Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

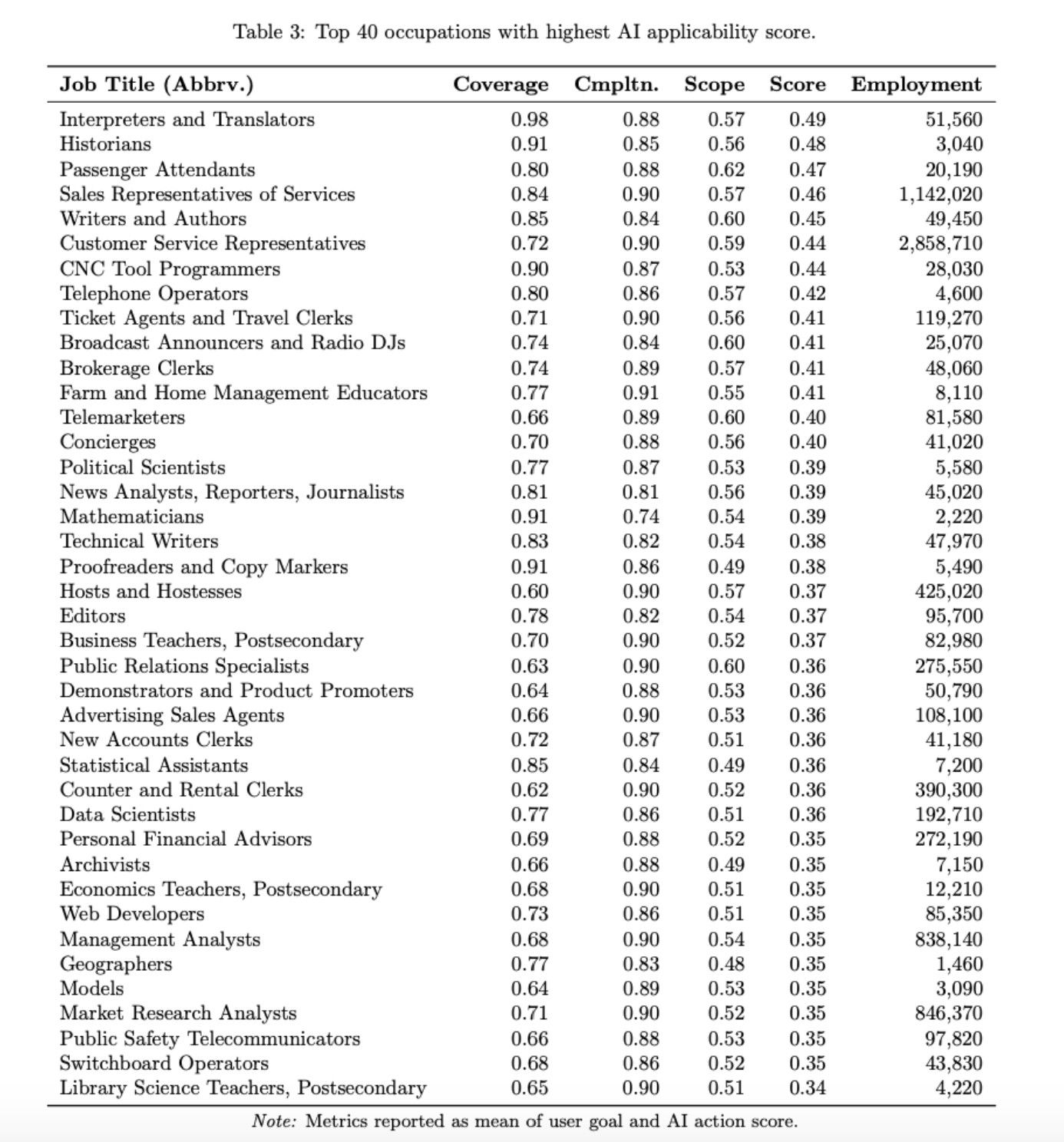

Microsoft, $MSFT, has said that these are the 40 jobs most at risk by AI

Source: unusual whales

Buy-now-pay-later firm Klarna reported AI-driven sales growth for the second quarter, enabling the company to generate revenues of $1 million per employee.

👉 The Swedish company said it had 20% like-for-like sales growth in the second quarter, with total revenues coming in at $823 million for the period. 👉The firm also saw adjusted operating profits of $29 million, up significantly from the first quarter’s $3 million. “AI adoption continues to deliver significant, tangible results. As a result of this strategy, average revenue per employee reached $1.0m, up 46% [year on year in the second quarter],” the company said in its quarterly report. 👉Klarna has aggressively leveraged AI to boost productivity performance. It has shed two in five jobs over the past two years as a result. “This shift reflects the growing impact of AI and automation in eliminating manual, time-consuming work across Klarna,” the company had said in its first-quarter results.

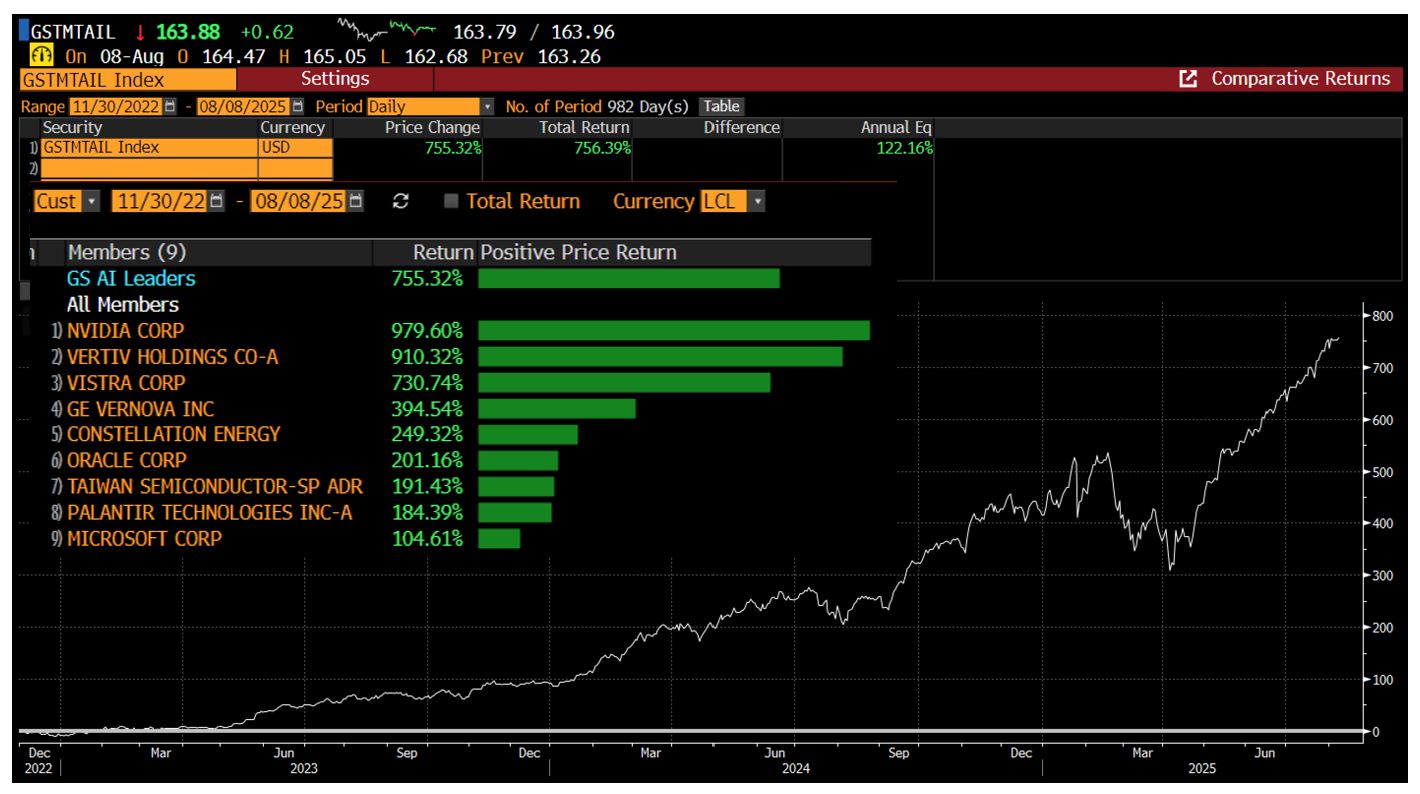

The Goldman Sachs AI Leaders Basket

Consisting of the 9 leading AI stocks (semiconductors: Nvidia, TSMC), software/data center (Palantir, Oracle, Microsoft, Vertiv), and power/infrastructure (GE Vernova, Constellation, Vistra) has made 756% since ChatGPT launch in 2022, an avg of 122% per year! Source: Bloomberg, HolderZ

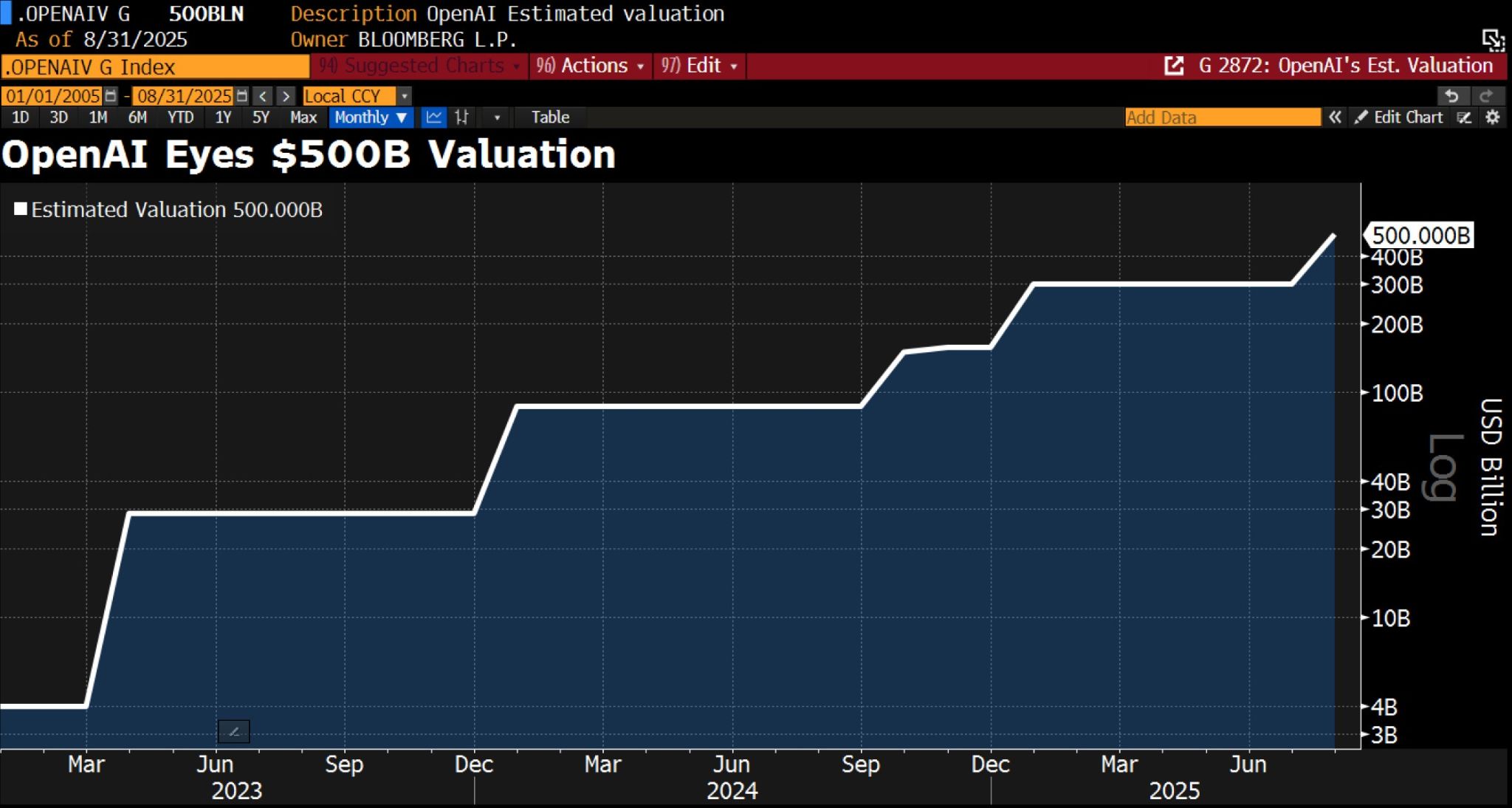

OpenAI might soon be worth $500bn – thanks to a potential stock sale for employees.

The company is reportedly in early discussions to allow current and former employees to sell their shares, which would value OpenAI at roughly $500bn. Source: HolgerZ, Bloomberg

Top AI companies by Market Cap

Source: Mark Roussin, CPA @Dividend_Dollar

NVIDIA CEO: “I’D STUDY PHYSICS, NOT SOFTWARE” IF I WERE 20 TODAY Jensen says if he were graduating college in 2025, he’d skip coding bootcamps and major in physical sciences like physics or chemistry.

During a trip to Beijing on Wednesday, Huang was asked by a journalist: “If you are a 22-year-old version of Jensen [who] just graduated today in 2025 but with the same ambition, what would you focus on?” To that, the Nvidia CEO said: “For the young, 20-year-old Jensen, that’s graduated now, he probably would have chosen ... more of the physical sciences than the software sciences,” adding that he actually graduated two years early from college, at age 20. Why? Because the next frontier isn’t just chatbots - it’s hashtag#AI that understands gravity, inertia, friction, and cause and effect. He calls it Physical AI: robots that don’t just generate images or code, but grip, move, and predict real-world outcomes - like not crushing your coffee mug. “When you put that physical AI into a physical object called a robot, you get robotics." And yes, he said this in Beijing, while leading the first $4 trillion company in history. Source: CNBC thru Mario Nawfal on X

Investing with intelligence

Our latest research, commentary and market outlooks