Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

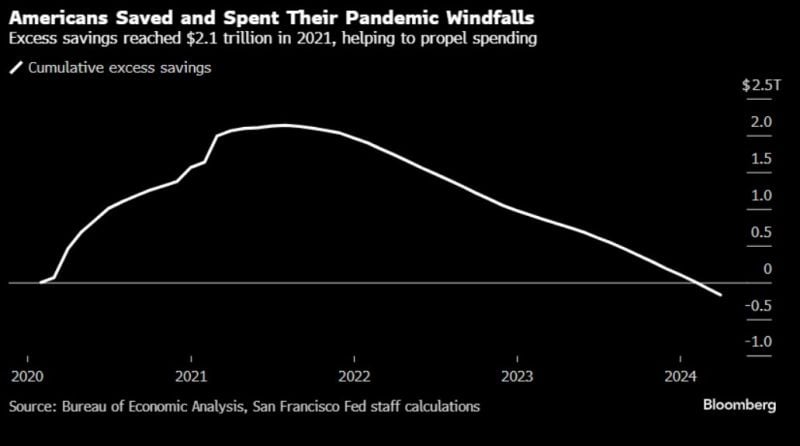

American excess savings reached $2.1 trillion in 2021, but they ran dry months ago.

The pandemic savings cushions that helped Americans weather high prices in recent years have worn through, contributing to a loss of consumer firepower that’s rippling through the economy. Delinquencies are rising. Executives are flagging caution among shoppers in recent earnings calls, and retail sales barely increased in May after falling the month prior. Economists forecast solid inflation-adjusted consumer spending in data out Friday, helped by lower gasoline prices, but that would follow an outright decline in April. Source: Bloomberg, Lisa Abramowitz

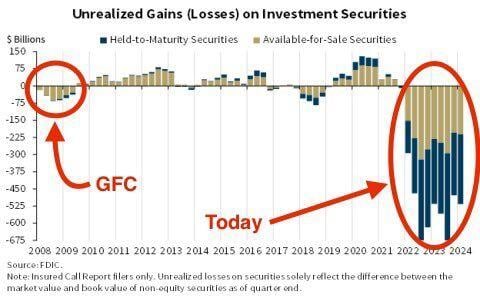

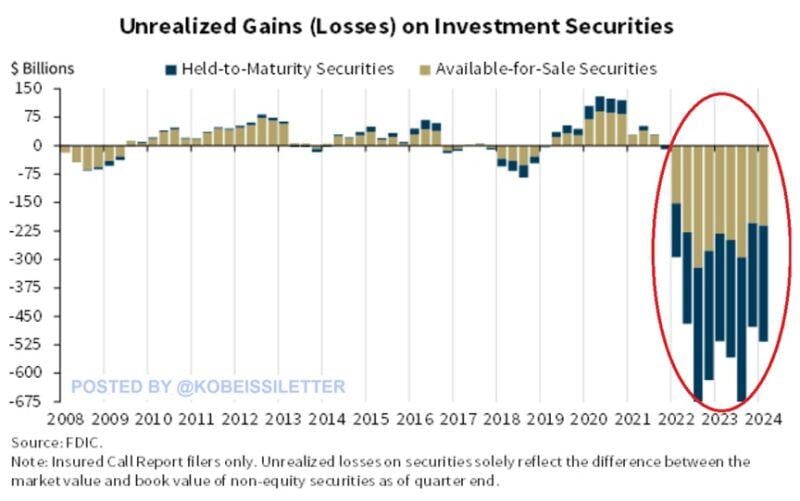

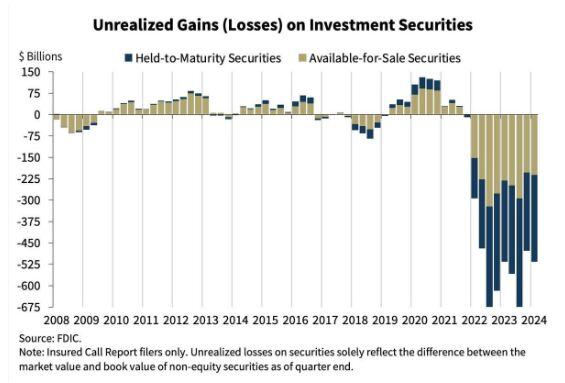

$525 billion in bank losses should concern everyone.

Source: BofA, Red pill rick

According to Nikkei, Japans Norinchukin Bank:

Japan's 5th largest bank with $840 billion in assets - will sell more than 10 trillion yen ($63 billion) of its holdings of U.S. and European government bonds during the year ending March 2025 "as it aims to stem its losses from bets on low-yield foreign bonds, a main cause of its deteriorating balance sheet, and lower the risks associated with holding foreign government bonds."

** Regional Banking Crisis Alert! **

**Huntington Bank Spooks Investors Yesterday, Shares Plunged 6%** - **New Guidance:** Net interest income to fall 1% to 4% this year - **Previous Range:** -2% to +2% - **Impact:** Largest drop since March 2023 Source: The Coastal Journal

BREAKING: U.S. Banking System >>> FDIC warns that 63 Lenders are on the brink of insolvency due to banks sitting on $517 billion in unrealized losses

This is $39 billion higher than the $478 billion recorded in Q4 2023. The surge was driven by higher residential mortgage-backed securities losses held by banks due to rising mortgage rates. Q1 2024 also marked the 10th consecutive quarter of unrealized losses, an even longer streak than during the 2008 Financial Crisis. As “higher for longer” returns, unrealized losses are likely to continue rising. Source: BofA, The Kobeissi Letter

BREAKING 🚨: U.S. Banks

Unrealized losses in the U.S. Banking System increased to $517 billion in Q1 Source: Barchart, BofA

Credit Agricole’s bond desk is targeted by climate activists

The French bank is under pressure to reveal the carbon footprint of its bond business. A group of investment managers with $777 billion in combined assets is using the bank’s AGM to demand that it start disclosing the greenhouse gas emissions tied to its capital markets operations.

Source: Bloomberg

JPMorgan Unveils IndexGPT in Next Wall Street Bid to Tap AI Boom.

The bank is creating thematic investment baskets using GPT-4 model. Trademark for name was filed last year, stirring speculation A year after a wave of speculation broke out over its application to trademark the word “IndexGPT” in connection to an unspecified artificial intelligence-powered tool, JPMorgan Chase & Co. is finally unveiling the product that will bear the name. IndexGPT is a new range of thematic investment baskets created with the help of OpenAI’s GPT-4 model. The tool generates a list of keywords associated with a theme, which are then fed into a separate natural language processing model that scans news articles to identify companies involved in the space. In essence, it’s a largely automated way to create so-called thematic indexes, which identify investments based on emerging trends — think cloud computing, e-sports or cybersecurity — rather than on traditional industry sectors or company fundamentals. Source: Yahoo Finance, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks