Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

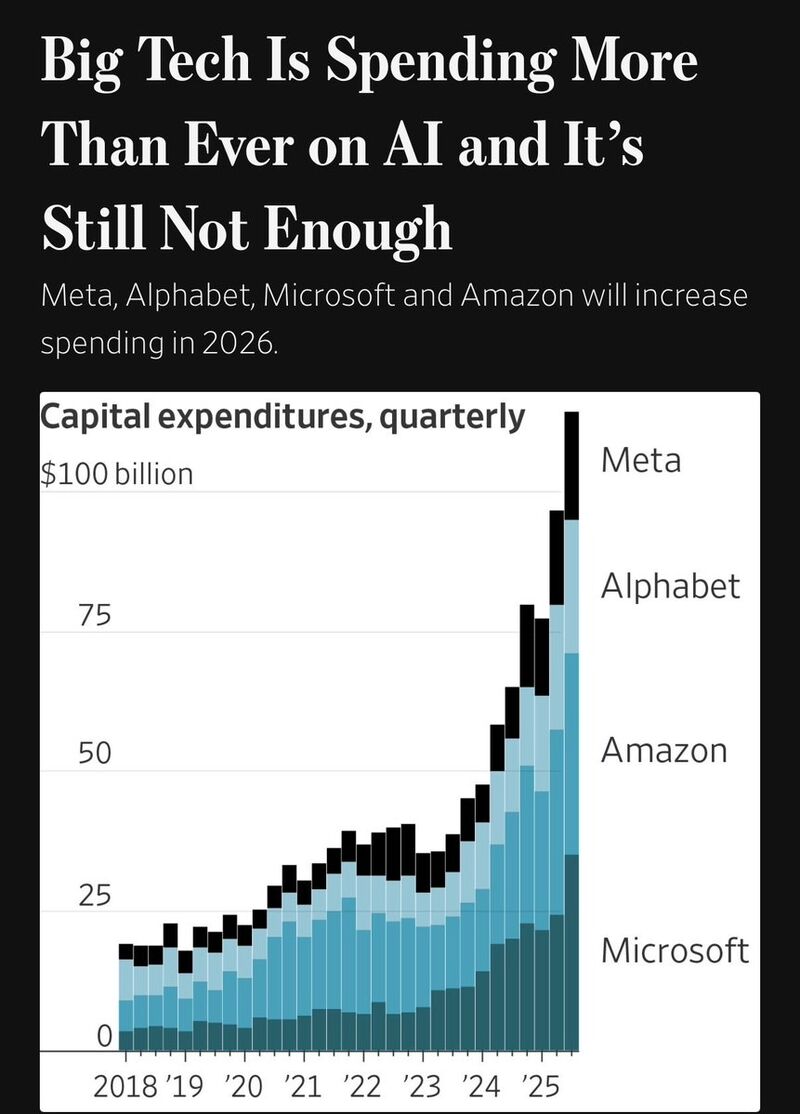

🚀 Big Tech just confirmed it — the AI spending boom is still in fire 🔥

This week’s earnings from the MAG7 show that AI CapEx is accelerating into 2026, powered by massive, structural demand that shows no signs of slowing. 💰 This investment wave isn’t just a side story, it’s the engine driving the bull market. 👀 Now the big question everyone’s asking: Will the rumored OpenAI IPO mark the peak of the AI bull run… or the next leg higher? Source: WSJ

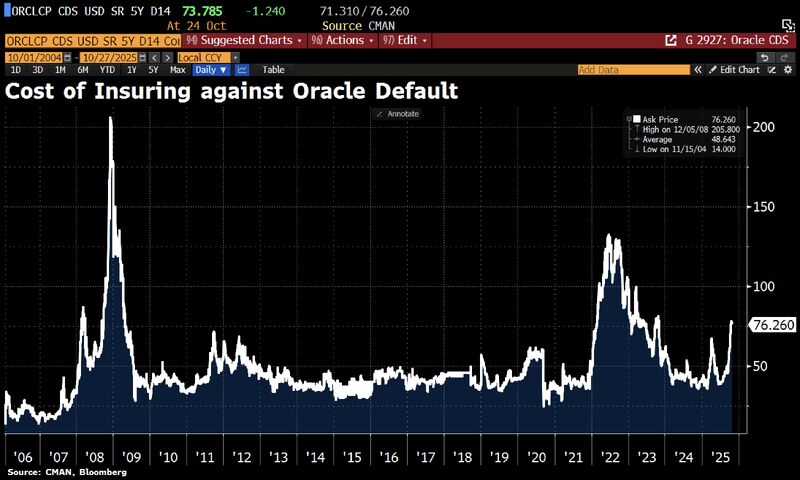

The cost of insuring against an Oracle default has surged following the company’s massive Q3 AI investment announcements – reaching levels not seen outside periods of major macro stress.

According to Goldman, Oracle’s CDS spreads have become a key sentiment indicator for the market’s appetite to finance large-scale AI spending. Source: HolgerZ, Bloomberg

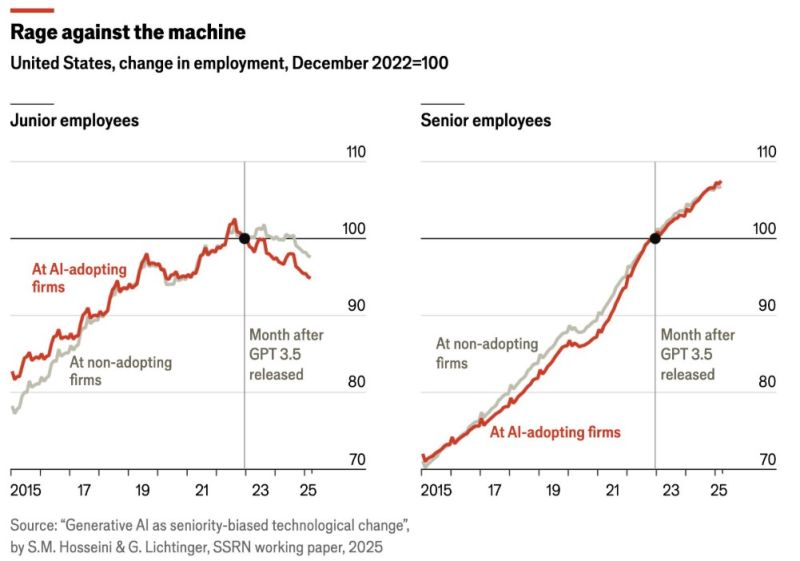

Tough time for the young generation...

Companies that have adopted AI aren't hiring fewer senior employees, but they have cut back on hiring juniors ones. Source: Crémieux @cremieuxrecueil on X

Big Move in AI + Mobility!

On Thursday, $NVIDIA dropped a game-changing announcement — it’s partnering with Uber Technologies to push the frontier of autonomous driving. Here’s what’s exciting 👇 🚗 Uber brings massive real-world driving data from millions of trips. 🧠 NVIDIA brings its Cosmos World foundational model — built to power self-driving intelligence. ⚡ Development will run on NVIDIA DGX Cloud, supercharging the entire training pipeline. The market noticed: Uber’s stock jumped after the news, as investors saw this as a strong move to cement Uber’s edge in next-gen transportation tech..

IBM’s post-earnings selloff wasn’t about the numbers — it was about the narrative.

On paper, the results were great: ✅ Revenue & earnings beat expectations ✅ Guidance raised ✅ Record free cash flow But in the AI era, “good” isn’t good enough. Investors wanted explosive AI-fueled growth. What they got was solid execution — and that’s not what the market is rewarding right now. This is the re-rating of expectations in real time. IBM is doing a lot right, but markets are chasing narrative velocity over operational discipline. Source: EndGame Macro @onechancefreedm

OpenAI has reportedly hired over 100 former investment bankers from firms like Goldman Sachs, JPMorgan, and Morgan Stanley

“Project Mercury,” is a secret effort to train AI models to automate junior bankers’ grunt work. Participants are paid $150/hour to build financial models and write prompts for tasks like IPOs and restructurings, with the goal of teaching AI to replicate analysts’ workflows. Contractors submit one model per week and receive feedback before integration into OpenAI’s systems. Source: Wall St Engine @wallstengine

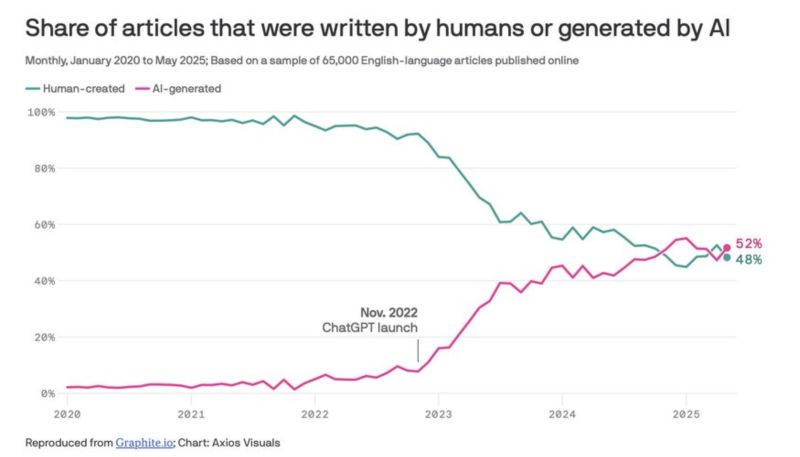

According to Oxford Researchers, the share of articles that are written by AI is now larger than the share of articles which are human created.

AI content went from ~5% in 2020 to 52% by May 2025. Projections say 90%+ by next year. Why? AI articles cost <$0.01. Human writers cost $10-100. The issue is the following: when AI trains on AI-generated content, quality degrades. Rare ideas disappear. Source: Ask Perplexity

Investing with intelligence

Our latest research, commentary and market outlooks