Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

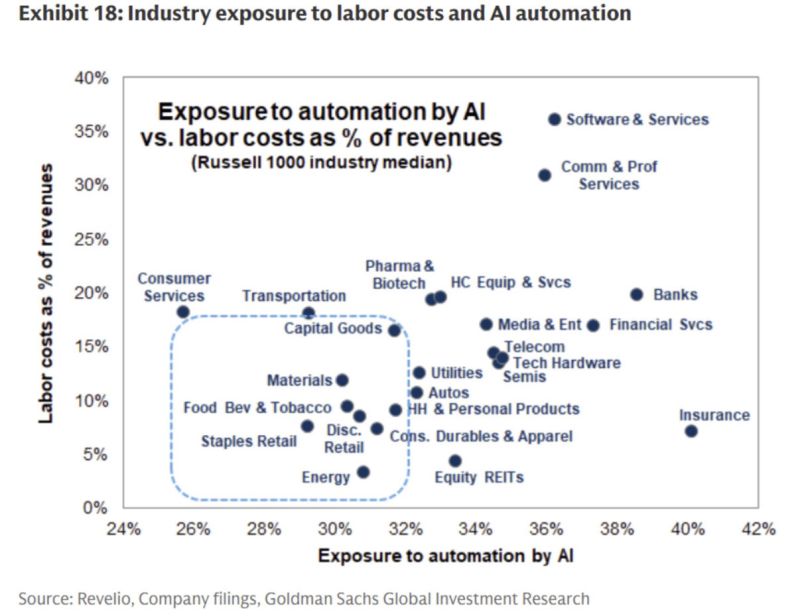

Banks and insurers might be longs as structural beneficiaries in the AI era.

Back office tasks get automated and margins improve. Software has a large opportunity to improve efficiency as well. Source: Greg @GS_CapSF

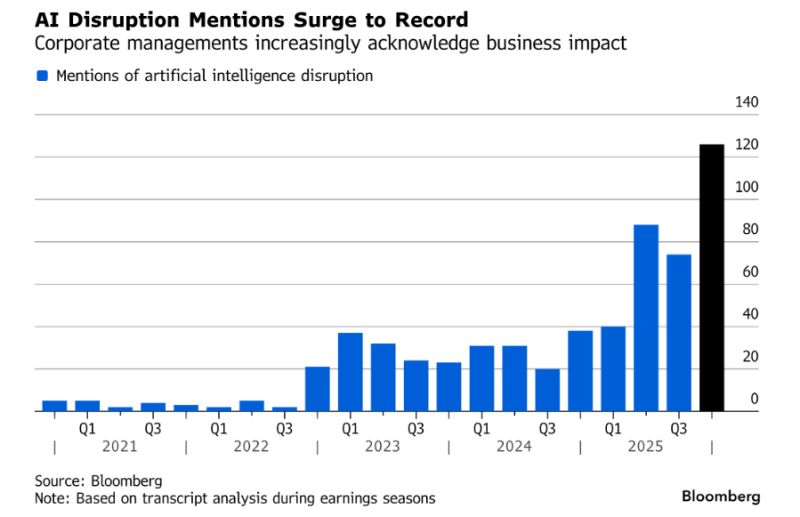

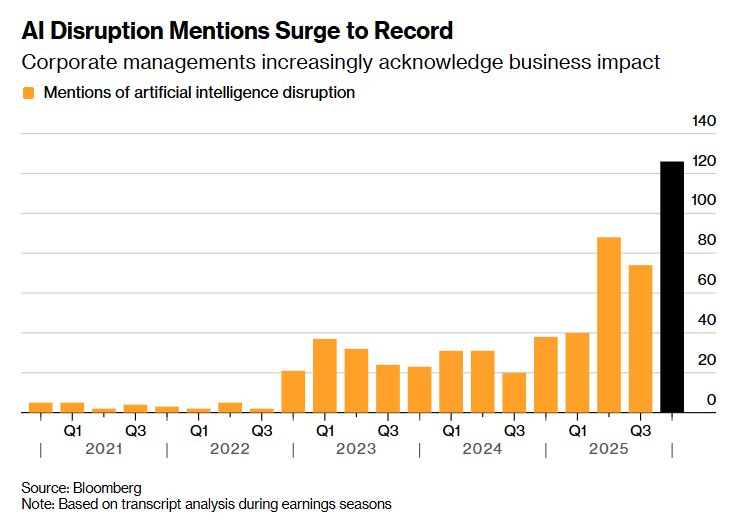

AI Risk Is Dominating Conference Calls as Investors Dump Stocks

Source: Bloomberg

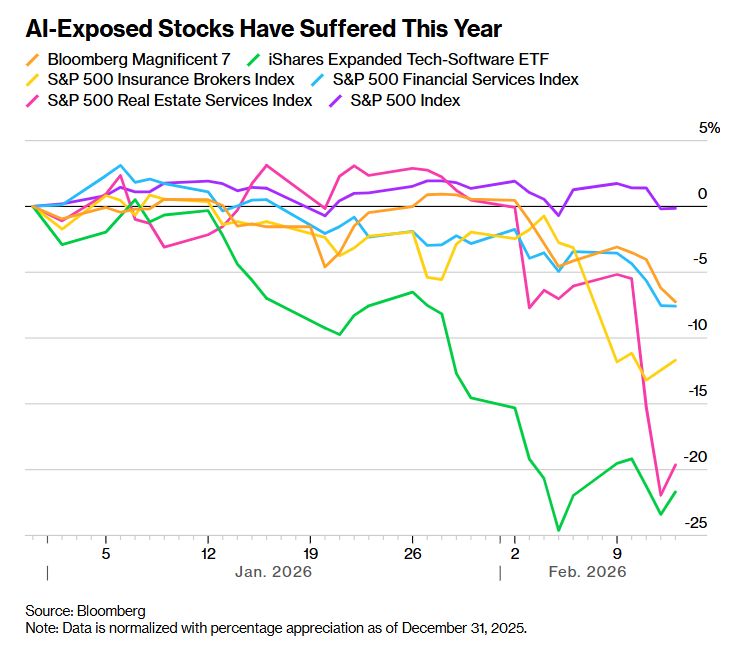

A Stock Market Doom Loop Is Hitting Everything That Touche AI

Source: Bloomberg

AI in China isn’t just "catching up"—it’s sprinting

China’s AI market is surging, fueled by government support and rapid innovation. Tech giants and startups like Zhipu AI and MiniMax are launching advanced models for coding and multimodal tasks, pushing the STAR AI Index up. The focus has shifted to agentic workflows and AI that can handle speech, visuals, and music, signaling a move beyond simple chat. With Premier Li Qiang calling for AI integration across all industries, China is narrowing the U.S. AI gap fast, making the global AI race more intense than ever. Source: CNBC

The "Sell First, Ask Questions Later" Era is officially here.

Markets are panicking over AI replacing jobs and businesses—a trend called AI Displacement Anxiety. Investors aren’t just worried about current earnings; they’re fearing future obsolescence from AI that doesn’t even exist yet. Example: Commercial real estate giants ($CBRE, $JLL, $CWK) saw shares drop 15%+ because of AI fears, not actual competition.

The "Old Guard" of Finance is officially on notice.

For years, complex tax planning was a key competitive advantage for expensive firms because it was slow, manual, and mentally demanding. Altruist has disrupted this model with Hazel AI, which can instantly analyze documents like tax returns, pay stubs, and meeting notes to generate personalized strategies in real time—turning days of back-office work into minutes. It enables advanced “what-if” scenario modeling for bonuses, home sales, retirement, and lifestyle changes through interactive dashboards, while addressing security concerns with zero-data-retention policies. At just $60 per month, it democratizes sophisticated tax optimization tools previously reserved for the ultra-wealthy, shifting power toward independent advisors. The message is clear: simply understanding tax returns is no longer enough—advisors who leverage AI to enhance insights and strengthen client relationships will be the ones who thrive. Source : Davis Janowski

Investing with intelligence

Our latest research, commentary and market outlooks