Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

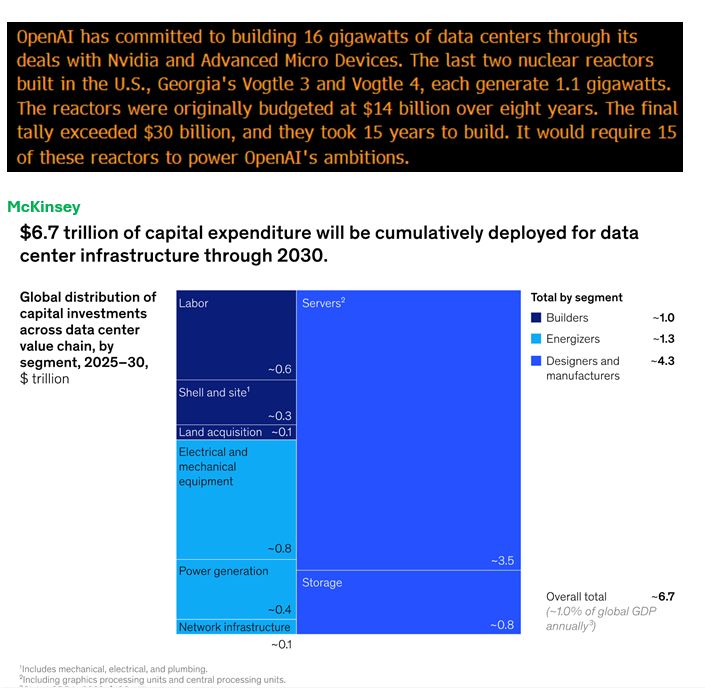

Quotes from Barron's & chart from McKinsey on AI CAPEX...

Source: Bloomberg, McKinsey, RBC

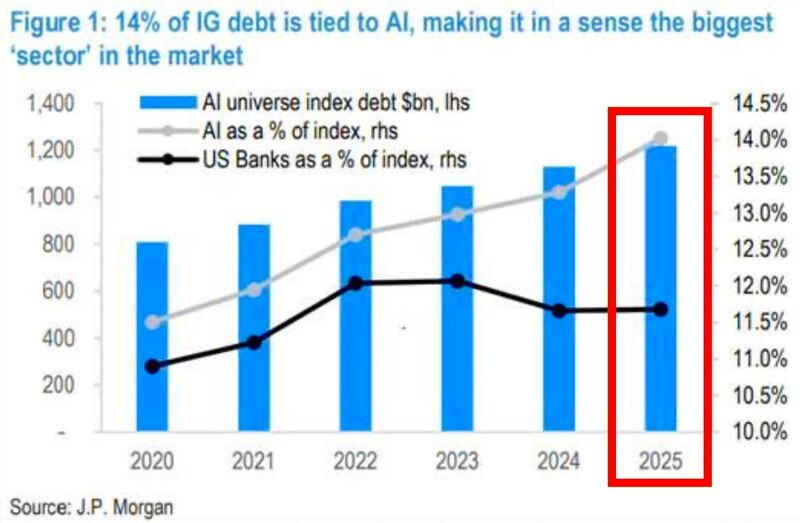

It's not just a stock bubble: AI is also now the largest sector in investment grade credit.

According to JP Morgan, AI-related companies now make up around 14% of the entire investment-grade debt market, with over $1.2 trillion in outstanding debt. It shows just how massive and expensive the AI buildout has become. These companies are financing data centers, semiconductor plants, and cloud infrastructure at a pace we haven’t seen in years. Much of the AI revolution is being funded by the debt markets. Every new data center, chip fab, and GPU cluster requires capital. It’s not just Big Tech spending cash reserves, the entire credit market is fueling AI growth. Source: JP Morgan, StockMarket.news

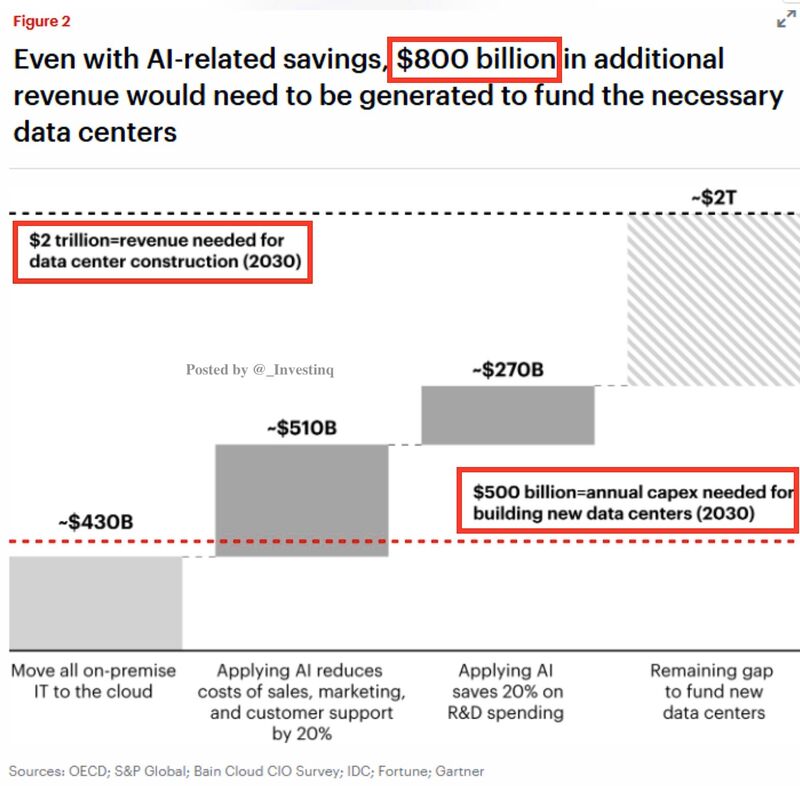

StockMarket.news: "AI isn’t cheap... By 2030, the world will need $2 trillion in revenue just to fund new data centers.

Even after AI-related cost savings, an $800 billion gap remains meaning $500 billion in annual capex just to keep building the infrastructure powering the AI boom. Can Big Tech and private equity afford to sustain this level of funding by 2030?" Source: StockMarket.news

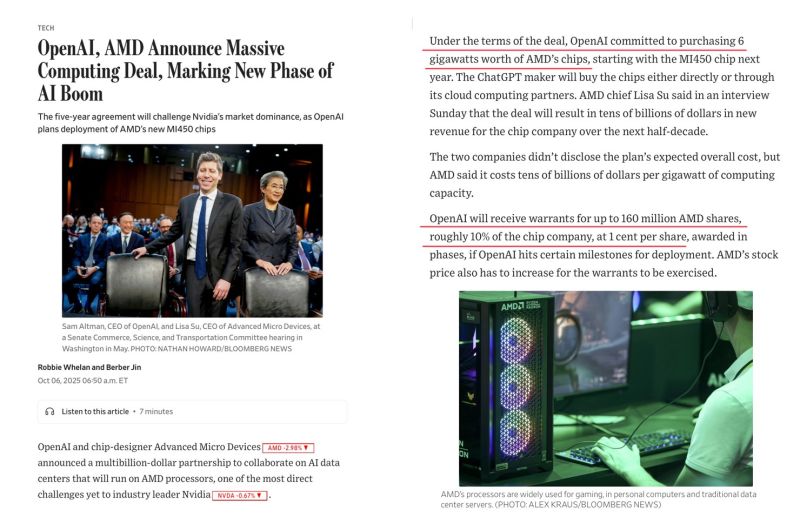

The OpenAI deal framework is very concentrated into a few companies

Source: Lance Roberts @LanceRoberts

AI’s energy demand is about to go vertical, and in many countries, the grids aren't ready.

China’s building 29 large nuclear reactors right now. The U.S. has none under construction. High costs, regulatory delays and market challenges hold us back, though advanced smaller reactors are emerging. Source: StockMarket.News

The circular AI economy...

$AMD giving OpenAI 10% of its stock (worth roughly $35bn pre-market) so OpenAI can buy 6 GW of AMD chips over the next few years. Stock up +27%. Source: Wasteland Capital @ecommerceshares

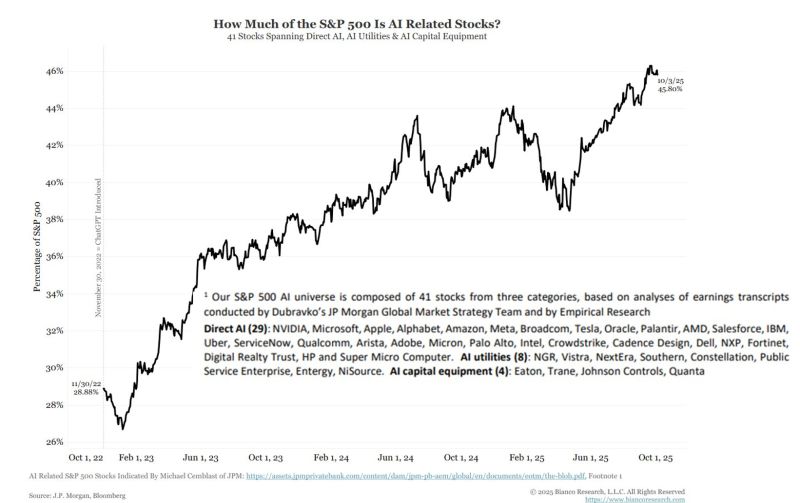

How much of the S&P 500 is AI related stocks?

JP Morgan has identified 41 "AI-Related" stocks. As this chart shows, they are now 45% of the S&P 500. Source: Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks