Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

New research paper from OpenAI sheds light on user behavior by analyzing sample of 1.1M messages from active ChatGPT users between May 2024 to July 2025

Findings, summarized in visualization by MadeVisualDaily, shows ChatGPT’s core appeal is utility: helping users solve real-world problems, write better, and find information fast. Source: @VisualCap, Liz Ann Sonders @LizAnnSonders

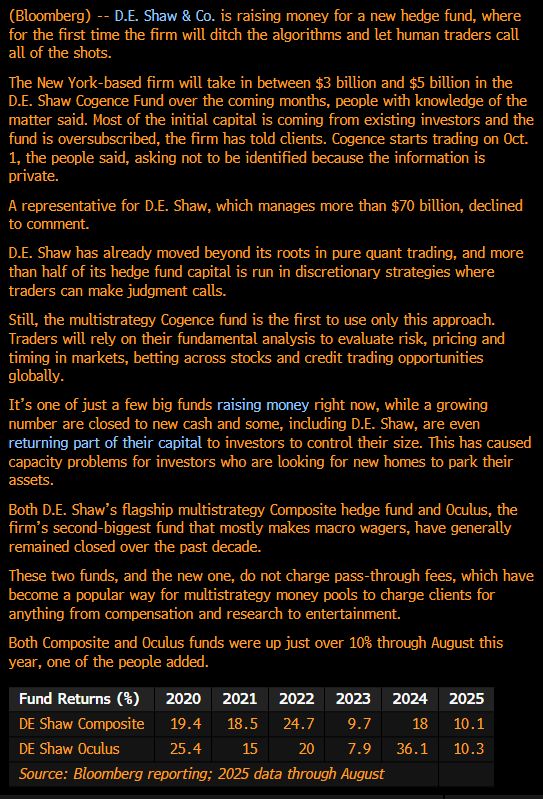

While everyone is moving away from humans towards ai, hedge fund giant de shaw is doing the opposite and launching its first ever fund run by humans, not ai.

DE Shaw is raising as much as $5 Billion in its first Hedge Fund run by humans. The D.E. Shaw Cogence Fund will trade stocks and credit. Source: Bloomberg, Nishant Kumar @nishantkumar07, Gurgavin

AI is eating the world

The 109 AI stocks in the Goldman Sachs TMT AI Basket are now worth $29.2tn, almost as much as the annual economic output of the US. Source: HolgerZ, Bloomberg

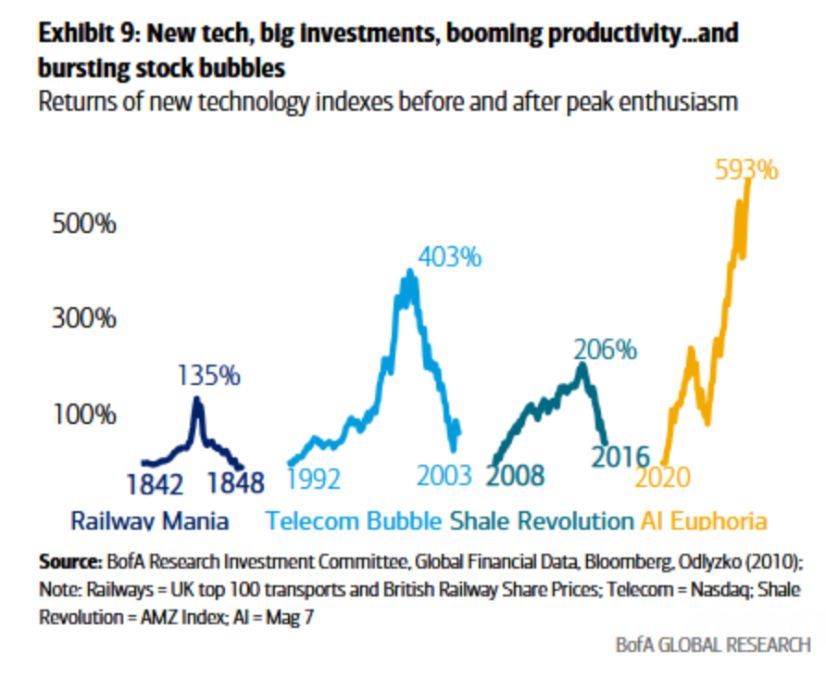

Is AI seriously overbought?

$AIQ is the Global X Artificial Intelligence & Technology ETF. It is at the most overbought levels since July 2024...just before markets crashed. Source: TME, LSEG

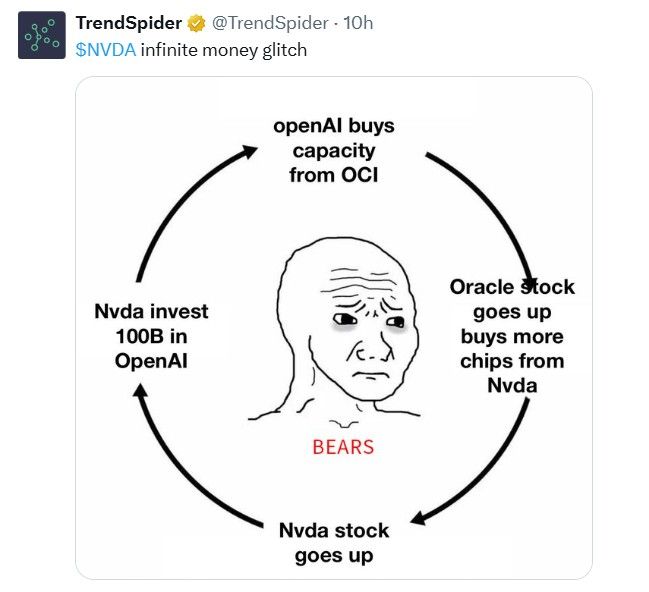

BREAKING: Oracle and OpenAI have signed a deal worth $300B, the largest cloud computing contract in history as per the Wall Street Journal

Looks like we found the customer responsible for Oracle’s 350% increase in remaining performance obligations. Source: @amitinvesting on X

Investing with intelligence

Our latest research, commentary and market outlooks