Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

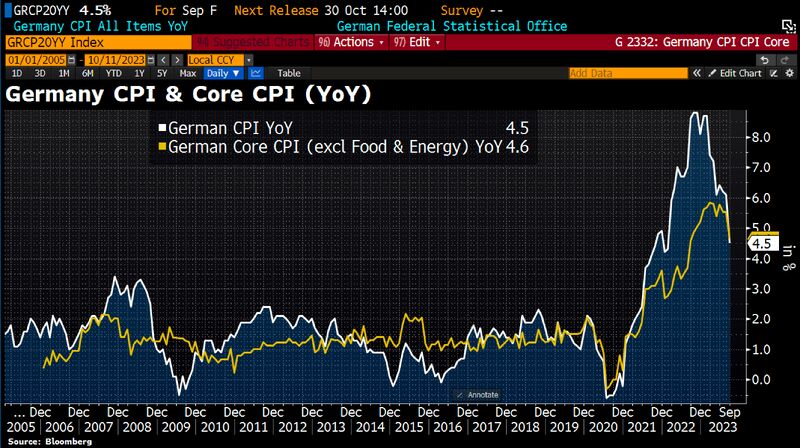

German inflation in September fell to its lowest rate since outbreak of war in Ukraine, confirming prior estimates

CPI slowed to 4.5% in September YoY from 6.1% in August. Headline CPI is now lower than Core CPI BUT food prices are already on the rise again. Compared to previous month, food has become 0.4% more expensive. Source: Bloomberg, HolgerZ

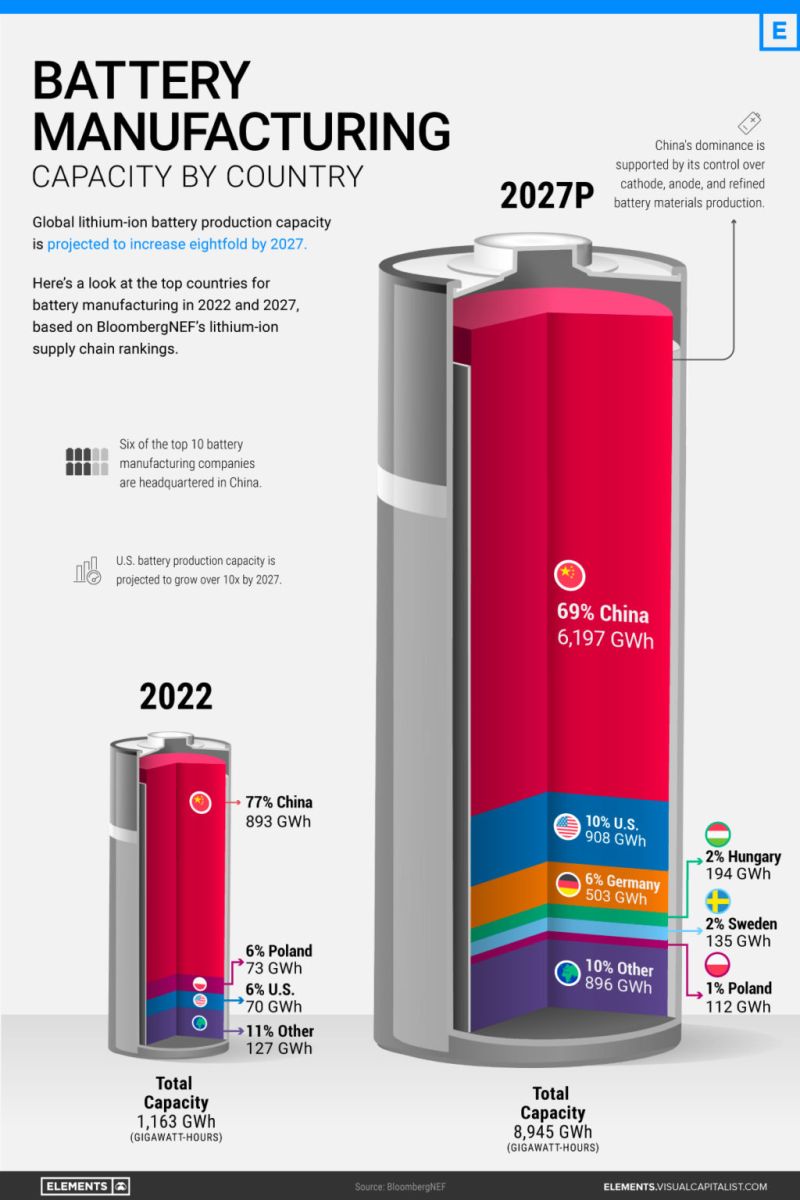

Visualizing China’s Dominance in Battery Manufacturing (2022-2027P)

by Elements / Visual Capitalist

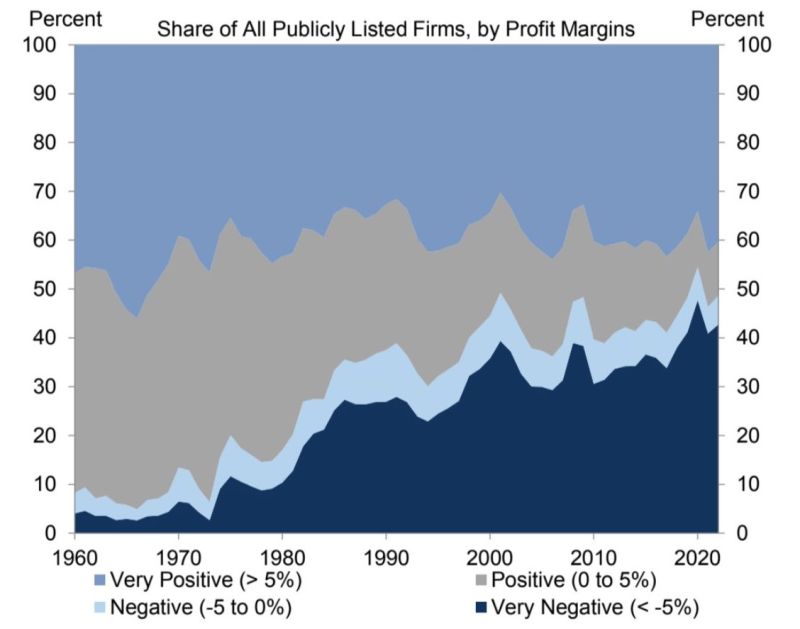

Almost half of US listed firms have negative profit margins

They have been able to survive in artificially low interest rates and ample liquidity environment. Things have changed though. Source: GS, Michel A.Arouet

US 10-year Yield pullback from last week peak

US 10-year Yield pullback sharply from last week peak. After the Non-Farm Payrolls report on Friday, the US 10-year Govt Yield came close to hitting 4.9%. As of today, that Yield is down below 4.6%.

European gas price jumped to 6mth high as security threats to region’s infrastructure added to rising tensions in Middle East

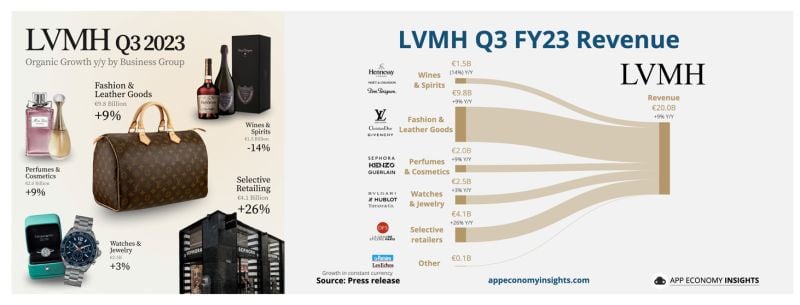

Q3 Revenue +9% Y/Y to €20.0B (in cc). 🍷 Wines & Spirits -14% to €1.5B. 👜 Fashion & Leather goods +9% to €9.8B. 💅 Perfumes & Cosmetics +9% to €2.0B. 💍 Watches & Jewelry +3% to €2.5B. 🛍️ Selective retailers +26% to €4.1B. Source: Quartr, App Economy Insights

LVMH Louis Vuitton Moët Hennessy. Q3 results in one image

Q3 Revenue +9% Y/Y to €20.0B (in cc). 🍷 Wines & Spirits -14% to €1.5B. 👜 Fashion & Leather goods +9% to €9.8B. 💅 Perfumes & Cosmetics +9% to €2.0B. 💍 Watches & Jewelry +3% to €2.5B. 🛍️ Selective retailers +26% to €4.1B. Source: Quartr, App Economy Insights

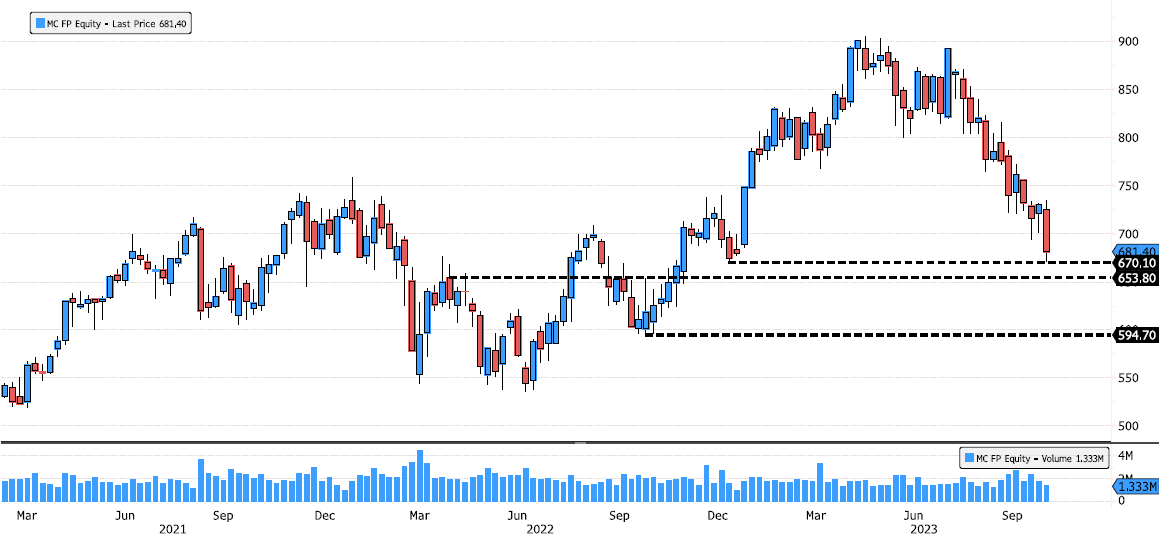

LVMH desperately trying to find support

LVMH (MC FP) is now dropping 25% since April high. Stock is trying to find some support for a technical rebound in this bearish trend. Keep an eye at 670 support. If broken next support is 654. Source : Bloomberg

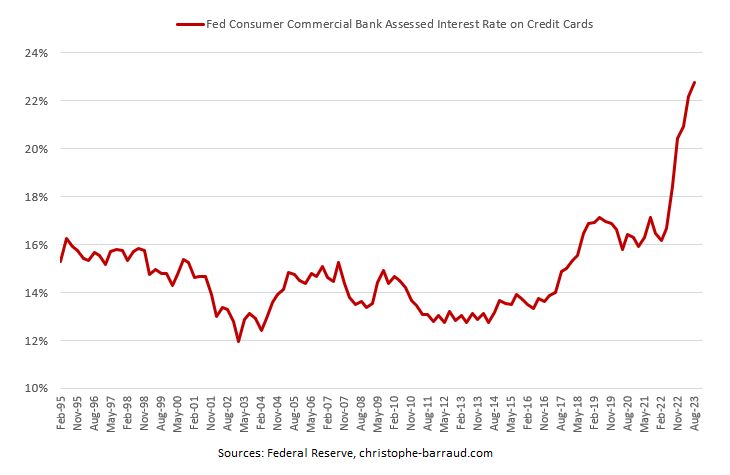

US average interest rate on credit cards is now close to 23% ⚠ (hitting a new record high since data are recorded)

Source: C.Barraud

Investing with intelligence

Our latest research, commentary and market outlooks