Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

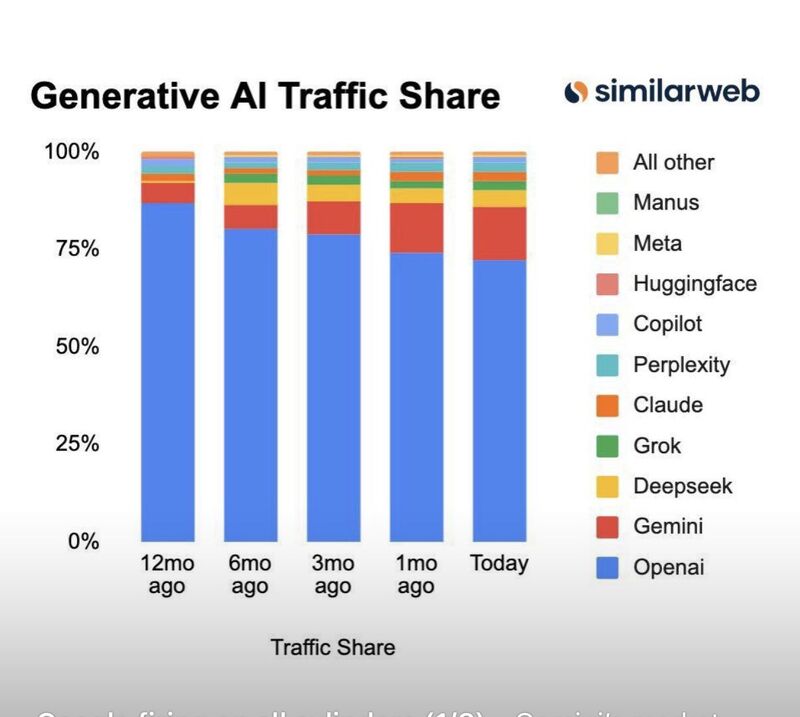

Google went from 5% to 14% market share BEFORE Gemini 3 launch👀

WSJ: "Gemini 3’s surge past ChatGPT and other competitors on benchmark tests has handed Google an elusive victory". OpenAI/ChatGPT continues to have a massive lead but the market share has been clearly eroding. DeepSeek, Perplexity and Claude come after Gemini-. Microsoft/Copilot is barely visible on the chart. Source: Josh Wolfe @wolfejosh

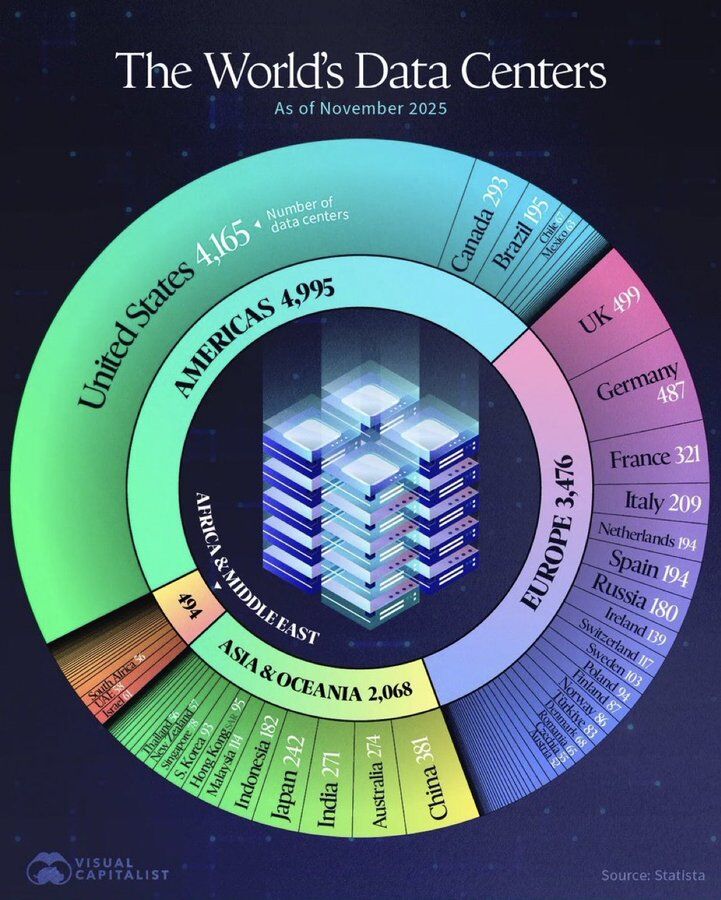

The world now has 11,030 data centers:

• Americas: 4,995 • Europe: 3,476 • Asia & Oceania: 2,068 • Africa & the Middle East: 494 Source: Investing visuals @InvestingVisual, Visual Capitalist

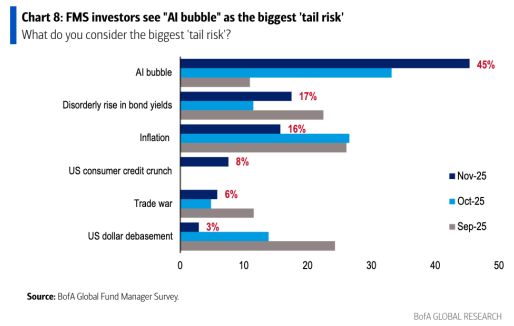

45% of fund managers surveyed by Bank of America in November said an "AI bubble" was the biggest tail risk for markets, spiking from just 11% in September.

Over half of these investors said they think AI stocks are already in a bubble. Source: BofA

🔥 3 Bullish Signals from NVIDIA’s Earnings Call Last Night — and why the AI trade is far from over.

Most CEOs play it safe on earnings calls. Jensen Huang did the opposite. Here are the 3 comments everyone in tech, AI, and markets should pay attention to: 🚀 1. “No AI Bubble” — Just Three Structural Shifts 1️⃣ The migration from CPU ➝ accelerated computing 2️⃣ Generative AI hitting a tipping point across every workload 3️⃣ The rise of agentic AI All three require massive infrastructure builds. And the kicker? Inference demand is exploding — and is set to become a major revenue engine for NVIDIA. 💰 2. “Funding Is NOT the Problem” Worried customers are running out of capital? NVIDIA is not. Hyperscalers are already monetizing AI, sovereign buying is ramping, and agentic AI opens entirely new revenue pools. Translation: the money is there, and it's accelerating. 🧠 3. “The Ecosystem Is the Moat” This one flew under the radar but is HUGE. The CFO pointed out: A100 GPUs from SIX years ago are still fully utilized — thanks to the Kuda software stack. It means: Longer useful life for GPUs Better ROI on datacenter capex A deeper, stickier NVIDIA ecosystem Plus, NVIDIA is expanding partnerships across enterprise platforms and top AI developers. 📈 Bottom Line This was a monster print: ✔ Strong results ✔ Confident guidance ✔ Constructive multi-year outlook After-hours? NVIDIA popped ~5%, and AI-related names rallied across the board. 📊 Valuation Check (Yes, Really) NVIDIA’s stock has actually de-rated lately — earnings kept growing, the share price didn’t. And now with Q4 guidance out, investors will pivot to 2026–2027. Here’s the jaw-dropper: ➡️ Using 2027 FactSet consensus, NVIDIA trades at 21× P/E. Twenty. One. Times. Earnings. For the company powering the entire AI revolution. 🔮 The Broader Message The AI trade is alive. Healthy. And nowhere near done.

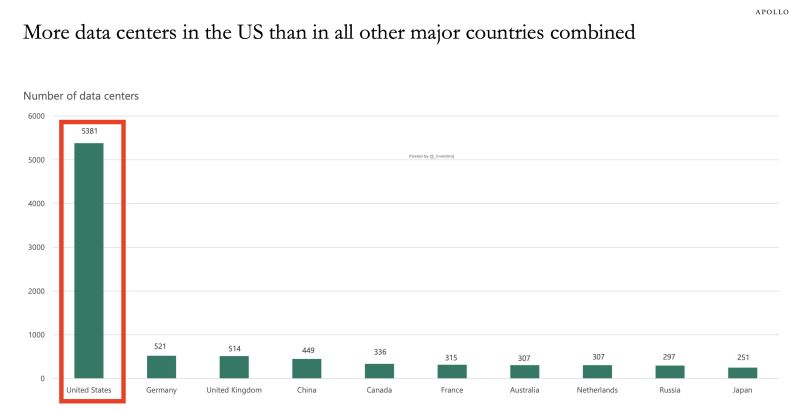

The US has 5,381 data centers — more than China (449) and every other major nation combined.

The American bet is simple: own the most compute, win the AI race. But China isn’t playing that game. Instead of chasing data center volume, China open-sourced frontier models (DeepSeek, Qwen, Baichuan) that run on cheap hardware. DeepSeek trained a frontier model for $5–6M (vs. tens of millions in the US). Inference costs are ~280x cheaper than ChatGPT. Modular data centers deploy in weeks, built around ultra-low-cost power. China isn’t scaling infrastructure. They’re scaling efficiency — and commoditizing intelligence. Meanwhile, the US is hitting a wall: the power grid. Data centers already use 6% of US electricity, headed to 11% by 2030. Spare grid capacity has fallen from 26% → 19%, on track for <15%. Some regions face 7-year waitlists just to connect new facilities. Ohio alone rejected 17 GW of new data center interconnection requests. You can build data centers. But can you power them? China can. By 2025, their installed capacity hits 3.99 TW (up 19% YoY). Renewables are nearly half of all generation. In the first five months of 2025 alone: 197 GW solar added 46 GW wind added By 2030, China is expected to have 400 GW of spare power capacity — over 3× global data center demand. The US built the most data centers. China built the power to scale whatever it wants. The real race isn’t about who has more compute today — it’s who can power their compute tomorrow. And on that dimension, China is pulling ahead. Source: StockMarket.news, Apollo

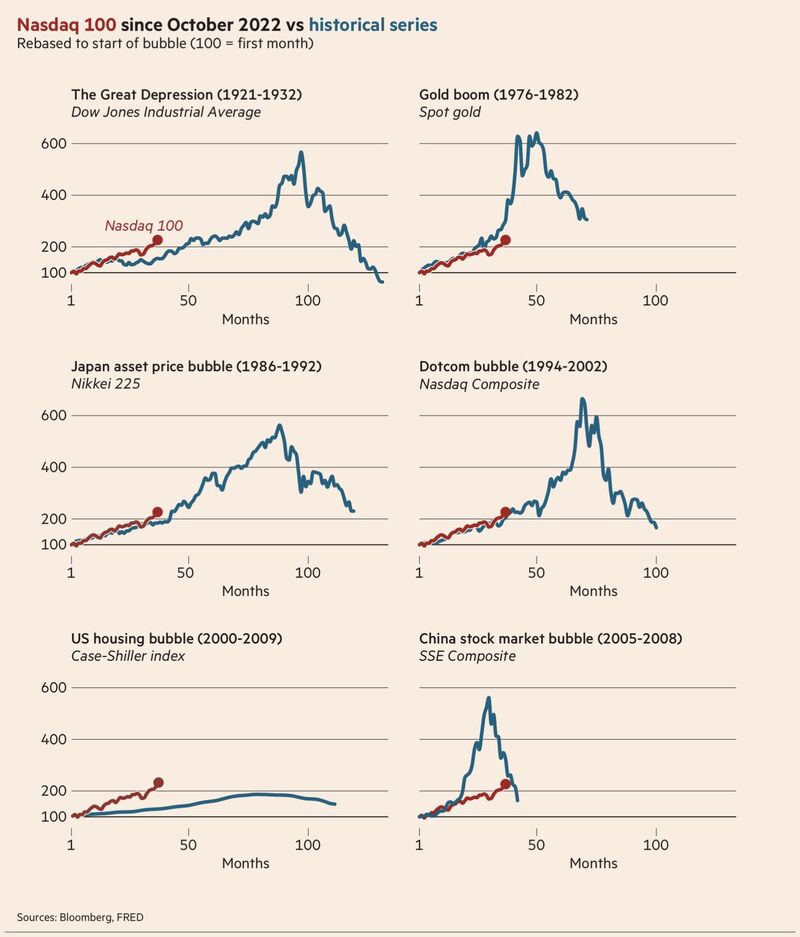

”The AI Bubble” in perspective.

What if the doomsayers are right but they have been, and they continue, miss the last +30% of the ”bubble” for their told-you-so moment? This is indeed what already happened most of this year. Source: Emre Akcakmak, Bloomberg, FT

🔥 OpenAI’s “Go Big or Go Bust” Strategy Just Went Public — and the numbers are insane.

According to leaked financials, OpenAI is preparing to lose $74B in 2028 alone — yes, one year — before expecting to swing to real profitability by 2030. What about this year? $13B in revenue $9B in cash burn A burn rate of ~70% of revenue ‼️ And it only gets wilder: OpenAI expects three-quarters of its 2028 revenue to be wiped out by operating losses. Meanwhile, competitor Anthropic expects to break even in 2028. OpenAI expects to burn $115B cumulatively through 2029. OpenAI’s commitments: Up to $1.4T over 8 years for compute deals Nearly $100B on backup data-center capacity Aiming for $200B in revenue by 2030 (a 15x jump from today) 💡 The read-through: This is the biggest strategic divergence in AI right now: Anthropic = disciplined scaling OpenAI = moonshot economics OpenAI is effectively saying: “We’ll lose tens of billions now to own the entire future later.” But there’s a catch: 95% of businesses still get zero real value from AI today. And OpenAI is funding its hyperscale buildout not from revenue (like AWS did), but from debt, investors, and chip-supplier deals — while losing money on every ChatGPT interaction. This ends one of two ways: 🚀 The most valuable company in history 💥 Or a case study in overestimating demand There’s no middle lane when you’re burning cash faster than any startup in history... Source: hedgie on X

A very interesting article by the FT >>>

Key takeaways: ➡️ 1. Jensen Huang’s Warning Isn’t Just Self-Interest Although Nvidia benefits from greater global AI investment, Huang’s claim that China may win the AI race has substantive grounding. The argument isn’t only about chips—it’s increasingly about energy. ➡️ 2. AI Progress Is Becoming Limited by Electricity, Not Chips Training frontier models consumes massive electricity. A single GPT-4–scale model can use ~463,000 MWh/year — more than 35,000 U.S. homes. As AI workloads expand, data centre electricity consumption could more than double by 2030. By 2040, data centres may consume 1,800 TWh annually, enough to power 150 million U.S. homes. Conclusion: The bottleneck is shifting from access to high-end chips to access to cheap, abundant power. ➡️ 3. China Has a Structural Energy Advantage China is rapidly expanding renewable energy capacity: Added 356 GW of new renewable energy last year (solar + wind). Solar alone grew 277 GW, far exceeding additions in the U.S. Massive government-backed projects linking industrial policy and grid expansion: Solar in Inner Mongolia Hydropower in Sichuan High-voltage lines to coastal tech hubs Local governments also subsidize electricity for Chinese tech giants (Alibaba, Tencent, ByteDance), lowering the effective cost of AI training, even with less advanced chips like Huawei’s Ascend 910B. ➡️ 4. The U.S. Faces Growing Power Constraints U.S. wholesale electricity prices near data-centre clusters are up as much as 267% over five years. Investment in large wind and solar projects is declining due to policy and regulatory uncertainty. The White House has ended subsidies for wind and solar, slowing capacity growth. Outcome: The U.S. is adding compute demand faster than energy supply. ➡️ 5. Chip Superiority Alone May Not Decide the Winner Nvidia’s H100 and Blackwell chips still outperform Chinese alternatives. But the historical “chip supremacy” model may matter less as: Chip performance grows only single digits yearly. China’s energy capacity grows double digits yearly. More cheap power → more compute hours → more model training → faster innovation. ➡️ 6. AI Dominance Will Belong to Those With Cheap Energy The article frames AI as part of a much older pattern: Britain dominated through cheap coal. The U.S. dominated through oil and hydroelectric power. Now, AI dominance will go to those who can run the most computation, not just build the best chips. ‼️ Final takeaway: The future of AI power belongs to countries that can provide abundant, inexpensive electricity — and right now, China is building that capacity faster than anyone else

Investing with intelligence

Our latest research, commentary and market outlooks