Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

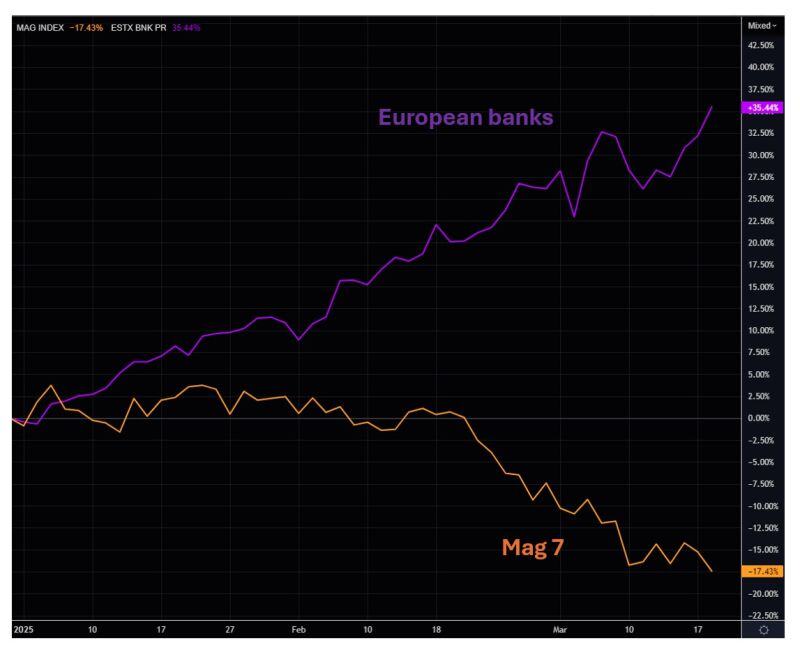

Who needs hot tech...

...when you can have European banks? Chart shows MAG vs SX7E YTD in %. Source: The Market Ear

UBS Group AG profit for the final quarter of 2024 beat expectations, aiding the Swiss bank in boosting buyback plans for this year to $3 billion.

Net income for the three months to December came in at $770 million, compared with a forecast for $486 million. Source: WSJ

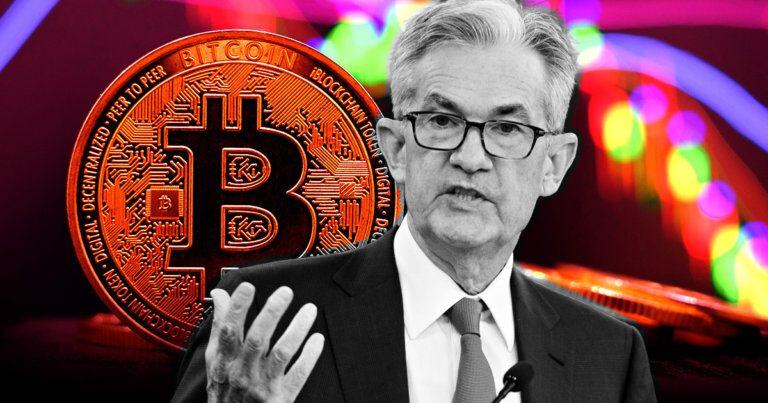

🔴 FED CHAIR POWELL SAYS BANKS CAN NOW SERVE CRYPTO TO CUSTOMERS 🚀

Banks can serve crypto customers as long as they can manage the risk, said U.S. Federal Reserve Chair Jerome Powell, amid allegations that the crypto industry is being cut off from financial institutions. "The threshold has been a little higher for banks engaging in crypto activities and that's because they're so new," Powell said on Wednesday when asked by a reporter during a Federal Reserve press conference about risks associated with cryptocurrency. The central bank is not against innovation, he added. Crypto firms have complained about the difficulty behind establishing and maintaining bank accounts in the U.S. Following the collapse of crypto exchange FTX in late 2022, several governmental agencies, including the Federal Reserve, issued warnings on "crypto-asset risks." Source: The Block

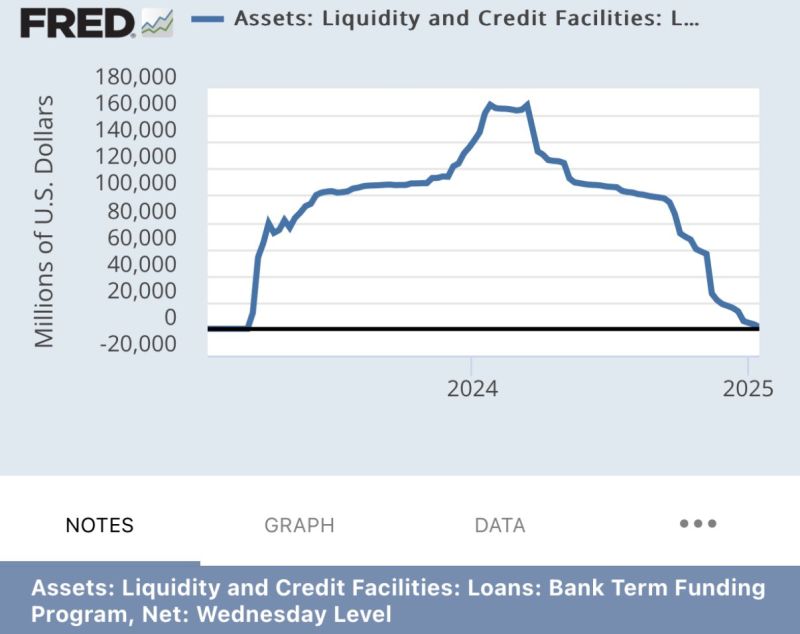

The BTFP, introduced under Biden, acted as a lifeline, letting regional banks trade toxic, low-yield debt for loans at par value, disguising their insolvency.

Now drained, what will happen to the program? Could this put the regional banking system at risk? Source: FRED, The Coastal Journal

$JPM JPMorgan is preparing to tell all its employees to return to the office 5 days a week

according to Bloomberg

Morgan Stanley is leaving the Net-Zero Banking Alliance, the lender said on Thursday.

👉 Morgan Stanley (NYSE: MS) has become the latest financial giant to abandon the Net-Zero Banking Alliance, a UN-backed coalition aimed at aligning banks’ financing activities with global net-zero emissions targets. The move follows recent exits by Citigroup (NYSE: C) and Bank of America (NYSE: BAC), and earlier departures by Goldman Sachs Group (NYSE: GS) and Wells Fargo (NYSE: WFC), marking a significant retreat from collective climate commitments by some of the world’s largest banks. 👉 These high-profile defections, driven by intensifying political and market pressures, cast doubt on the ability of voluntary financial coalitions to sustain ambitious climate action in a polarized environment. 👉 Launched in 2021, the NZBA aimed to transform the financial sector’s role in combating climate change. As part of the broader Glasgow Financial Alliance for Net Zero, it united over 140 banks across 44 countries, with members committing to reduce greenhouse gas emissions linked to their financing activities and to achieve net-zero emissions by 2050. 👉 NZBA members pledged to set interim 2030 emissions targets for high-impact sectors, including energy, transportation, and heavy industry, aligning their portfolios with the 1.5°C warming limit set by the Paris Agreement.. Source: Bloomberg, thedeepdive.ca

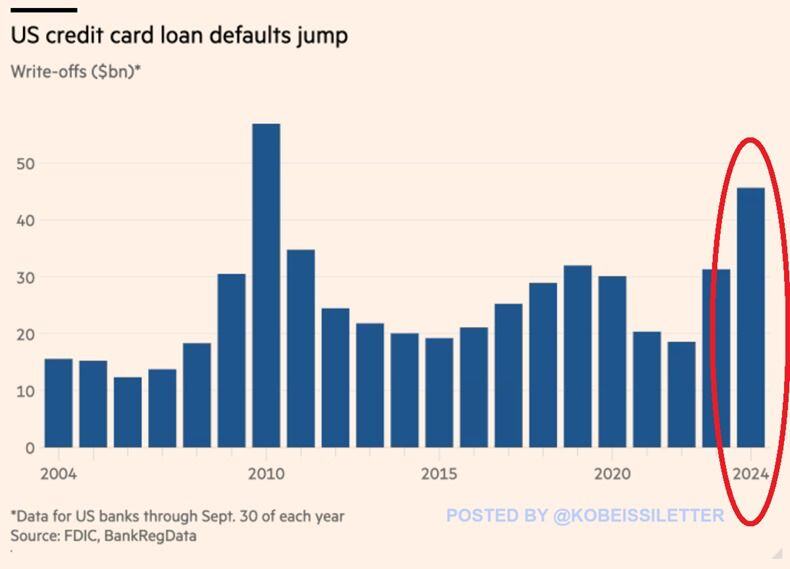

BREAKING: US credit card defaults jumped to $46 billion in the first 9 months of 2024, the highest since 2010.

Credit card defaults are now up over 50% year-over-year. Defaults of seriously delinquent credit card loan balances have more than doubled over the last 2 years. Bottom-income consumers were hit the hardest due to years of elevated inflation and interest rates. Additionally, the savings rate of the bottom third is now 0%, according to Moody’s. Source: FT, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks