Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔴 XAI AND PALANTIR PARTNER TO ACCELERATE AI IN FINANCIAL SERVICES

▶️ xAI has partnered with Palantir to drive AI adoption in the financial services sector, focusing on developing AI-driven solutions for businesses. The partnership, unveiled on May 6, extends an earlier collaboration with TWG Global. The collaboration aims to implement AI to enhance growth and operational efficiency, especially in the financial sector, by using "modular AI agents" tailored to specific business needs. AI’s integration at the C-suite level is key to its success, according to both companies, as they seek to unlock AI’s full potential in financial operations. Source: PYMNTS thru Mario Nawfal

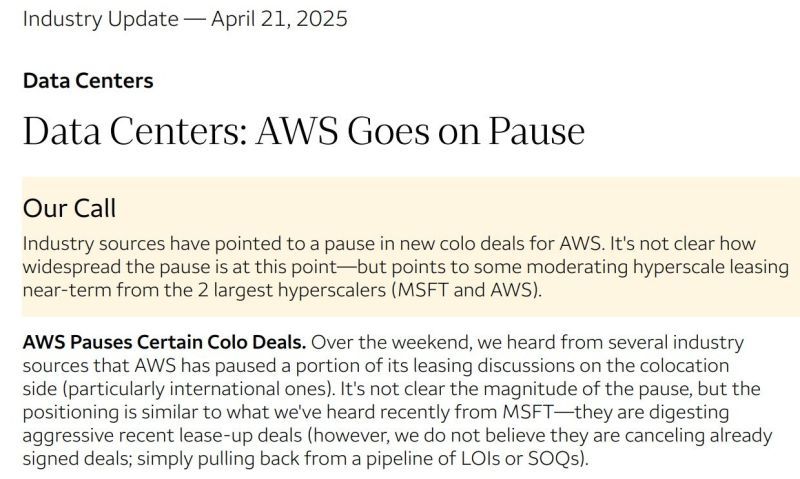

WELLS FARGO + COWEN FLAG AWS DATA CENTER LEASING PAUSE

Both banks say Amazon $AMZN AWS has hit pause on some colocation leasing deals—mainly international. Cowen notes hyperscale demand is cooling a bit, especially in Europe, with Amazon slightly pulling back on U.S. colocation activity too. Wells Fargo heard from multiple sources that AWS is stepping back from ongoing leasing talks, mirroring what’s been seen from Microsoft lately. Source: Wall St Engine

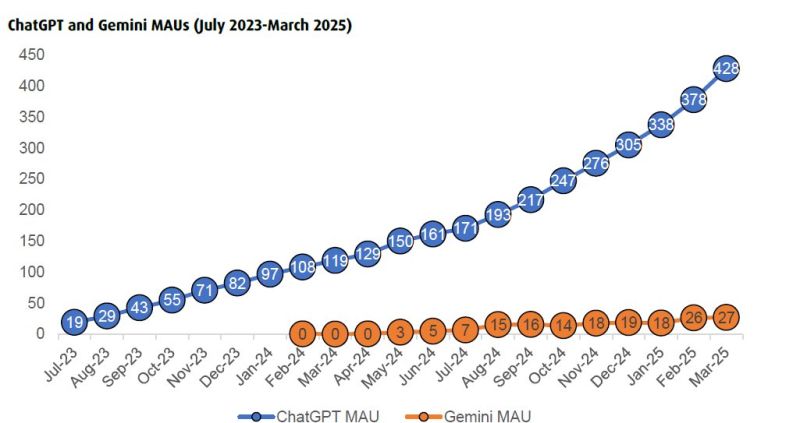

Absolutely brutal chart for Alphabet $GOOGL MAU = Monthly Active Users

Source: Pythia Capital, No Brainer @PythiaR

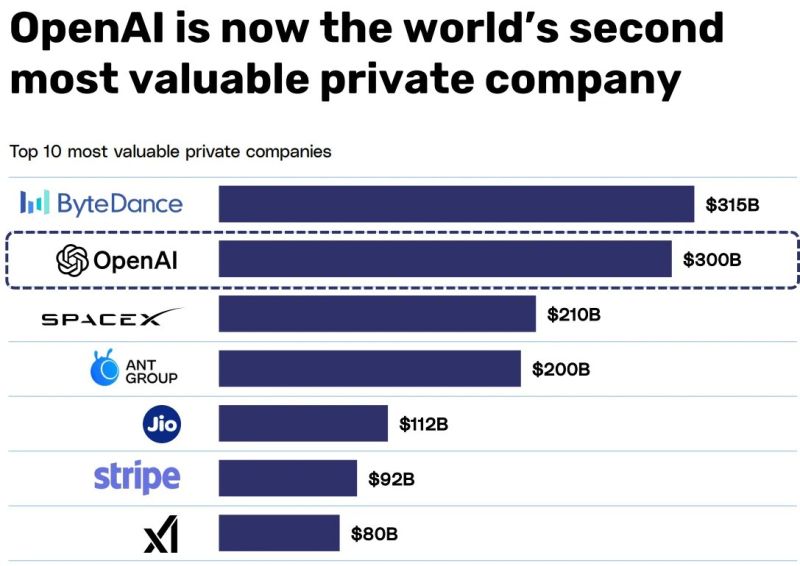

OpenAI is now the world's second most valuable private company

Source: Markets & Mayhem @Mayhem4Markets

🔴 ROBINHOOD INTRODUCES “ROBINHOOD CORTEX”, OFFICIALLY BRINGING AI TO THEIR PLATFORM. THIS IS ABSOLUTELY WILD ‼️

Together with Cortex, Robinhood announced Robinhood Strategies and Robinhood Banking to give their customers access to privatewealth management and banking services historically reserved for the ultra-wealthy. They are also giving a first look at the next big thing from Robinhood: "Robinhood Cortex", an AI investment tool launching later this year that is designed to provide real-time analysis and insights that help customers better navigate the markets, identify opportunities, and stay up to date on the latest market moving news.

Is the AI bubble popping right before our eyes?

Microsoft Abandons More Data Center Projects, TD Cowen Says - Bloomberg Source: Bloomberg

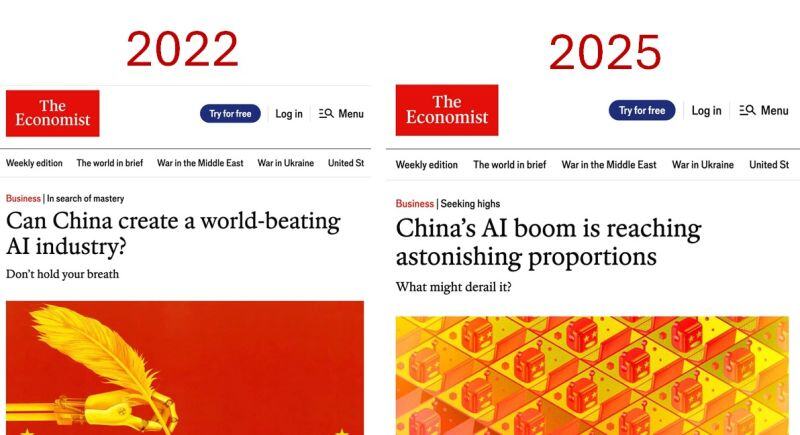

What a change of perception in 3 years...

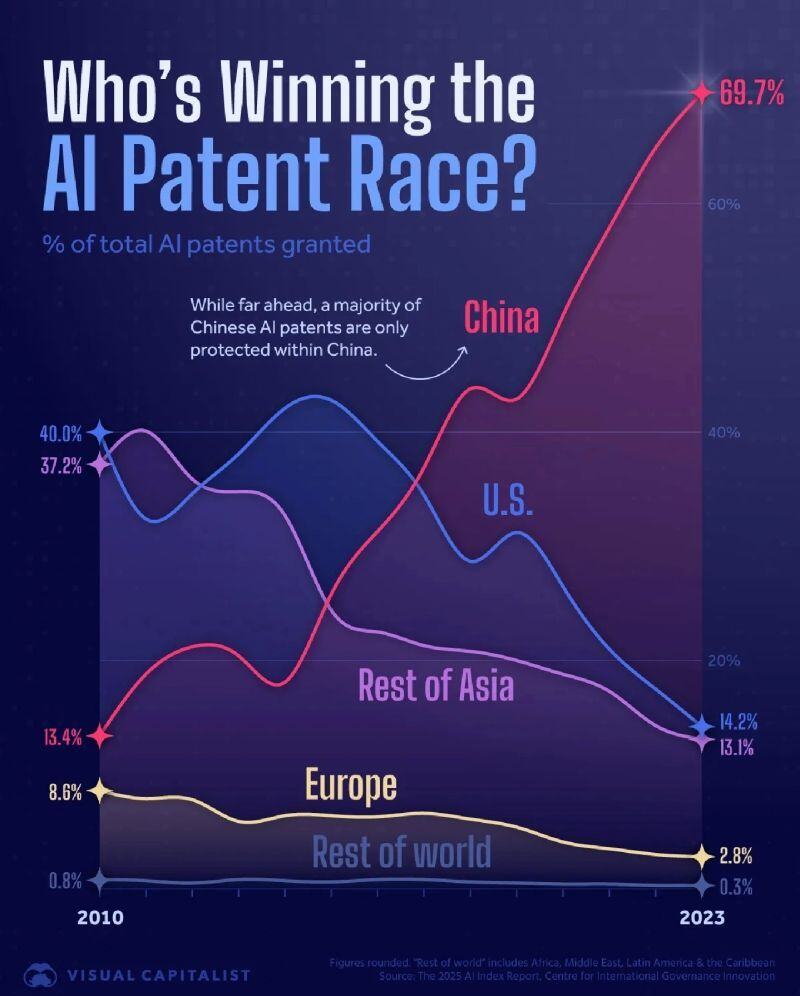

It seems that the West too often underestimates China China has achieved what they deemed impossible to do. We've seen this first hand in the EVs, electric batteries, solar panels, wind turbines and renewable energy. We might see it with AI as well Source: Cyrus Janssen @thecyrusjanssen @richardturrin

Investing with intelligence

Our latest research, commentary and market outlooks