Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Jevons' Paradox in action: The initial response to the "DeepFreak" suggests companies are spending more, not less.

Cloud Capex is projected to grow 40% in 2025, according to @MeliusResearch Source: Holger Zschaepitz @Schuldensuehner

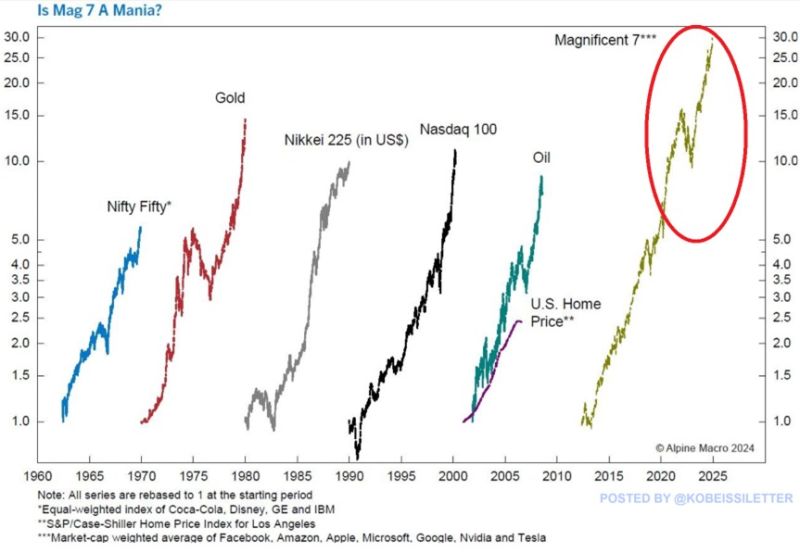

Is AI hype a bubble or the next big thing?

Magnificent 7 stocks are 30 TIMES higher than where they were 10 years ago, exceeding gains of other historical manias. The Nasdaq 100 rose 12x in 10 years before the 2000 Dot-Com Bubble popped. The Nikkei 225 rose 10x in a decade during the Japanese bubble of the 1980s. Furthermore, Gold saw a 15x increase in price in the 1970s before its peak. Lastly, Nifty Fifty stock prices rose 5x in the 1960s before the bull market ended in 1969. Will AI live up to the historically high expectations? Source: The Kobeissi Letter

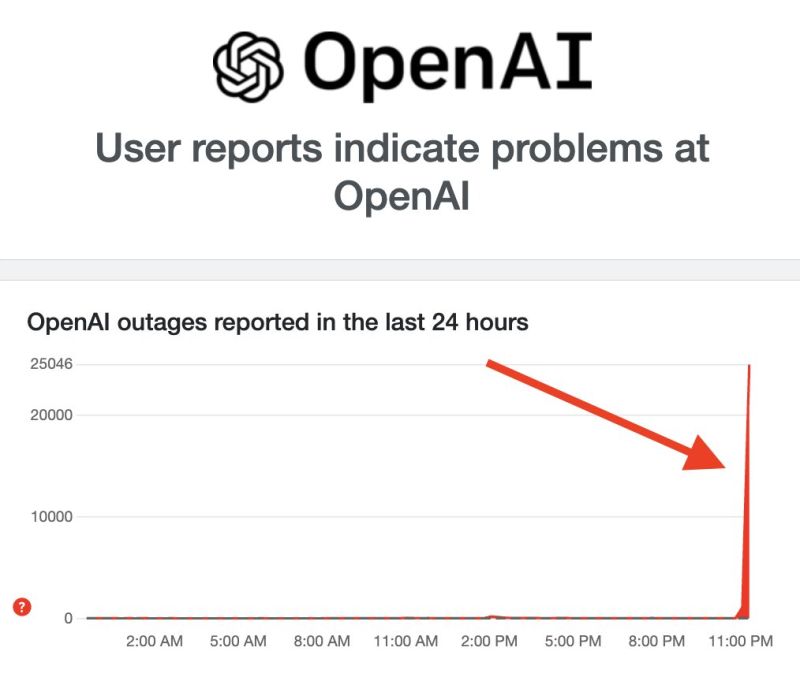

BREAKING: ChatGPT is down worldwide with millions of users unable to access the platform.

Source: The Kobeissi Letter

OpenAI is in early talks to raise a large funding round at a $340 billion valuation,

more than doubling what it was worth in October, according to the Wall Street Journal, citing unnamed people familiar with the matter.

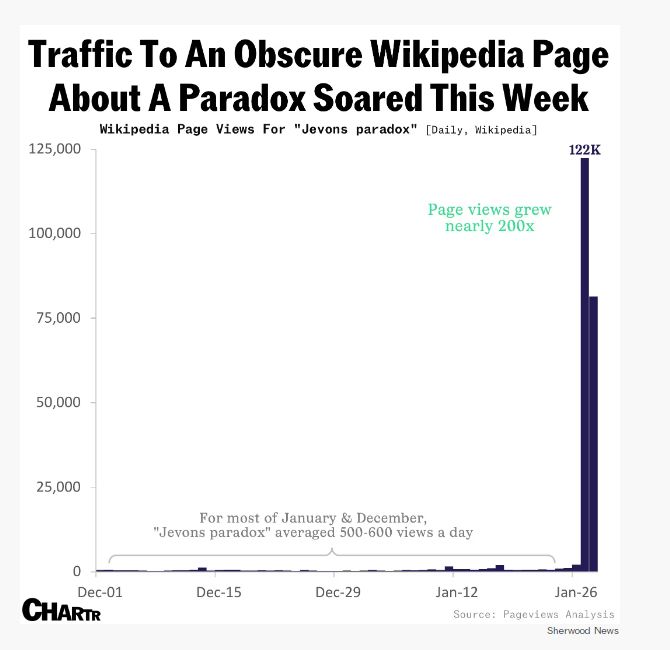

⚡ The Jevons paradox

🚨 In the wake of DeepSeek turning the entire industry on its head — and wiping nearly $600 billion off of the market cap of Nvidia in a single day — one new phrase has become table stakes for anyone wading into the DeepSeek discourse: Jevons Paradox, with traffic to its associated Wikipedia page soaring this week. 👉 Per that very Wikipedia page: “...the Jevons paradox occurs when technological advancements make a resource more efficient to use (thereby reducing the amount needed for a single application), however, as the cost of using the resource drops, overall demand increases causing total resource consumption to rise.” 👉 The original example posited by Mr. William Stanley Jevons, summarized nicely by Axios, was coal. Progress in steam engines, which enabled them to use less coal, didn’t lead to a drop in coal demand — it led to a huge rise. Though a bit of an oversimplification, that is essentially the crux of the current debate in AI: DeepSeek reportedly achieved something for a lot less money and resources than US competitors like OpenAI and Meta used. That could be interpreted in two ways: • We will therefore need fewer high-tech chips like the ones Nvidia makes, and fewer energy plants to power them (which is why power and datacenter stocks got hammered this week); • Or, and this is where the Jevons Paradox comes in, WE WILL WANT EVEN MORE 💪 The market seemed to follow the first school of thought on Monday 🐻 , but came around to the second by Tuesday 🐮 , with chip analysts and tech heavyweights, most notably Microsoft’s CEO Satya Nadella, citing the paradox as proof that AI use will “skyrocket.” 🚀 🚀 🚀 Source: Chartr

Why "cheap" AI will benefit the overall ecosystem explained in one chart

As the cost of AI comes down, what are the sectors that benefit from cheap intelligence? 1. Cybersecurity (e.g $CRWD) 2. Data Storage/Analytics (e.g $NOW) 3. Robotics (e.g $AMZN) 4. AI Agents (e.g $MSFT $CRM) 5. Advertising (e.g $META, $GOOGL) 6. Ecosystems (e.g $AAPL) NB: These are not investment recommendations Source: Lin@Speculator_io

💻 AI hardware & infrastructure were the biggest beneficiaries of the AI boom with Microsoft, Amazon, Oracle, Google, Meta and others spending zillions.

With the rise of DeepSeek & other small models, questions are the following: 1) Will these giants maintain their spending forecasts? 2) How they justify it after DeepSeek release? 3) Will the perceived value move up the chain towards applications? Source: Deutsche Bank thru Ali Dhanji @DhanjiatRJ on X

Investing with intelligence

Our latest research, commentary and market outlooks