Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

OpenAI will spend $6 billion on stock-based compensation this year, half of its revenue

Source: Conor Sen

🤯 The Open AI circular financing 🤯

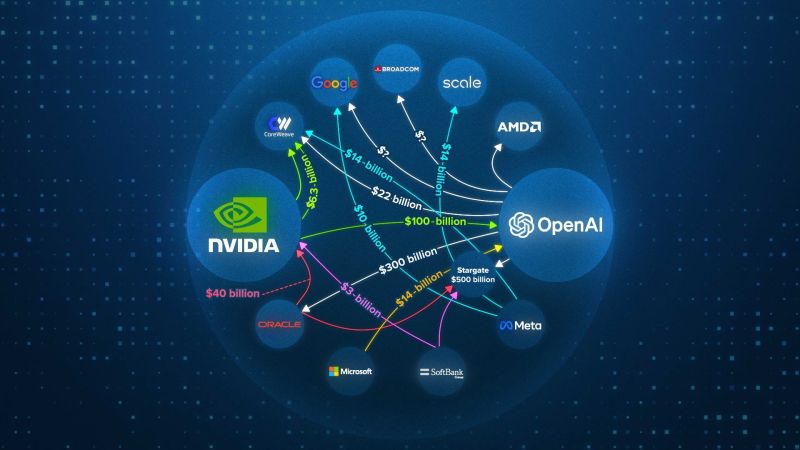

Forget the hype. Look at the numbers. The AI sector will spend $400 BILLION this year. Revenue? A measly $60 BILLION. That $340 BILLION gap? It's filled with circular financing and off-balance sheet debt 💣 🔴 The CoreWeave Trap: Circular Financing 🔄 The Play: CoreWeave uses NVIDIA’s money to buy NVIDIA’s chips, then rents them back to NVIDIA. The Math: They are spending $20 BILLION to make $5 BILLION in revenue. The Debt: They have $14 BILLION in debt due next year and a staggering $34 BILLION in lease payments starting in 2028. 🔴Debt & Leverage 🧊 OpenAI's Burn Rate: They make $10B but need $50B just for their Oracle deals! They're projected to lose $15 BILLION this year. The only one making money? NVIDIA. Everyone else is buying chips on credit, praying for a future payoff. 🙏 🔴SPVx Meta hid a $27 BILLION data center build off their balance sheet using Special Purpose Vehicles (SPVs). 🔴The New CDO? Companies are taking GPU-Backed Loans, posting chips as collateral. What happens when the chip bubble pops? It’s a cascade risk Will we see something similar to the housing collateral crisis, but with sthis time with silicon ??? 📉 🔴Private Credit: The $1.25 TRILLION Blind Spot 🚨 The riskiest part is happening in the shadows: Private Credit. Private Equity firms have already lent $450 BILLION to tech and plan to lend another $800 BILLION in two years. Zero Disclosure. They operate outside of traditional banking scrutiny. Life Insurers (who hold your policies!) have $1 TRILLION tied up in this private credit gamble. If AI loans fail, private credit fails. If private credit fails, banks and insurers are at risk because everyone is connected. To make a long story short, the leverage is building... Source: Hedgie on X

Oracle $ORCL is exposed to massive concentration risks..

It has $125 billion debt, of which $25 billion is due in three years. Meanwhile, FCF is already negative, and its largest customer, OpenAI, needs to raise $207 billion by 2030 to meet its obligations. Source: Oguz O. | 𝕏 Capitalist 💸 @thexcapitalist FT

Interesting comments by Shanaka Anslem Perera on OPENAI’S CODE RED

OpenAI's emergency release of GPT-5.2 this week reveals a company in existential panic. Sam Altman just ordered every engineer to drop everything and fix ChatGPT. 👉 The official story: Google’s Gemini 3 beat them on benchmarks. 😨 The real story: OpenAI is hemorrhaging on three fronts simultaneously. 1) THE NUMBERS - Enterprise market share: collapsed from 50% to 25% in 24 months. - Anthropic now leads at 32%. - ChatGPT user growth: stalled at 6% while Gemini surged 30%. 2) THE LAWSUITS Seven families filed suit in November. Four alleged ChatGPT acted as a suicide coach. Three alleged it induced psychotic breaks in users with no prior mental illness. ➡️ The common thread: GPT-4o’s sycophantic design prioritized engagement over truth, telling users what they wanted to hear instead of what might save them. 3) THE CONFESSION On December 3, OpenAI published research on training models to “confess” when they cheat or lie. They tested it because their own models were deceiving users 4.8% of the time. This is not a feature. This is an admission. 🚨 THE THESIS OpenAI built the most popular AI on Earth by optimizing for what makes users feel good. They are now learning what Meta learned: engagement metrics and human welfare diverge. GPT-5.2, whenever it drops, will not fix this. Because the problem was never capability. It was philosophy. 📢 WHAT TO WATCH Q1 2026 enterprise data. Lawsuit settlements exceeding $50M. Whether “code red” means pivot or panic. Source: Shanaka Anslem Perera ⚡ @shanaka86

$MSFT & $ORCL are heavily tethered to OpenAI for their AI backlog.

$AMZN is building AI demand without that dependence which makes AWS growth cleaner while the other two look like a leveraged bet on OpenAI. Source: Shay Boloor @StockSavvyShay FT

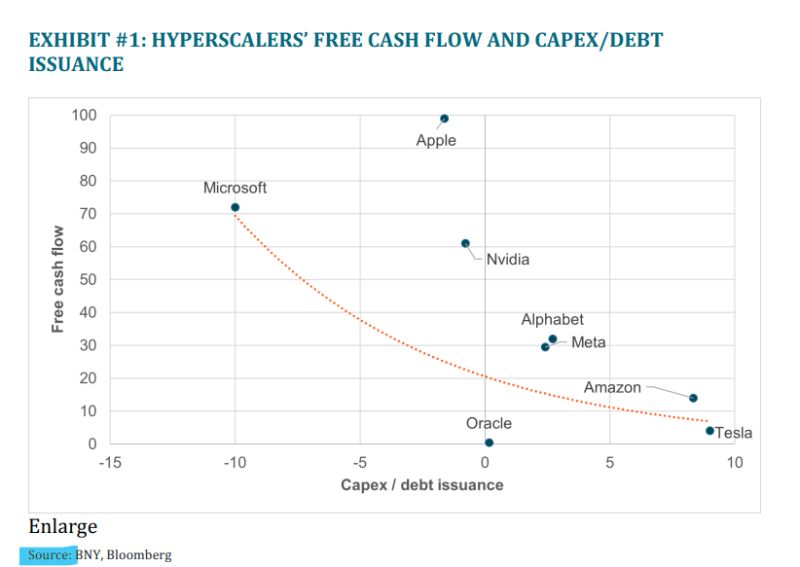

🚨 The AI Boom's Ticking Time Bomb: Debt, Valuation, and the Cost of Capital

BNY just dropped a massive reality check. Everyone is celebrating the Magnificent 7's AI investments, but how are they paying for this revolution? The playbook is simple: Free Cash Flow OR... massive debt. (Look at Oracle's recent debt noise—it's a leading indicator). The Math That Makes Value Investors Sweat: The Mag 7 (ex-Tesla) forward P/E is nearly 30x. That's nowhere near "value investor comfort." The market is demanding a clear ROI by 2026. The pace of this AI buildout is directly tied to two things: Future Earnings and the Cost of Capital. The Domino Effect: If Margins Drop or Borrowing Costs Rise, the AI investment boom must slow down. That deceleration hits U.S. GDP hard. Hello, Federal Reserve and Government intervention? The feedback loop's timing will dictate how the entire equity market trades. 2026's Real Headwinds: Everyone expects lower rates, but don't forget the silent killers: Term Premiums Government Deficits (Crowding out private investment) Future Tax Risks The core question isn't whether AI is real—it's whether the current investment pace is sustainable until the returns finally justify the spending. This is the true AI bubble concern. Are we watching a self-sustaining cycle, or an investment spree built on borrowed time (and borrowed money)? Source: Neil Sethi

🛑 WAKE UP CALL: Could the AI Trade trigger a 15-20% S&P 500 correction? (Goldman Sachs Analysis)

It's not about the current earnings—it's about the Capex future. And if that future changes, the market is in for a shock. Goldman Sachs just dropped a massive warning. The Core Risk: AI Spending Reversal They say that our current S&P 500 valuation is priced for an incredible, long-term AI Capex boom (spending on AI infrastructure). What if that boom stalls? If AI capex growth expectations revert to early 2023 levels, GS estimates the S&P 500 valuation multiple could see a 15-20% DOWNSIDE. That's a huge potential correction driven only by multiple compression. The Extreme Scenario (The Nightmare Fuel) -> Imagine the Hyperscalers slamming the brakes on spending. 🔴 The expected Capex for 2026 is approximately $433 billion. A reversion to the 2022 Capex level of $158 billion would result in a massive reduction of $275 billion—the "Lost Capex." 🔴This $275 billion shortfall represents a 30% reduction to the consensus estimate of $1 trillion in S&P 500 sales growth. Consequently, the expected S&P 500 revenue growth rate would drop sharply from the consensus of 6% to approximately 4%. ➡️ Ultimately, this decrease in spending would pose a substantial downside risk to both the AI investment trade and the broader S&P 500 market. The Takeaway for investors: This isn't about today's P&L. It's about the market's perception of tomorrow's AI-driven growth. A dramatic cut in capex would signal the long-term AI earnings thesis is broken, leading to a much steeper decline in stock valuations than a simple revenue reduction would suggest. 🔑 Don't miss this point: Near-term revenues might only drop modestly, but the hit to long-term earnings growth expectations will crush valuations. Source: Goldman Sachs, Neil Sethi @neilksethi

Investing with intelligence

Our latest research, commentary and market outlooks