Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

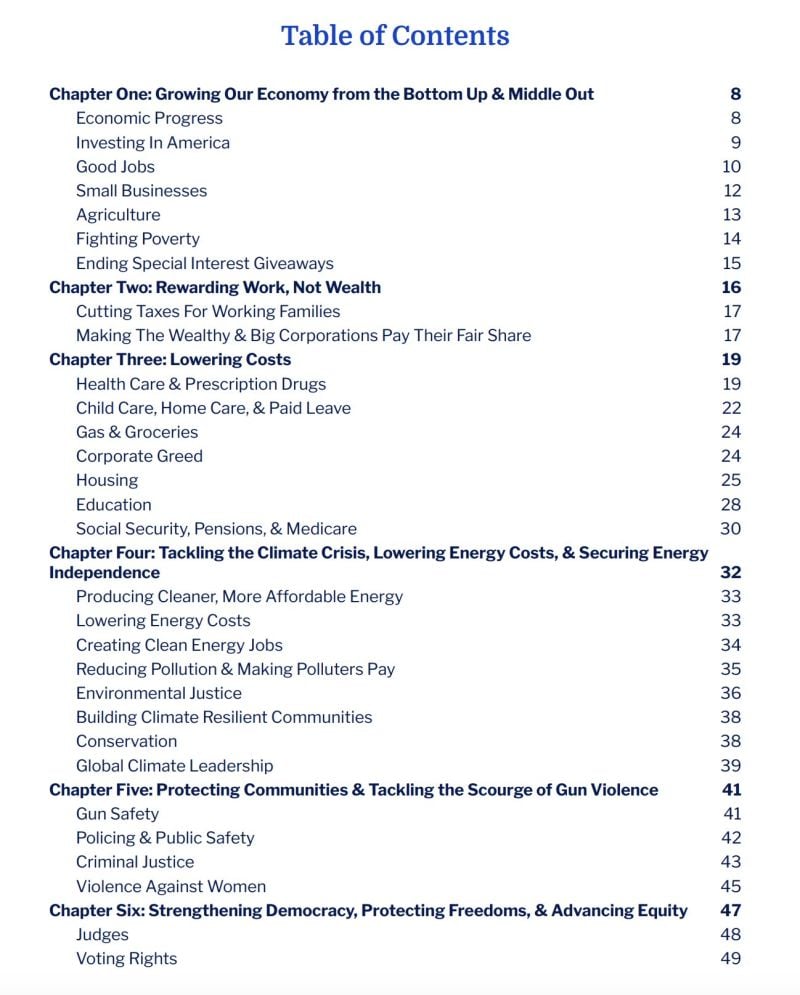

JUST IN: U.S. elections - The Democratic Party releases its platform, with no mention of Bitcoin or crypto

The Democratic Party's official 2024 platform was released yesterday (Monday) on day one of the Democratic National Convention, without any mention of Bitcoin or cryptocurrency. This decision aligns with the past four years of the Biden-Harris administration's hostility towards the industry. Despite the growing significance of Bitcoin and digital assets, neither Kamala Harris or Tim Walz, who are running for president and vice president in the upcoming election this November, has prioritized the inclusion of Bitcoin and crypto in the party's agenda. Source: Bitcoin magazine, www.zerohedge.com

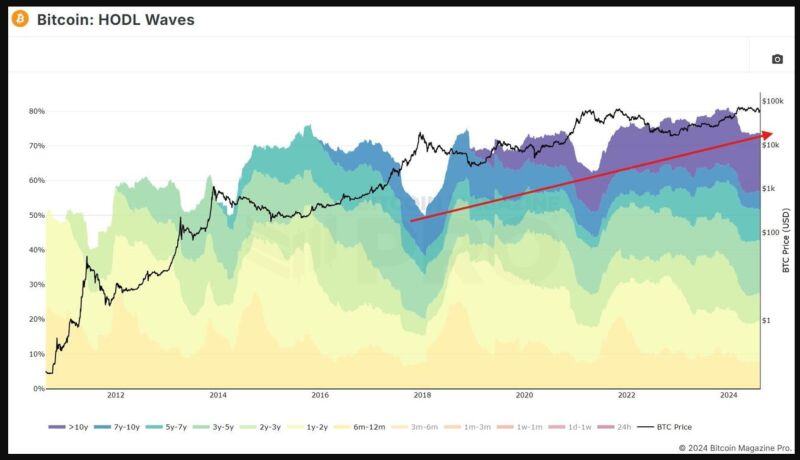

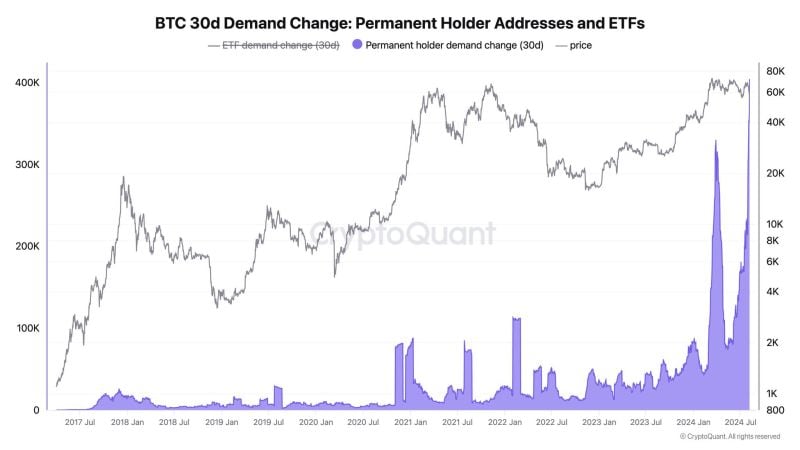

Recent data from Bitcoin Magazine Pro shows a significant trend among Bitcoin holders: nearly 75% of all circulating Bitcoin has remained dormant for over six months.

This strong HODLing behavior reflects a steadfast belief in Bitcoin's long-term value, despite market fluctuations. Source: www.zerohedge.com

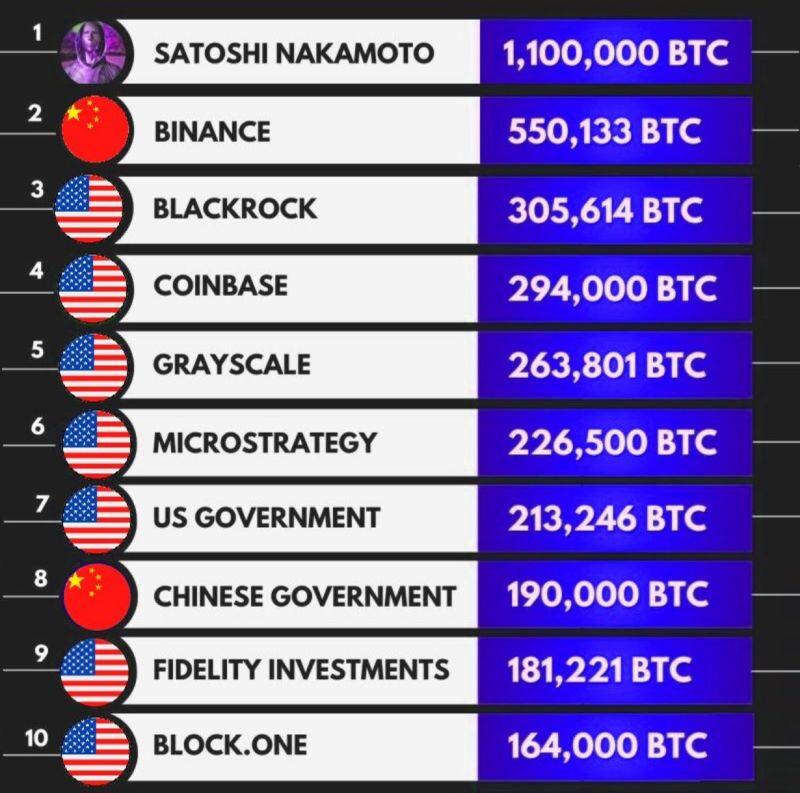

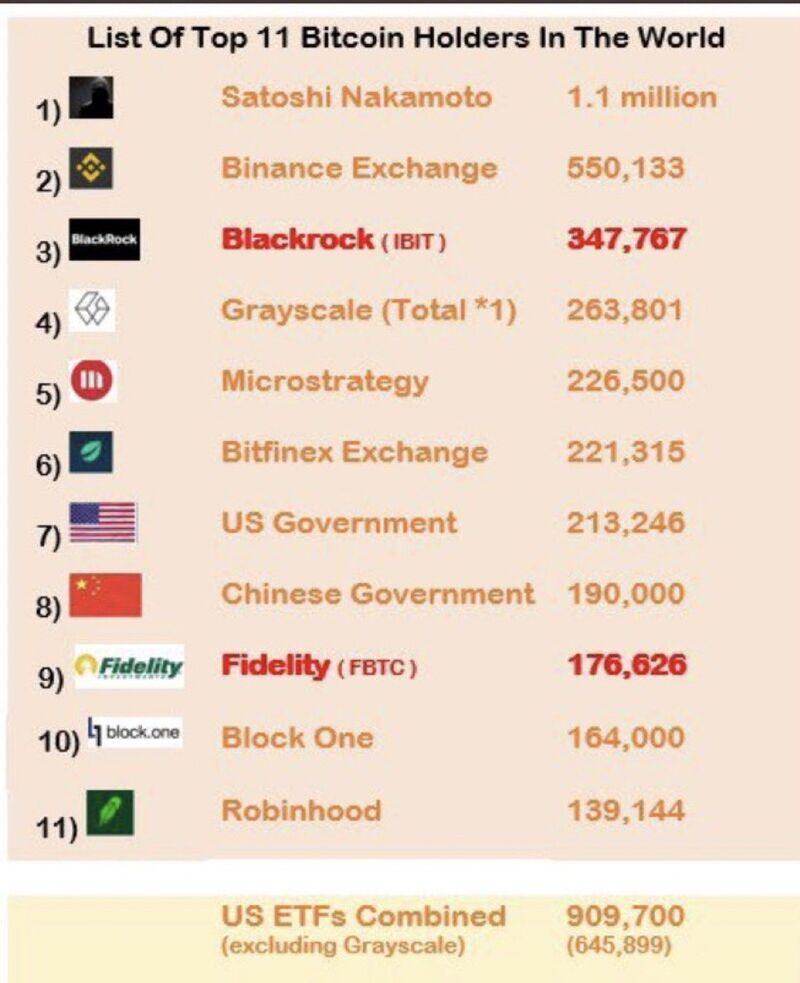

The US government just moved $2 billion of seized bitcoin $BTC, two days after Trump's speech 👀

Source: Joe Consorti

Investing with intelligence

Our latest research, commentary and market outlooks