Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 “China is going to win the AI race.” — Jensen Huang, CEO of NVIDIA

When the world’s most valuable tech CEO says the US might lose the AI race, people listen. At the FT’s Future of AI Summit, Huang didn’t hold back: ⚙️ China’s advantage → lower energy costs + looser regulations. ⚡ “Power is free” — local governments are literally subsidizing electricity for data centers (ByteDance, Alibaba, Tencent). 🇨🇳 Chinese firms are ramping up domestic AI chips — even if they’re less efficient than NVIDIA’s, they’re cheap to run. 🇺🇸 Meanwhile, the US faces export bans, fragmented AI rules, and what Huang calls “cynicism.” His message? “We need more optimism.” The irony: The US bans NVIDIA’s best chips from China to protect its lead. But by doing so, it might be accelerating China’s self-reliance. Huang’s warning hits hard: regulation, energy policy, and mindset could decide who truly leads in AI — not just who has the best chips. 💬 What do you think — is Huang right? Will policy and power matter more than chips and code in the next phase of the AI race? See the link to FT article >>> https://lnkd.in/eas5VKjj

"You have a choice. Either get replaced by AI, or learn how to use it and become 10x more productive"

"Stop thinking of your job as 1 big thing. Instead, think of your job as a bundle of tasks" "In the future, managing robots will be more important than managing humans" "GPT is the new MBA" Source: @Uncle Shaan on X

🔥 “We’ve entered the AI virtuous cycle.” — Jensen Huang, CEO of NVIDIA (CNBC)

At the APEC CEO Summit in South Korea, Jensen Huang painted a powerful picture of what’s happening in AI right now — and why growth might only accelerate from here. He explained it simply: “The AIs get better. More people use it. More people use it — it makes more profit. More profit creates more factories. More factories create better AIs. And the cycle repeats.” That’s the AI virtuous cycle — a self-reinforcing loop driving innovation, usage, and investment at record speed. 💡 The result? Smarter models → More adoption → Bigger profits → Massive infrastructure buildouts → Even smarter models. It’s not just hype, it’s momentum. Big Tech is pouring billions into AI infrastructure, fueling this cycle and redefining how fast industries evolve. Source: CNBC

OpenAI deals this year (@KobeissiLetter)

• Stargate $500 billion • Nvidia $100 billion • AMD $100 billion • AWS $38 billion • Intel $25 billion • TSMC $20 billion • Microsoft $13 billion • Broadcom $10 billion • Oracle $10 billion ➡️ Total Value: $816 billion Source: Morning Brew ☕️@MorningBrew

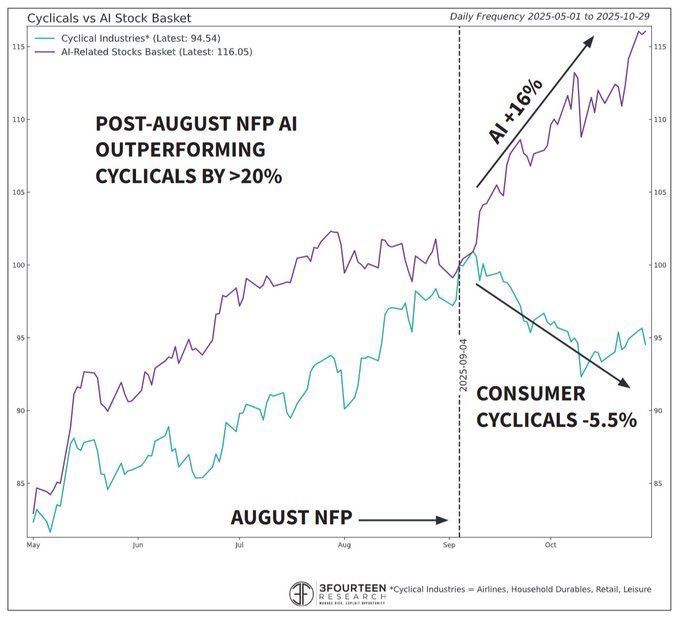

AI mania is the only game in town as the real economy sinks.

Great chart from @WarrenPies highlighting the recent divergence. Source: Bob Elliott @BobEUnlimited

Samsung bets big on AI 🇰🇷 Korean tech giant

Samsung just announced plans to buy and deploy 50,000 Nvidia GPUs — a massive move aimed at supercharging its chip manufacturing for mobile devices and robotics. 💡 The partnership is another win for Nvidia, whose GPUs remain the gold standard for building and deploying advanced AI systems. 🔧 Samsung also confirmed it’s working with Nvidia to optimize its 4th-gen HBM (High Bandwidth Memory) for next-generation AI chips — a move that could reshape the global AI hardware landscape. 👉 The AI arms race just got another heavyweight upgrade.

💥 Microsoft’s latest SEC filing quietly revealed a lot about OpenAI’s finances.

According to the numbers, OpenAI lost roughly $11.5 billion last quarter — a figure inferred from Microsoft’s own disclosures. 📊 With a 27% stake in OpenAI, Microsoft recorded a $3.1 billion hit to its net income, pointing to massive operating losses at its AI partner. 💸 The filing also shows Microsoft has now funded $11.6 billion of its $13 billion total commitment to OpenAI — and those losses are now being reflected directly in Microsoft’s earnings under equity accounting rules. 🤔 The takeaway: the AI boom is incredibly expensive, and even the biggest players are feeling the weight of the burn rate.

Investing with intelligence

Our latest research, commentary and market outlooks