Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it...

A Swiss court has ruled that regulators’ decision to wipe out SFr16.5bn (£15.5bn) of Credit Suisse bonds as part of a government-orchestrated rescue was unlawful but stopped short of ruling whether investors should be repaid. The case was brought by about 3,000 investors across 360 cases after Swiss financial regulator Finma ordered the bank’s Additional Tier 1 (AT1) bonds be written off in March 2023, as part of Credit Suisse’s emergency rescue by UBS. The Swiss Federal Administrative Court said that Finma had no clear legal basis for the move. The court found that the regulator’s decree had been invalid but did not rule on whether the bonds should be reinstated or repaid. Source: FT https://lnkd.in/eTfcR2yT

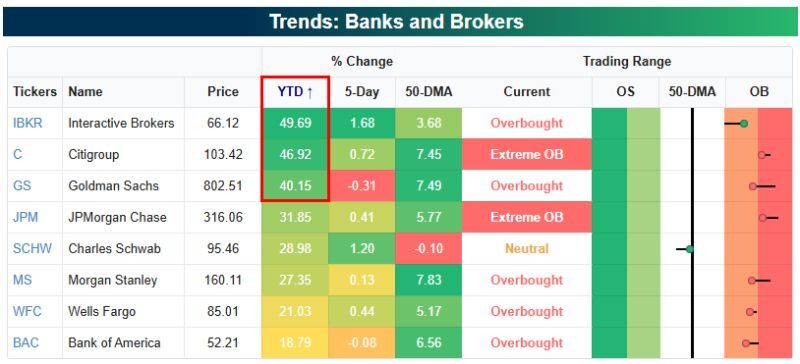

Goldman $GS, Citi $C, and Interactive Brokers $IBKR are all up 40%+ year-do-date.

Source: Bespoke

Activist investor Cevian Capital has said it is “not viable” to run a large international bank from Switzerland due to new strict capital proposals

Unless the position changes UBS would have “no other realistic option” but to leave the country. Cevian is Europe’s largest dedicated activist investor and holds about 1.4 per cent of UBS’s shares. It added that the government proposals, which would force the bank to have as much as $26bn in extra capital, could not be meaningfully changed through lobbying efforts. “The board has the responsibility to ensure that UBS protects its competitiveness,” Lars Förberg, Cevian’s co-founder, told the Financial Times. “Under the current proposals, it is not viable to run a big international bank from Switzerland. We therefore see no other realistic option but to leave.” He added: “The message from the Federal Council is clear: UBS is too big for Switzerland . . . I respect the Federal Council’s decision, but I do not understand it. It cannot be undone. Lobbyists cannot change that either. That effort can be spared.” Link to article: https://lnkd.in/ekU4KnUE

In case you missed it...

According to NY Post, banking giant UBS is ramping up its threats to leave Switzerland and set up shop in the US — a radical response to Swiss regulators who have proposed onerous new capital requirements on the financial behemoth. Source : New York Post

Trump is now attacking Goldman Sachs and his CEO David Salomon

Source: X

European banks' biggest balance sheets

The balance of power is shifting. With Deutsche Bank having scaled back, French banks now hold the largest balance sheets with BNP Paribas in #1 position. Even Société Générale now exceeds Deutsche Bank in total assets, and Santander has also moved ahead. Source: Bloomberg, HolgerZ

JPMORGAN $JPM JUST ANNOUNCED A NEW $50 BILLION SHARE BUYBACK PROGRAM

JPMORGAN JUST INCREASED ITS QUARTERLY DIVIDEND OF $1.50 PER SHARE UP FROM $1.40 Source: Evan on X

Investing with intelligence

Our latest research, commentary and market outlooks