Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 CODE RED at OpenAI! Sam Altman sounds the alarm! 🚨

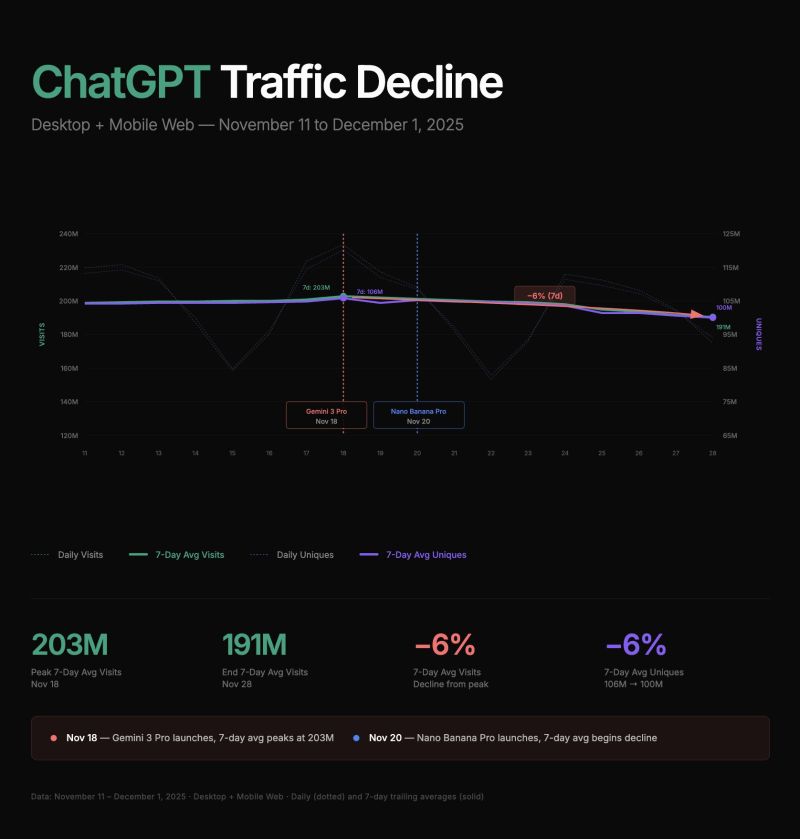

The AI race just got a lot hotter, and the early leader is feeling the heat. 🔥 OpenAI CEO Sam Altman has declared a "code red" to completely refocus the company's efforts on its flagship product, ChatGPT. Here's the critical breakdown you need to know: The Threat: Rivals like Google (Gemini 3) and Anthropic (Opus 4.5) have recently leapfrogged OpenAI's GPT-5 on key industry benchmark tests. The lead is shrinking FAST. The Fix: A "surge" effort is underway to significantly improve speed, reliability, and personalization of ChatGPT. The Sacrifice: OpenAI is delaying other ambitious projects—like AI agents for shopping/health, advertising products, and personalized news (Pulse)—to dedicate resources to the core chatbot. The Stakes: This is a "critical time" for the $500bn start-up, grappling with intense competition, soaring data center costs, and the non-stop battle for top AI talent. Stats That Matter: ChatGPT still has a dominant market share with over 800 million weekly users. BUT, users are now spending more time chatting with Google's Gemini than with ChatGPT (per Similarweb data). ChatGPT already accounts for roughly 10% of global search activity and is growing quickly. The Bottom Line: The AI frontier is moving at warp speed. As Google integrates its powerful, bespoke-chip-trained Gemini 3 models immediately, OpenAI is forced to pause future innovations to defend its core product. The fight for the AI crown is officially on! Who do you think wins this high-stakes race? 👇 Source: FT

$IBM CEO says that at today’s costs it takes about $80B to build & fill a 1 GW AI data center

So the ~100 GW of announced capacity implies roughly $8T of capex & “no way you’re going to get a return on that,” since you’d need “about $800B of profit just to pay for the interest” Source: Wall St Engine

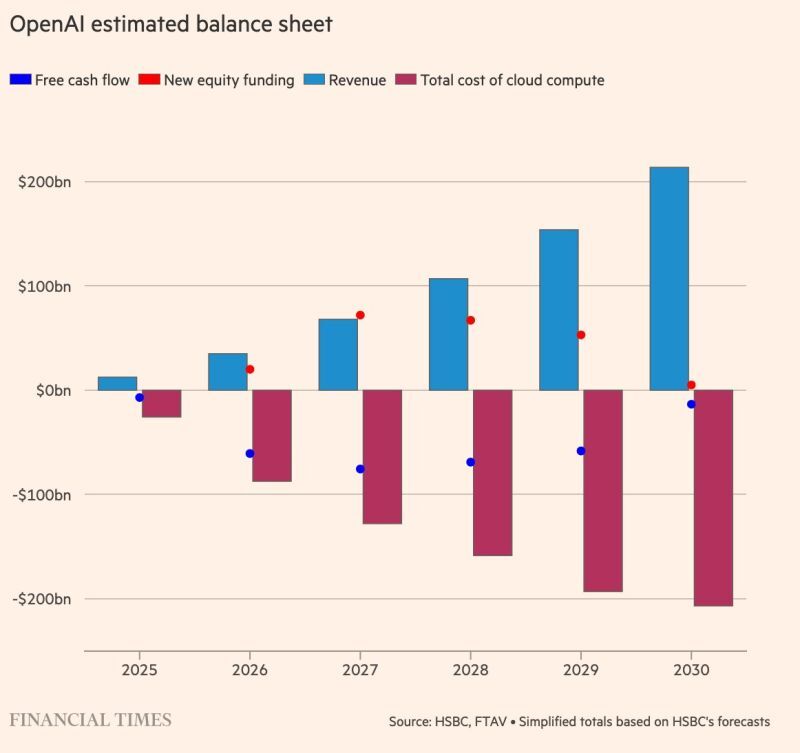

HSBC forecasts that OpenAI is going to have nearly a half trillion in operating losses until 2030.

https://lnkd.in/eMkGJKyi Source: Jack Farley @JackFarley96, FT

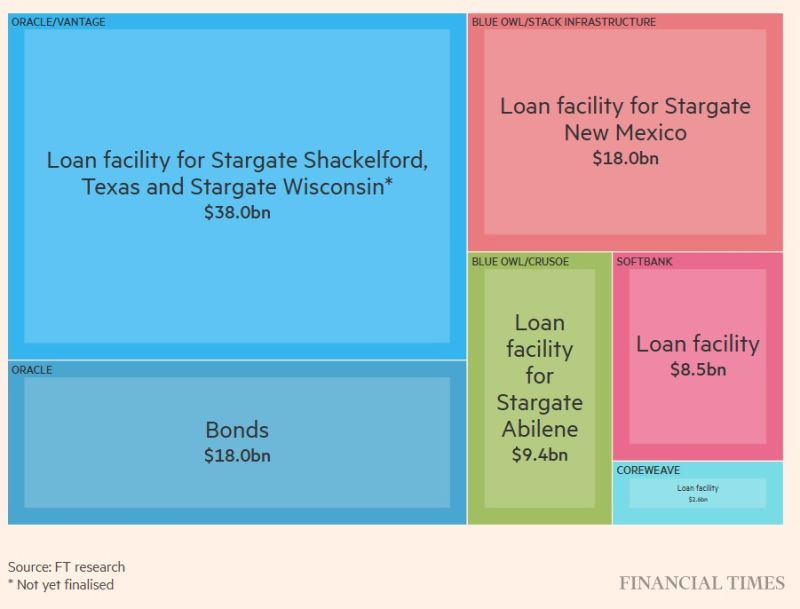

A great FT article on how OpenAI partners amassed $100bn debt pile to fund its ambitions

A great FT article on how OpenAI partners amassed $100bn debt pile to fund its ambitions.

🦔 HSBC built a model to figure out if OpenAI can actually pay for all the compute it's contracted. The short answer is no. Actually not even close.

The Commitments: $250B in cloud compute from Microsoft $38B from Amazon 36 gigawatts of contracted capacity All tied to a total deal value up to $1.8 trillion HSBC’s estimate: OpenAI will owe ~$620B per year in data-center rent once everything ramps… and only a third of that capacity is online by 2030. 🔢 The Math (and the Problem) By 2030: Cumulative rental costs: $792B (→ $1.4T by 2033) Projected free cash flow: $282B Cash from Nvidia/AMD: $26B Undrawn debt: $24B Liquidity: $17.5B Even after stacking every possible dollar, there’s still a $207B hole — plus the $10B safety buffer HSBC thinks they need. 💥 And here's where it gets tricky 👇 HSBC’s model already assumes everything goes right: 3B OpenAI users by 2030 (44% of all adults outside China) Paid conversion rising from 5% → 10% 2% share of global digital ads $386B in annual enterprise AI revenue Even under that fantasy scenario, OpenAI still can’t pay the bills. HSBC’s suggested “solution”? OpenAI may need to walk away from its data-center commitments and hope Microsoft/Amazon “show flexibility.” Translation: The economics don’t work — unless everyone politely pretends the contracts aren’t real. And yet this is the company anchoring a $500B Stargate project and driving hundreds of billions in AI infrastructure spending. If this is what the best case looks like… imagine the base case. My take: be very careful with AI plays which are asset-heavy. They might disappoint in terms of shareholders' returns in the years to come. Do you remember the Telecom bubble? The long-term winners have been the asset-light companies. The asset heavy companies never recover. Source: Hedgie on X, FT

Investing with intelligence

Our latest research, commentary and market outlooks