Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Good chart by @GoldmanSachs on AI exposure by industry

Source: Goldman Sachs, @tanayj on X

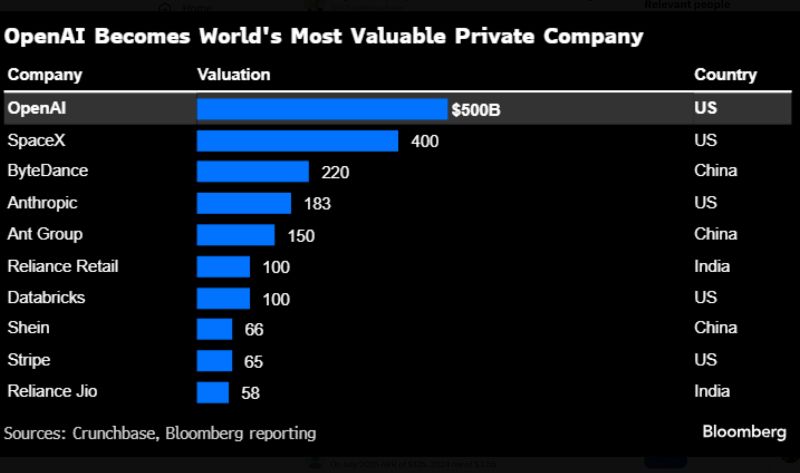

OpenAI valuation soars to $500bn, topping Musk’s SpaceX

Current and former OpenAI employees sold ~$6.6bn of stock to investors at a $500bn valuation, boosting the US company’s price tag well past its previous $300bn level. Source: HolgerZ, Bloomberg

AI is carrying the market:

Since ChatGPT’s launch in Nov 2022, AI-related stocks have delivered 181% gains in key names, while the rest of the S&P 500 has managed just 25%. More importantly, AI has powered 75% of total index returns, nearly 80% of earnings growth, and an incredible 90% of all capex growth. Without AI, the S&P’s rally would look far more modest. Source: StockMarket.news, JPAM

OpenAI and Oracle are betting big on America’s AI future

OpenAI and Oracle are bringing online the flagship site of the $500 billion Stargate program, a sweeping infrastructure push to secure the compute needed to power the future of artificial intelligence. The debut site in Abilene, Texas, about 180 miles west of Dallas, is up and running, filled with Oracle Cloud infrastructure and racks of Nvidia chips. The data center, which is being leased by Oracle, is one of the most notable physical landmarks to emerge from an unprecedented boom in demand for infrastructure to power AI. Over $2 trillion in AI infrastructure has been planned around the world, according to an HSBC estimate this week. Source: CNBC

Is Silver a pure AI play?

Note how Silver has been moving in sync with Global X Artificial Intelligence ETF $AIQ... Source: The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks