Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

WIth the Vix <17, Brent oil<$90/bbl and S&P 500>4350, do you feel that risk is currently mispriced?

Source: HolgerZ, Bloomberg

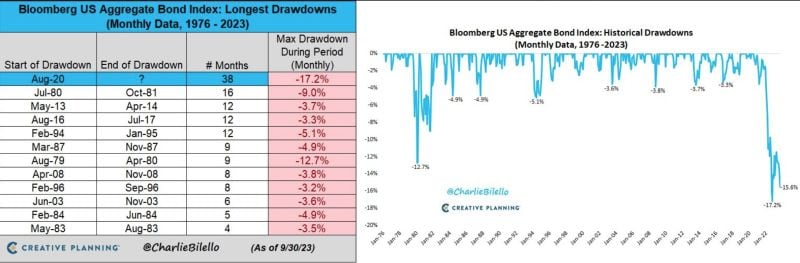

This is by far the longest bond bear market in history, at 38 months and counting...

Source: Charlie Bilello

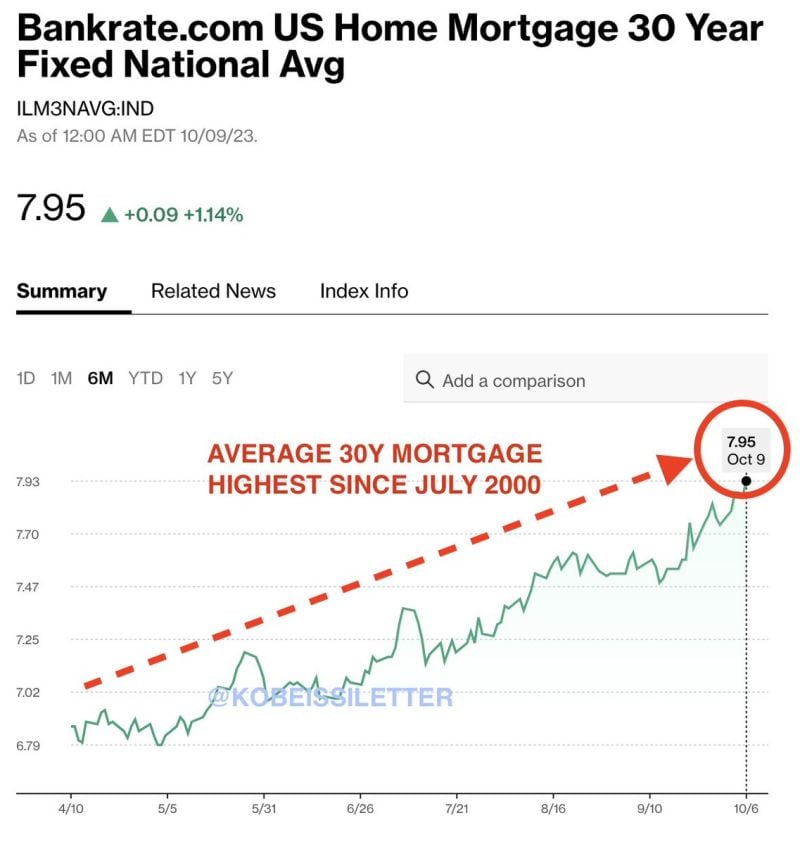

Average interest rate on a US 30-year mortgage rises to 7.95%, its highest since July 2000

Mortgage demand also just fell to its lowest level since 1995. 8% mortgages are the new normal. Source: The Kobeissi Letter

Fighting the Fed has transformed bond ETFs into cash incinerators..

$TLT has come out of nowhere to hit #3 on the Top 20 Cash Burning ETFs list (lifetime flows minus aum today) with over $10b lost. Top of list used to be -2x/-3x, VIX, commodity ETFs. Now its vanilla bond ETFs... Great table from psarofagis thru Eric Balchunas, Bloomberg

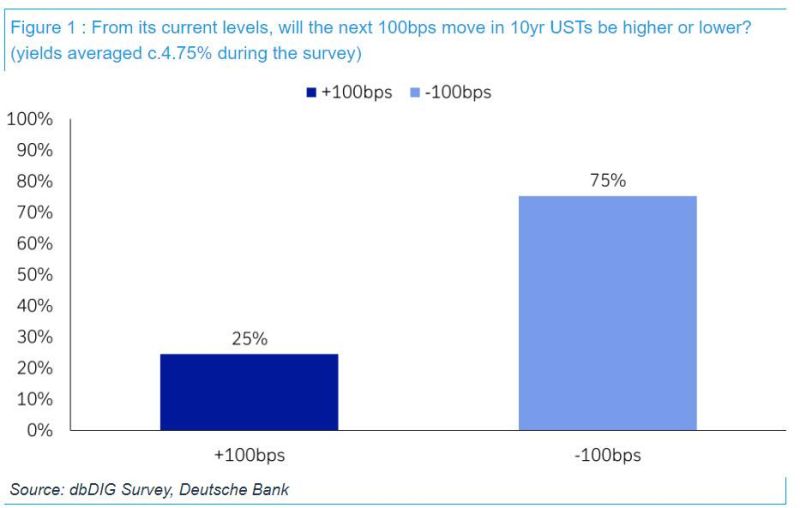

Vast majority on Wall Street think next 100bps move in 10Y yields is LOWER (and vast majority think the next 10% S&P 500 move will be LOWER)

The Deutsche Bank October 2023 global financial market survey, conducted between the 3rd and 6th of October, had 410 responses from around the world. - 75% think the next 100bps move in US 10yr yields is lower (average yield 4.75% during the survey). A big turnaround from June’s results where a small majority expected 4.5% before 2.5% when we were halfway between the two. Well done to that small majority as it got there in just 3 months. - 72% think the next 10% move in the S&P 500 will be lower. Slightly less than in June. In March 76% thought the next 10% move would be up so a different mood to earlier this year. Source: DB

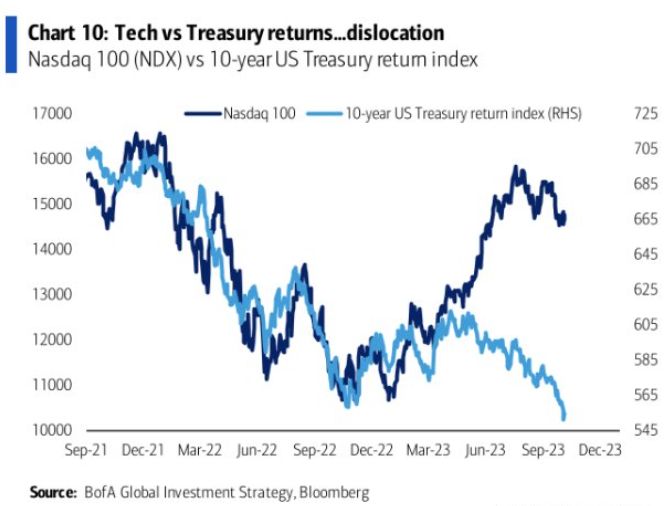

The gap between returns in tech stocks and US Treasuries has widened significantly since June

As bond prices continue to plummet but equities hold higher, this gap is getting larger. Source: BofA, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks