Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

CoreWeave Behind the AI Hype, a Debt-Fueled Illusion

Nvidia is investing $2B in CoreWeave, deepening a partnership central to AI infrastructure expansion. CoreWeave plans to build over 5 GW of AI data centers by 2030 using Nvidia’s next-gen platforms. However, despite the hype, CoreWeave’s financials raise serious concerns: the company is losing money on every dollar of revenue, carries a massive working-capital deficit, holds over $10B in long-term debt, and relies on rapidly depreciating GPU assets. Facing weak demand, CoreWeave is increasingly using “compute-for-equity” deals—trading GPU capacity for startup equity at inflated valuations—effectively acting like an AI venture capitalist rather than a stable infrastructure provider. The business model depends on continued access to debt markets; if funding dries up, risks fall heavily on retail investors while early institutional players are likely already exiting.

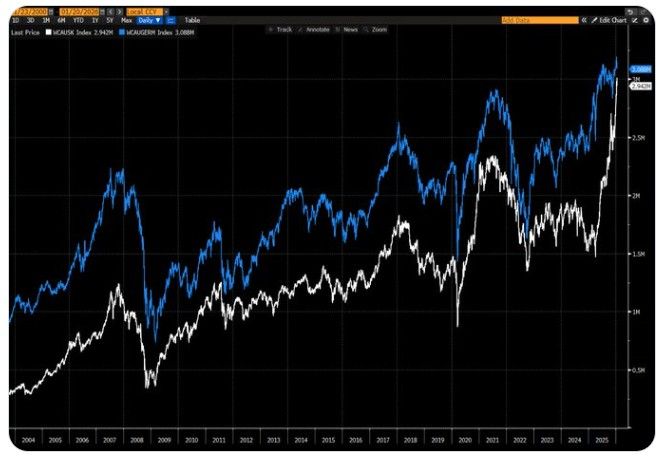

Korea's market cap (in white) is about to top Germany's (in blue) on this massive AI rally

Source: David Ingles, Bloomberg

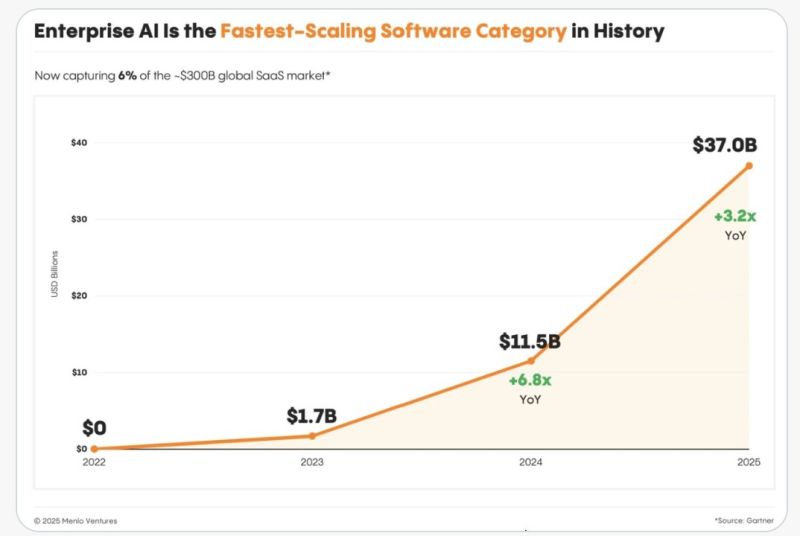

Enterprise AI adoption is booming!

In '25, 76% of AI use cases were purchased by enterprises, rather than built internally (vs. 53% in '24). Enterprise AI software refers to artificial intelligence applications specifically designed for large-scale organizations to automate complex business processes, improve decision-making, and enhance productivity across departments like HR, finance, and supply chain. Unlike consumer AI (like a personal chatbot), enterprise AI is built with a focus on security, scalability, and integration with existing corporate systems like ERP (Enterprise Resource Planning) or CRM (Customer Relationship Management) Source: Puru Saxena @saxena_puru

Taiwan will invest $ 250 billion in U.S. chipmaking under new trade deal

The U.S. and Taiwan have reached a trade agreement to build chips and chip factories on American soil, the Department of Commerce announced Thursday. As part of the agreement, Taiwanese chip and technology companies will invest at least $250 billion in production capacity in the U.S., and the Taiwanese government will guarantee $250 billion in credit for these companies. In exchange, the U.S. will limit “reciprocal” tariffs on Taiwan to 15%, down from 20%, and commit to zero reciprocal tariffs on generic pharmaceuticals, their ingredients, aircraft components and some natural resources. Source: CNBC

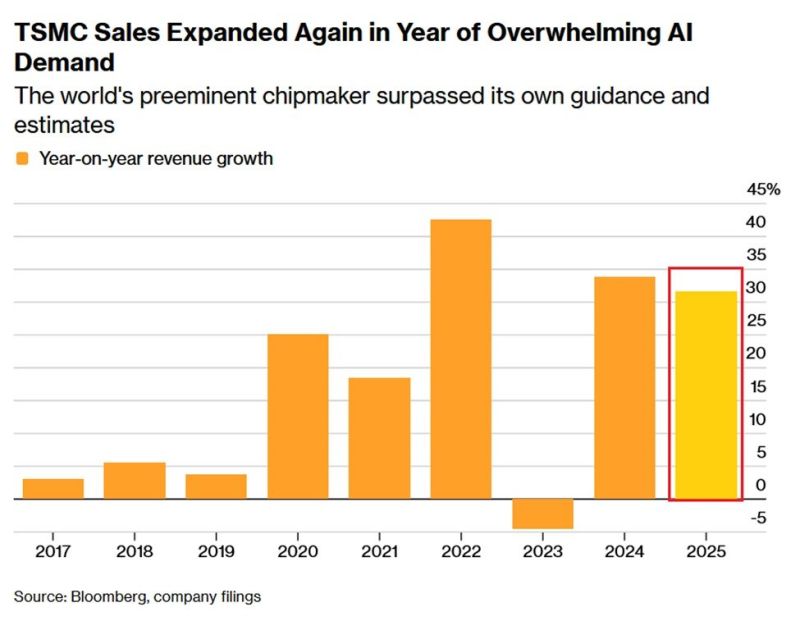

BREAKING: The AI chip boom shows no signs of slowing.

Taiwan Semiconductor, $TSM, reported a +35% YoY increase in net profit for Q4 2025, driven by surging AI chip demand. Asia’s most valuable company has now posted YoY profit growth for 8 consecutive quarters. At the same time, revenue grew +21% YoY in Q4 2025, to $33.7 billion. Both revenue and profit beat analyst estimates. Full-year 2025 revenue jumped +32% YoY and surpassed $100 billion for the first time in company history. TSMC also expects record CapEx in 2026, at $52-56 billion, up +32% YoY, to expand global manufacturing capacity. Source: The Kobeissi Letter

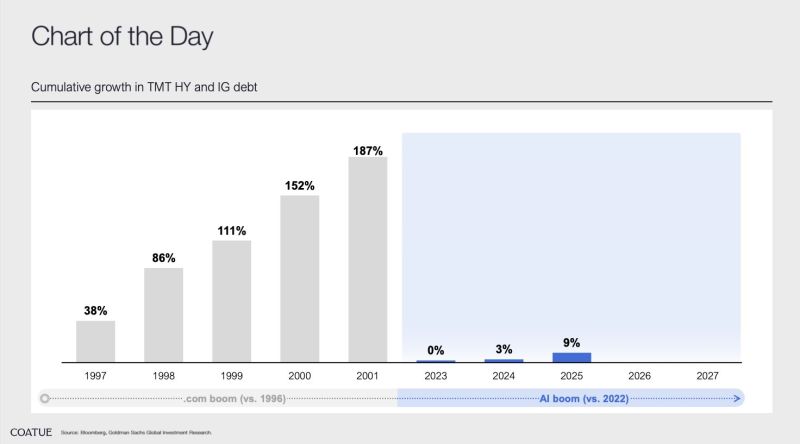

The dot-com boom ran on debt. The AI boom runs on balance sheets.

That difference matters. Source: Goldman Sachs, COATUE

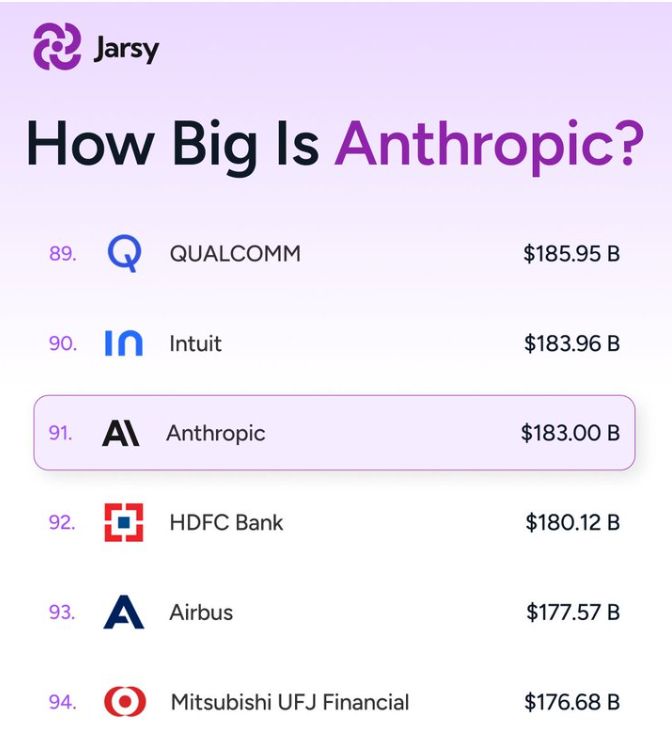

According to Reuters (via an FT report), Anthropic is laying groundwork for an IPO as early as 2026.

They’re also reportedly in talks for a private funding round that could value the company north of $300B — a huge step up from their most recently disclosed ~$183B post-money valuation. If Anthropic were public today and you simply treated that ~$183B as its market cap, here’s the fun part: 📈 It would land around the low-90s globally by market cap — roughly #91 — just ahead of Airbus (≈$181B). For context, that neighborhood looks like: Blackstone ≈ $186B HDFC Bank ≈ $180B (Anthropic) ≈ $183B Airbus ≈ $178B Source : Reuters, FT

Investing with intelligence

Our latest research, commentary and market outlooks