Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Speakers at the Bitcoin 2024 Conference in Nashville US

- Donald Trump - Robert F. Kennedy Jr. - Cathie Wood - Michael Saylor - Edward Snowden - Vivek Ramaswamy Source: Bitcoin Magazine

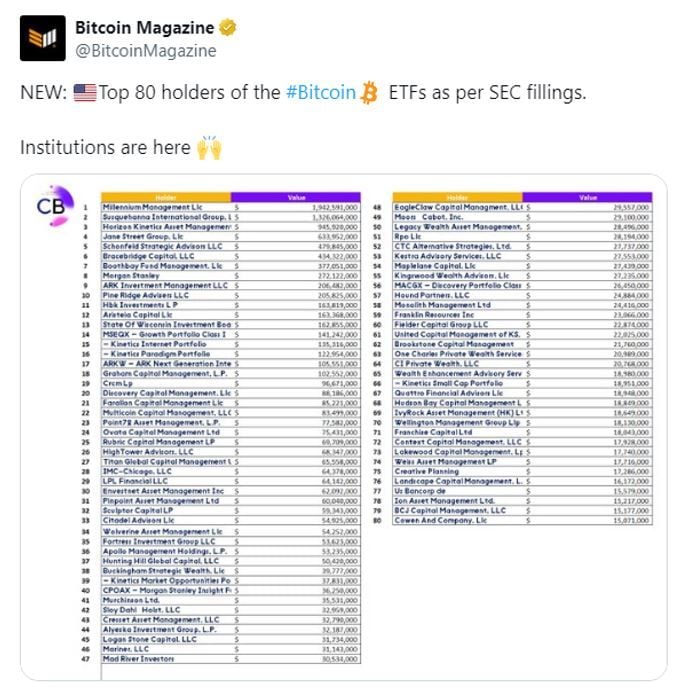

Even just combining the 80 companies found manually in SEC filings accounts for 17% of the total bitcoin ETF holdings.

While not all can be considered institutional investors, significant numbers are included - e.g Millenium, Susquehanna, Horizon Kinetics, Jane Street Group, Schonfeld, Morgan Stanley, Point72, Farallon, tc. Viewing ETF inflows solely as retail contributions seems inappropriate. Source: Ki Young Ju

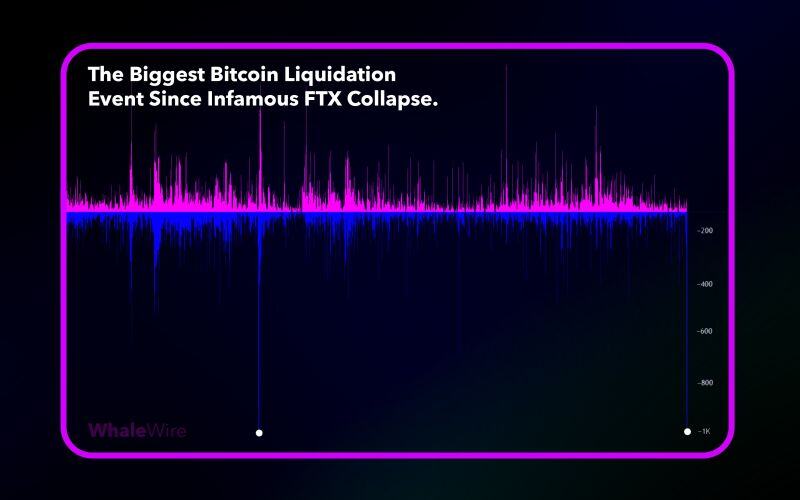

JUST IN: On-chain data confirms this is the second-largest liquidation event in Bitcoin's entire history, right after the FTX collapse in November 2022.

This comes amidst news that Germany is selling $3.5B worth of seized $BTC, and Mt. Gox begins paying back $8.5B to creditors, with the majority expected to be sold. Source: WhaleWire on X

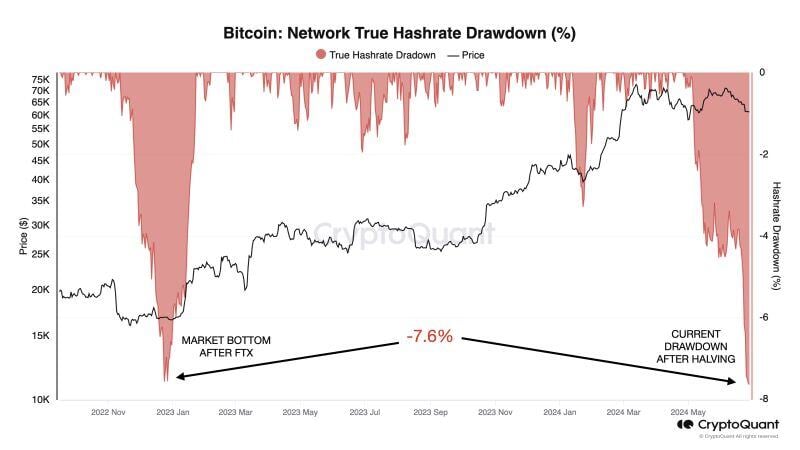

Bitcoin miner capitulation has reached levels comparable to December 2022: 7.6% drawdown.

December 2022 marked the cycle bottom after the FTX collapse. Source: Julio Moreno, Cryptoquant

BREAKING: Donald Trump is reportedly in talks to speak at the 2024 Bitcoin convention in July.

This would make Trump the first presidential candidate to speak at a crypto event. Most recently, Trump said he "will end Biden's war on crypto" at a rally in Wisconsin. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks