Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Nasdaq 100 and Bitcoin have moved in tandem for the past 4+ years.

With the recent Tech rally, the Nasdaq is showing its largest divergence versus Bitcoin during this time frame. Will we see bitcoin catch up or Tech catch down? Source: David Marlin

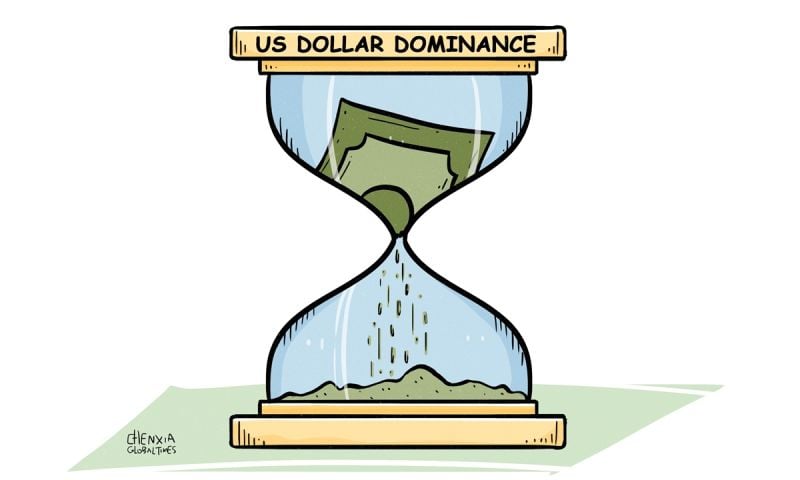

s de-dollarisation (or at least attempts of de-dollarisation) accelerating?

=> Saudi Arabia ditches US dollar and will NOT renew the 50 year 'petro-dollar' agreement with the United States. Saudi Arabia will now sell oil in multiple currencies, including the Chinese RMB, Euros, Yen, and Yuan, instead of exclusively in US dollars. => Russia's Moscow Stock Exchange suspends all trading in $USD & $EUR => El Salvador securities market launching on liquid with trading pairs in Bitcoin Source: radar, Global Times

Investing with intelligence

Our latest research, commentary and market outlooks