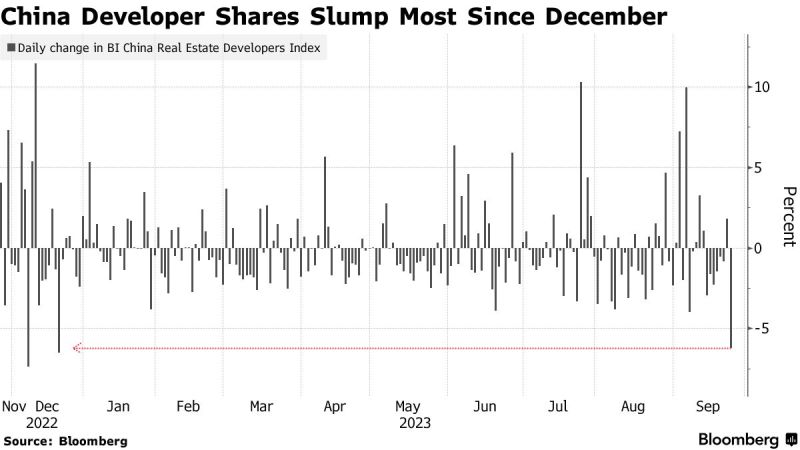

Chinese property stocks tumbled the most in nine months as concern over a possible China Evergrande Group liquidation added to fresh signs of stress across the industry

A Bloomberg Intelligence gauge of developer shares fell as much as 6.4% Monday, taking its loss in valuation this year to $55 billion. Evergrande, which scrapped key creditor meetings at the last minute and said it must revisit its restructuring plan, dived 25%. China Aoyuan Group Ltd. was the biggest drag on the gauge, slumping by a record 76% after shares resumed trading. Sentiment has worsened dramatically in recent days as investors brace for years of pain from the ailing sector, with policy support failing to resolve liquidity woes. While developers are pinning their hopes on the upcoming Golden Week holiday period to revive home sales, a rapid cooling of a late-August rally in property shares shows any relief may be short lived. Source: Bloomberg

Ethereum back on June 2022 trend support

Ethereum (XETUSD) is back on June 2022 trend support. Keep an eye on the is level. Source : Bllomberg

Investing with intelligence

Our latest research, commentary and market outlooks